Canada is a CA$2 billion (US$1.83 billion) petfood market, with dog food accounting for 60% and cat food for 36% of sales. As in the US, much of the sales growth in Canada is occurring outside of the core mass market, with bargain-seeking shoppers shifting to lower-priced channels while pet parents with a more pampering bent seek out premium and superpremium products.

Packaged Facts estimates that approximately 10% of the petfood sold in Canada is “superpremium” (defined as priced 20% or more above the category average), while another 30% is “mass premium” (priced 10%–20% above the category average). Considering the pet product introductions in Canada in the last few years, marketers clearly are fueling the Canadian market for higher-end products. This trend goes hand-in-hand with growth of the pet specialty channel, which continues to increase market share at the expense of mass channels, both in dollar sales and in percentage draw among pet product shoppers.

In the petfood market as in the human food market, premium and superpremium positioning is closely intertwined with “natural” products. Not all premium products are natural, but natural products are at the core of the premiumization trend, and consumers increasingly tend to equate “natural” products with higher quality.

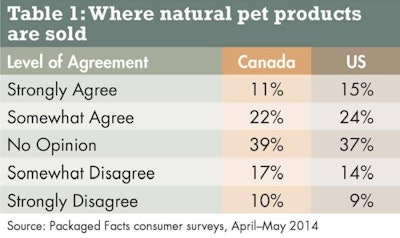

Although the premiumization pendulum has not swung as far in Canada as in the US market, the direction of the momentum is clear. Packaged Facts consumer survey data from April–May 2014 show that 11% of Canadian pet owners strongly agree that natural products sold in the pet specialty channel are superior, compared with 15% of US pet owners, and another 22% of Canadians at least somewhat agree in the superiority of natural pet channel products, compared with 24% of their American counterparts (see Table 1).

Similarly, 11% of Canadian pet owners strongly agree that natural and organic petfoods are safer than regular petfoods, compared with 18% of US pet owners, and another 19% of Canadians at least somewhat agree that natural and organic petfoods are safer, compared with 23% of US consumers (see Table 2).

Other metrics show Canadian pet owners overall tracking their US counterparts fairly closely, albeit with a more temperate streak. Overall, for example, 11% of Canadian pet owners strongly agree that store brand petfoods can be as good quality as the national name brands, compared with 15% of US pet owners (see Table 3). Cultural differences within the Canadian market, however, loom large in attitudes toward store brands. Among Canadian pet owners with French as their primary language (primarily though not exclusively meaning pet owners in Quebec), 18% strongly agree that store brands can be as good quality as national brands, compared with only 9% of Canadian pet owners with English as their primary language.

This pattern of cultural borders being more salient than national ones is broadly evident in retail shopping behaviors. Overall, Canadian pet product shoppers are somewhat less migratory than their US counterparts: Only 14% of Canadian pet owners strongly agree that they shop for petfoods in a variety of stores, compared with 20% of US pet owners. Among Canadian pet owners with French as their first language, however, fully 27% strongly agree that they shop around.

Similarly, only 4% of Canadian pet owners overall strongly agree that they are buying more pet products online, compared with 14% of US pet owners, while 44% of Canadian pet owners strongly disagree that they are venturing into pet product shopping online. But here again le différence lives. Among Canadian pet owners with French as their first language, the share who strongly agree that they are doing more pet product shopping online jumps to12%, while the share who strongly disagree plummets to 16% (see Table 4).

Cultural and regional differences are therefore alive and well within the Canadian pet products market, and often more dramatically so than on either side of the US-Canadian checkpoint.