SDR Ventures recently released its first quarter 2017 analysis of the pet industry. Called “The Deal Hound,” the report explores mergers and acquisitions, capital market conditions and current industry trends. It was the M&A activity that I found most interesting, as several acquisitions made in the first three months of 2017 show clear support of the current directions various industry segments are taking.

Expanding product reach in a complex market

Archer Daniels Midland Company (ADM)’s purchase of Crosswind Industries in January 2017 and investment firm KKR’s investment in China’s Gambol Pet Group in February 2017 have a common theme: that of expanding business capabilities in order to increase reach.

“With five production facilities and a wide range of successful products, Crosswind represents a strong opportunity to expand our capabilities, and a great fit not just with the animal nutrition business, but across ADM’s wider portfolio of ingredients, colors and flavors for pets,” said ADM Animal Nutrition president Brent Fenton of the Crosswind acquisition.

"By partnering with KKR, we aim to expand and provide healthy packaged pet food to customers both overseas and in

Parkers Pet Provisions’ acquisition of Complete Natural Nutrition in and VisioCap’s acquisition of Nature’s Logic, both in March 2017, highlight expansions in a particularly popular segment: natural pet foods.

“[Complete Natural Nutrition is] the perfect addition to our family of natural products,” said Spyq Sklar, president and chief operating officer of Parkers Pet Provisions. “We were very impressed by their industry-leading recipes, and we’re excited to work with our independent retail and distribution partners to share these products with pet parents around the world.”

Nature’s Logic, a premium, all-natural pet food company, will be a boon for VisioCap, according to the company. "We are honored to have the opportunity to work with the talented management team at Nature's Logic and support their ongoing efforts to build a high quality and differentiated pet food and treat company," said Steve Marton, founding partner of VisioCap, of the acquisition.

New avenues of profit in trending market segments

WellPet’s February 2017 purchase of WHIMZEES, a Netherlands-based maker of natural dental chews, opens up an avenue for the company in the popular pet dental segment. “This is a major growth opportunity for WellPet, and an exciting one,” said WellPet Chief Executive Officer Camelle Kent. “Natural dental chews today represent a significant and fast-growing segment of the treats market, and WHIMZEES is an established leader in this category.”

Phillips Pet Food & Supplies, a distributor of pet food and supplies to the independent retail channel, acquired PetFlow, a significant online retailer in the pet category, in March 2017. In doing so, the company expanded its presence in a current hot market: the internet. “This transaction is reflective of the broader consolidation thematic in pet retail as market leaders position themselves for success in an omni-channel world,” said Bryan Jaffe, managing director and co-head of Cascadia Capital’s consumer and retail practice. “The acquisition of PetFlow by Phillips uniquely positions the acquirer as a provider of ecommerce capabilities to its customer base of independent specialty retailers, many of whom do not possess the capital or expertise to compete in digital.”

Briefly:

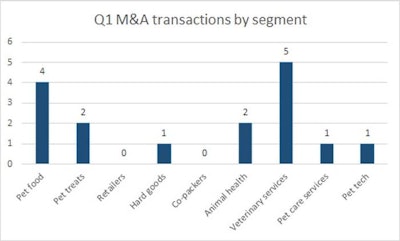

Within the pet segment, the pet food industry is among those topping the charts for mergers and acquisitions during the first quarter of 2017. | SDR Ventures

Contact Me