The J. M. Smucker Company signed a definitive agreement to acquire Ainsworth Pet Nutrition, LLC for approximately US$1.7 billion, after an estimated tax benefit of US$200 million. The transaction, announced April 4, is expected to close early in Smucker's fiscal year beginning May 1, 2018.

"After five generations, our family, in partnership with L Catterton, made the decision to sell Ainsworth Pet Nutrition to The J. M. Smucker Company," said Sean Lang, executive chairman of Ainsworth, in a press release.

About Ainsworth Pet Nutrition and effects of acquisition

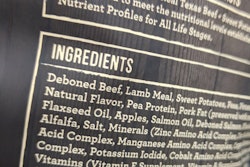

Ainsworth Pet Nutrition employed a diverse strategy to grow from a regional, value-based manufacturer to a national presence, according to Petfood Industry’s Top Pet Food Companies database. Ainsworth's partnership with Rachael Ray brought celebrity appeal, a string of acquisitions amassed market share, and ongoing private label development supports its bottom line. The privately owned company, founded in 1933 as Dad's Pet Care, has virtually doubled its sales in the last decade. Rachael Ray's Nutrish brand accounts for about two-thirds to three-quarters of company revenue, which is dominated by products for dogs. Ainsworth also produces Wal-Mart's Pure Balance brand.

Ainsworth is headquartered in Meadville, Pennsylvania, USA. In addition to its headquarters, the Smucker acquisition includes two manufacturing facilities owned by Ainsworth, which are located in Meadville, Pennsylvania and Frontenac, Kansas, USA, along with a leased distribution facility in Greenville, Pennsylvania. Smucker anticipates that more than 700 Ainsworth employees will join Smucker in conjunction with the transaction.

Ainsworth also sells pet food and pet snacks under several additional branded and private label trademarks. Ainsworth operates two additional manufacturing facilities that are primarily used to provide contract manufacturing services to third-party pet food distributors. Those facilities and the associated business are not included in this transaction.

Financial aspects of Smucker’s acquisition of Ainsworth

Smucker expects the benefits of the transaction to include:

- Smucker anticipates the acquired business to contribute net sales of approximately US$800 million in the first full year after closing the transaction.

- This acquisition and the addition of the high-growth Nutrish brand will increase the scale and further accelerate the growth profile of the company's pet food business.

- Nutrish holds a leading position and is one of the fastest-growing brands in the premium dry dog food segment within the grocery and mass channels, a key growth driver for the overall category. The acquisition of Nutrish will significantly expand the Smucker's presence in the premium dry dog food segment within the grocery and mass channels, complementing Smucker's Nature's Recipe brand.

- The transaction further strengthens the Smucker's position in dog snacks with the presence of Nutrish in fast-growth segments, including natural meats and long-lasting chews.

- While Nutrish has a relatively smaller presence in premium cat food, Smucker believes the brand is well-positioned for significant growth in this segment.

Annual cost synergies of approximately US$55 million are expected to be fully realized within three years after closing, with approximately US$25 million anticipated in the first year. After giving effect to the first year of synergies, Smucker expects the acquired business to generate earnings before interest, taxes, depreciation, and amortization of approximately US$110 million in the first full year after closing the transaction, excluding one-time costs, and contribute approximately US$0.25 of accretion to Smucker's adjusted earnings per share.

Bank of America Merrill Lynch provided committed financing for the all-cash acquisition of Ainsworth. Smucker will fund the transaction with debt, which is valued at $1.9 billion, prior to an expected tax benefit related to the acquisition with a present value of approximately $200 million. After factoring in the estimated tax benefit and anticipated annual cost synergies of $55 million, the purchase price represents a multiple of approximately 12 times EBITDA.

Smucker expects to incur approximately $50 million in one-time costs related to the acquisition, the majority of which are expected to be cash charges. Approximately two-thirds of the one-time costs are expected to be recognized in the first year after the closing of the transaction.