The ongoing economic crisis in Iran is forcing pet owners to make a difficult choice: spend nearly half their monthly income on a single pack of imported, smuggled pet food or rely on lower-quality domestic alternatives.

According to Iran's Veterinary Society, the country was home to between six and eight million pets in the past year, primarily cats and dogs — suggesting that one in every 10 Iranians owns a pet. Despite mounting challenges, Iranians are not abandoning their companion animals, though finding high-quality and affordable food has become increasingly difficult.

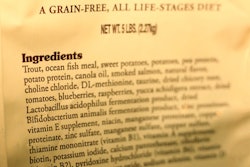

Pet food imports have been prohibited in Iran for several years, Savis Ansani, owner of Tehran-based Persian Pet International, told Petfood Industry. Yet smuggled foreign brands still account for about 50% of the pet food market, with popular labels like Royal Canin, Taste of the Wild, Acana, and Orijen entering the country primarily through the UAE and Turkey.

Despite the ban, Iran remains a lucrative market. According to Statista Market Insights, Iran’s pet food sector is projected to reach nearly $916.5 million in value by 2025.

Still, only a small percentage of Iranians can afford imported products. The steep devaluation of the Iranian rial has turned foreign pet food into a luxury. “The exchange rate is US$1 to 1 million Iranian rials, or roughly 100,000 tomans, which is the unofficial currency,” Ansani explained. “A worker’s monthly salary is about 10 million tomans, or approximately US$100. For reference, a 2-kilogram box of Royal Canin for cats costs around 4 million tomans — or US$40.”

A domestic industry struggles to gain ground

Several domestic brands have emerged in recent years to fill the gap, but growth has been constrained by sanctions, inflation, and technical challenges.

"Iranian pet food market is not bad, but due to sanctions and economic inflation in our country, business is particularly hard," Dr Navid Nasirian, owner of a local pet food brand Nutripet, told Petfood Industry.

Nutripet recently launched a manufacturing plant with three production lines, though not all planned capabilities have come online. Nasirian cited technical difficulties installing imported machinery as a major setback.

The industry also lacks access to modern European and U.S. equipment and expertise. Meanwhile, many domestic brands face trust issues among consumers.

"Demand is good, but customers hardly believe in local brands," Nasirian admitted.

Dr. Jalaleddin Mirfakhrai, director of J.M. Vet Group and a former importer of pet food before the ban, echoed this sentiment. “Some brands disappeared after a while, and some are still working and have gained reasonable market share,” he said. “Unfortunately, since there is no standard regulation for pet food production in Iran, the quality is very variable.”

According to Mirfakhrai, only a few manufacturers produce most of the domestic brands, often changing only the packaging design. J.M. Vet Group now produces its own brand, Farafood, which has become one of the more popular local options.

Local customers share fears over locally manufactured pet food quality and safety, which may not be entirely groundless. According to Ansani, the local industry can be described as high production volume, high prices and low quality.

For Iranian veterinarians, the issue of the safety of local pet food is now coming to the fore.

"Unfortunately, the use of locally produced pet food could lead to serious kidney-related diseases in pets over the next year or two," Ansani said. "In fact, we are already seeing an increasing number of urinary and kidney cases in our veterinary clinics on a daily basis."

Looking ahead

Despite the difficulties, pet industry professionals in Iran remain cautiously optimistic.

“Many Iranians hope for improved relations between the Iranian government and the United States, which might lead to better economic conditions,” Ansani said.

If economic conditions improve and foreign companies re-enter the market legally, Iran’s pet food industry could grow significantly — mirroring the rapid development seen in neighboring Turkey.

Western brands maintain strong recognition among Iranian customers, although the market is flooded with fake products.

"The government is not even trying to control or fight back all the black import in this segment," Mirfakhrai said. "Since there is no control, you can find all sorts of fake products in the market, especially for the most popular brands. Prices are crazy, and you should expect to pay more for such products."

Meanwhile, local pet food manufacturers are watching the progress of U.S.-Iran negotiations with concern, uncertain how the potential return of legal imports under a future Trump administration might impact their market position.

"If pet food imports are eventually allowed again, most pet owners are unlikely to trust or return to domestically-produced brands," said Ansani. "They would undoubtedly prefer internationally recognized products, as is already the case in many shelters and for stray animals, where well-known foreign pet foods are used despite the current restrictions."