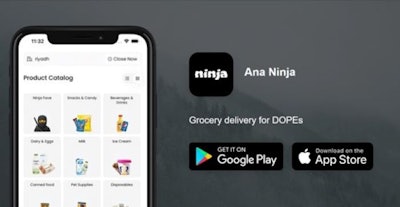

Ninja, a Saudi quick commerce (q-commerce) technology startup, made some key announcements regarding its operations as its mega-seed funding round closed for the fourth quarter of 2022. The grocery delivery app, which also retails pet food for the Saudi market, announced that it had secured additional investments from Bunat Ventures, alongside other venture capitalists from the region. No amount for the investments was disclosed, but Ninja did acknowledge strong growth in the Saudi market with 1.5 million downloads of its app in just four months since launch.

Ninja’s pet product assortment currently carries 20 pet supply items ranging in categories from wet and dry cat food, treats and litter from Whiskas, Fancy Feast Temptations and Trill brands. The company now has full coverage of the three largest cities in Saudi Arabia: Riyadh, Jeddah and the Eastern Province of the kingdom. Ninja is aiming to expand its operations to the rest of the country before spreading out to new territories, noted Canberk Donmez, Ninja’s co-founder.

Q-commerce expanding rapidly in Saudi Arabia

Ninja is just one of several q-commerce startups in Saudi Arabia looking to leverage investments to expand rapidly throughout the kingdom, where fast deliveries in under 15-25 minutes are all the rage. In the last year alone, q-commerce company Rabbit has begun investing US$60 million in Saudi Arabia. Similarly, BARQ has raised US$4 million in its latest funding round.

This subset of the e-commerce arena is gaining significant attention due to the highly developed nature of the Saudi digital market, where q-commerce accounts for about 15% of total orders. According to Ken Research, the kingdom’s q-commerce market is expected to cross 4 billion orders annually by 2026.

Opportunities for pet food

For the pet food industry, monitoring the q-commerce startup space is important, as several reports have highlighted how changing demographics are raising shopper demand for quicker delivery. The data being generated from these systems is also something for the pet food industry to consider. As the patterns of q-commerce emerge for Saudi Arabia, optimization of consumer profiles can occur, down to the neighborhood level, allowing for a minimization of inefficiencies in a decentralized structure.

Taking a broader look, the Middle East and North African region q-commerce market is projected to reach US$47 billion by 2030, per Redseer.