As Packaged Facts reports in “Pet Supplements in the U.S.” (January 2021), pet supplement sales jumped 21% in 2020 to reach nearly US$800 million, fueled by heightened consumer concerns over personal health and pet health in the wake of COVID-19, and in contrast to several years of growth in 3%–5% range.

This growth spurt ties in part to the growing flood of pet CBD supplements, a segment Packaged Facts estimates at US$100 million, with scores of companies offering pet products featuring the hemp derivative. Droves of consumers, in turn, seek out such natural and plant-based remedies to address issues including anxiety, pain management and inflammation in both themselves and their pets.

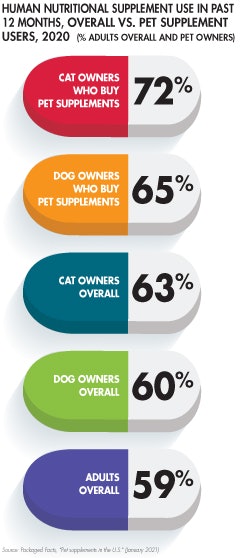

The connection between human and pet supplement use

Survey data from November/December 2020 show a clear relationship between human supplement and pet supplement use (see Table 1). Among adults overall, 59% take human supplements, as do 60% of dog owners and 63% of cat owners overall. These numbers notch up among dog or cat owners who buy pet supplements: 65% of dog supplement purchasers and 72% of cat supplement purchasers take human supplements themselves. Because of this human-to-pet splash over, pet supplement marketers often follow trends in human supplements, as demonstrated by CBD and by omega-3 before that.

TABLE 1: There is a definite uptick in human supplement purchasing by those who buy supplements for their pets when compared to pet owners who only buy supplements for themselves.

As in the human supplements market, pet owners typically turn to pet supplements to help prevent or (particularly for older consumers/older pets) provide relief from a health condition. Supplements therefore form part of a larger health and wellness movement, which also includes a focus on higher quality foods, appropriate exercise, and quality bonding and interaction time.

The place of supplements in the pet space

Veterinary advances in recent years have led to pets living longer lives, and supplements can help improve a pet’s quality of life during those extra years. Pandemic-related stay-at-home and work-from-home dynamics have increased the amount of time humans are spending with their pets, encouraging them to pay more attention to their pets’ health — a wellness focus not likely to quickly subside with the pandemic.

With pet foods and now pet treats equally responding to this heightened focus on wellness, cross-category competition with pet supplements continues to increase. Triggered in part by the decreasing novelty of the natural pet food trend, and in part by concerns over canine dilated cardiomyopathy (DCM) with the grain-free diets that became deeply embedded in the natural food trend, the pendulum has swung back to a degree to pet food formulas that are science-based and/or veterinary diets, many of which target specific health issues. Hill’s Pet Nutrition, for example, reported an 11% jump in pet food sales during the third quarter of 2020 compared with the previous period. Hill’s offers a wide selection of condition-specific foods through its Prescription Diet line, including products targeting digestion, heart health, joint care, kidney support, skin & coat, and urinary health.

More generally, survey results show that, among those who have recently changed pet foods, usage rates of veterinarian-recommended formulations are higher (at 19% of dog owners and 14% of cat owners who have recently switched) than among dog or cat owners overall.

In addition to health and wellness, functional pet foods and treats play upon two of the biggest selling points in the pet market — economy and convenience — making it possible for pet owners to avoid both the extra expense of supplements and the struggle of trying to get their pets to consume a pill or tablet. The latter is no small advantage; one of the biggest issues pet owners have with pet supplements is the difficulty in getting the pet to swallow them. Additionally, pet owners enjoy pampering their pets by giving them treats, valuing the “quality time” and bonding experience, and functional treats offer that benefit to boot.

Cross-currents among pet supplements, pet treats and pet food illustrate how, in this omnimarket era of the pet industry, competition spans product categories and even the product versus service divide, rather than simply draining from brick-and-mortar into the digital web.