.png?auto=format%2Ccompress&q=70&w=400)

Upscale private label. Private label pet food products are encroaching upon premium and mid-priced segments in developed markets. Petfood superstores are particularly well placed to exploit this trend.

Origin and traceability. Now in the forefront, due to the spring 2007 recalls in North America, are issues such as the quality and tractability of ingredients.

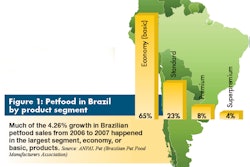

Economy products thrive. In developing economies, much of the growth in pet food sales will come from the economy segment, as increasing numbers of people are lifted out of poverty.

Premium opportunities. In developing pet food markets, there will be potential for premium products in certain locations including Moscow, Beijing, Shanghai, Mexico City and Rio de Janeiro.

Freshness advantage. One strategy that indigenous firms in developing markets can use to gain an advantage over foreign rivals at the very top end of the premium segment is to market their products in terms of their freshness.

Growth by region

Worldwide retail sales of dog and cat food topped US$45 billion in 2007, according to Euromonitor International (Packaged Facts estimates US$46 billion). That's a total growth of nearly 43% from the 2002 amount of US$31.57 billion. Euromonitor projects 2012 global retail sales of dog and cat food will be US$52 billion. Following are estimates of growth rates for various regions.

Latin America. Sales of dog and cat food in Latin America grew a remarkable 107.2% from 2002 to 2007, to a total of US$5.04 billion. Growth is expected to continue at 26.5% to a total of US$6.37 billion by 2012. Hot growth countries for pet food include Mexico and Brazil, which together account for 78% of the Latin American pet market.

Western Europe. Euromonitor figures show total Western European cat and dog food sales at US$14.47 billion in 2007, up from US$10.16 billion in 2002. Growth is projected to continue at 7.6% between now and 2012, to a total of US$15.57 billion. France, Germany and the UK combined represent 60% of the total.

Eastern Europe. One of the fastest pet food growing markets, Eastern Europe increased sales nearly 200% from 2002 to 2007, and Euromonitor projects it to grow another 56% between now and 2012. That would put total retail sales for cat and dog food at US$3.95 billion, up from US$2.54 billion in 2007. Influencing factors include increasing levels of disposable income, changing perceptions of pets, increased demand for prepared petfood rising urbanization and improved distribution infrastructure. Currently Poland and Russia comprise 64% of the Eastern European market.

Asia. Asia is a tale of two pet food markets: developed countries like Japan (70% of the Asian market), South Korea and Singapore, and developing areas like China, India and Vietnam. Countries such as Thailand fall somewhere in between. As a region Asia-Pacific has grown 21% in cat and dog food sales over the past five years, to a total of US$4.41 billion, and is projected to grow at the same rate until 2012, reaching US$5.33 billion.

US pet food sales surge

The total US market for pet food and supplies, adjusted for inflation, grew to US$24.9 billion, 34% from 2002-2007, according to a Mintel report ( www.mintel.com ). The study attributes some of that growth to pet owners spending more on products for their pets that are less utilitarian and more fun. Consumers are also becoming more discerning about the quality and makeup of products they feed their pets in light of the wide-scale pet food recall that began in March 2007. Mintel expects the market to continue dynamic growth through 2012 as consumers continue to treat their pets as well as, or better than, they treat themselves.

For its report, Mintel commissioned exclusive consumer research through Greenfield Online to explore pet ownership and care. Fieldwork was conducted in May 2007 among a nationally representative sample (weighted against the total population for estimation) of 2,000 adults aged 18+. The report also includes data from Simmons Research, using the National Consumer Survey (NCS) and IRI's Infoscan data. Wal-Mart sales are not included in the IRI data, but Mintel estimates US sales of pet food and supplies through Wal-Mart will be $3.7 billion in 2007, accounting for 15% of sales. Value figures are at retail selling prices (rsp) excluding sales tax.

Key findings

Hispanic outreach. Hispanics, a quickly growing part of the US market, are more likely than non-Hispanics to own a dog. Marketers should consider more outreach through channels that Hispanics are apt to use.

Changing channels. Mass merchandisers command 34.5% of the total market for pet food and supplies, compared to 22% for supermarkets and 19% for pet specialty stores. Mass merchandiser prices are 13-18% lower than the prices in traditional supermarkets, according to Progressive Grocer . On the other hand, pet specialty stores offer a "warm and fuzzy" shopping experience and frequent shopper programs.

Pets as reflection of self. The shifting perception of the family pet, from companion to reflection of oneself, continues unabated. Pet owners are increasingly interested in products and services on the higher end of the pet care spectrum.

Market drivers

Pet populations. According to the American Pet Products Manufacturers Association, there are approximately 88 million pet cats in the US today. Cats outnumber dogs by 14 million; however, the number of dogs increased 1.2% between 2005 and 2007, and the number of cats declined by 2.4% during that period.

Green products. Pro-environmental products and services for pets seem to have an especially bright future. Expect taglines like "Love your pet; Love your Earth."

Obesity solutions. Pet owners are addressing pet obesity much as they would for themselves, creating opportunities for both traditional weight loss solutions and weight loss "shortcuts" for pets. Mimicking some human weight loss solutions, such as Jenny Craig for dogs, could be beneficial.

Aging pets . A significant percentage of US pets have reached the mature lifestage15% of dogs and 17% of cats are over the age of 11. More pet owners will be purchasing more expensive life-stage and condition-specific foods, supplements and treats, like those that address joint and digestive health, as well as those that maintain vision.

Happy days

Mintel uses the SPSS to forecast the market to 2012. SPSS correlates historic data with key economic and demographic factors. Mintel expects US sales of pet food and supplies to rise to US$35.3 billion by 2012, an increase of 26% (adjusted for inflation).

.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)