US retail sales of fast-moving consumer goods – a category that includes petfood – have increased 1.3% since the beginning of 2014, according to Nielsen’s Q2 Global Consumer Confidence Report, and US consumer confidence continues to rise, prolonging an upward trend – and 11% increase – since the first quarter of 2013. However, Nielsen says, most of that gain in consumer confidence has come from positive news related to the US job, housing and equity markets, while the retail environment for non-durable goods is still playing catch-up from the recession.

Fortunately, with the petfood and pet care markets seemingly recession proof (or at least recession resistant), US pet owners have continued to spend on their pets at a high level, leading to much stronger growth than for consumer goods overall in the US. Perhaps robust petfood and pet care sales are even playing a considerable role in fast-moving consumer goods showing any type of increase.

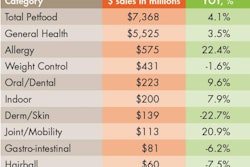

In the US pet retail channel alone, sales of petfood have increased 4.1% from May 2013 to May 2014, according to GfK, with pet treats especially driving growth (from 7.8% to 11.7% throughout the four quarters of 2013) and all other formats of dog food also showing strong growth (5% to 8.7%). Natural petfood sales have also been strong in the US, with GfK data showing an 11.7% increase in 2013 in pet specialty retail.

A new survey from Wellness Natural Pet Food puts some consumer sentiment behind the black and white numbers. The online poll of 1,179 US dog or cat owners revealed that 80% believe their pets eat better than they do. Slightly more (82%) of respondents said they look for special features when selecting petfoods, with natural ingredients the most cited at 59%. Other petfood attributes showing up in the survey included digestive benefits (42%), no artificial colors, flavors or preservatives (40%), no corn, wheat or soy (24%), lower fat (also 24%), grain free (18%) and unique ingredients, such as superfoods (12%).

(Probably the only surprise on that list is that grain free didn’t garner a higher percentage, considering the explosive growth of such petfoods in the US over the past few years. GfK said sales of grain-free petfoods increased 32.4% in 2013, rising to a total of US$1.8 billion in the pet retail channel; the number of grain-free products in the US soared 64% from January 2012 through December 2013.)

These consumer trends are not only good news for petfood manufacturers; they also bode well for suppliers to the industry. Another study, by the Freedonia Group, showed that US demand for petfood packaging is poised to increase 4.8% annually, reaching US$2.5 billion by 2018. That growth will come on top of 5% annual increases from 2008 to 2013, the market research firm said.

Continuing humanization of pets and premiumization of petfood products, including a focus on health and nutrition, will drive the growth, as will the use of higher value, more sophisticated packaging and the ongoing strength of the US petfood market, the study indicated. Specifically, this will translate into:

- A much higher demand for plastic pouches – projected to rise 8.3% a year and reach US$540 million by 2018 – as consumers increasingly seek convenience features such as zippered closures and lighter weight. (The latter will also help reduce transportation costs for petfood manufacturers.)

- The same desires for convenience and lighter weight driving higher demand for plastic tubs and cups for wet petfood, more of which have peelable lids that are easier to open and help consumers avoid cuts from medal edges.

- A boost in demand for pouches, bags, tubs, cups and chub packaging for chilled and frozen petfoods, expected to double in sales through 2018.

- Woven polypropylene bags for dry petfood gaining favor, increasing 8.6% annually through 2018. Overall, dry food will continue to comprise the largest petfood packaging segment, mainly bags, with a 49% share in 2018.