Worldwide retail sales of dog and cat food topped US$45 billion in 2007, according to Euromonitor International. That figure represents a total growth of nearly 43% from the 2002 amount of US$31.57 billion.

Though Euromonitor projects the global growth rate to decrease to 15% by 2012 - still a very healthy gain, resulting in sales of US$52 billion - some regions of the world will continue to grow at an even faster clip. Here we look at some of those areas, as well as more mature petfood markets like Western Europe.

Sales of dog and cat food in Latin America grew a whopping 107.2% from 2002 to 2007, to a total of US$5.04 billion, Euromonitor says. Regional growth is expected to continue at 26.5% to a total of US$6.37 billion by 2012. Hot growth countries for petfood include Mexico and Brazil, which together account for 78% of the Latin American pet market.

Spotlight on Brazil

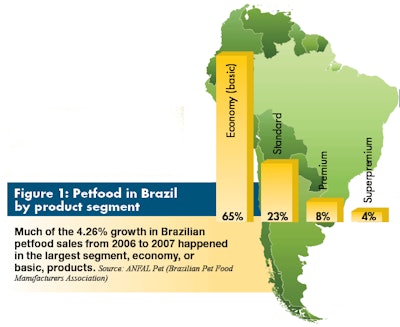

In 2007 petfood sales increased in Brazil by 4.26% over 2006, to US$3.07 billion. That fell short of the expected 11% growth, according to Associação Nacional dos Fabricantes de Alimentos para Animais de Estimação (ANFAL, or Brazilian Petfood Manufacturers Association). Yet the industry hopes to grow by at least 5% in 2008, for a total of US$3.22 billion.

The lower growth came from raw material price increases and high taxes, which make it more difficult for consumers to buy nutritionally improved products. This also reduces competitiveness abroad, ANFAL says.

All 2007 sales growth occurred in the economy priced, or basic, product segment, which accounts for 65% of the market. Sales in the standard segment, with a 23% market share, have remained steady, while the premium segment - 8% of the market - and superpremium segment - 4% market share - have been decreasing (Figure 1).

In 2007 the Brazilian petfood industry produced 1.8 million tons of petfood. ANFAL believes the potential of the market is much greater; its 31 million dogs and 15 million cats represent a potential petfood consumption of 3.96 million tons per year. Currently only 45% of pets are fed prepared petfoods.

Western Europe

Euromonitor figures show total Western European cat and dog food sales at US$14.47 billion in 2007, up from US$10.16 billion in 2002. Growth is projected to continue at 7.6% between now and 2012, to a total of US$15.57 billion. France, Germany and the UK combined represent 60% of the Western European pet market.

Northern and central Europe are more sophisticated and saturated petfood markets. Southern Europe (Italy, Spain, Portugal, Greece) is a little behind and still experiences faster growth than the rest of Western Europe. In the northern area the expenditure per shopper has increased and driven market growth (Figure 2), while in the southern area it has been the penetration rate in households. Dry petfood is progressively expanding its share throughout Western Europe.

Pets' changing role toward family member status makes humanization one of the strongest trends here. Another important factor is private label production. This includes a clear premiumization trend, but there is also a significant segment of consumers who need affordably priced petfoods.

Increasingly heavy price competition has reduced growth of overall petfood sales in the grocery channel, but it still performs well thanks to the escalating entrance of premium petfoods. In 2007 they recorded 2% growth in Western European grocery and pet specialty stores, Euromonitor says.

Spotlight on Germany

Germans consider pets part of their families and transfer their own expectations for food onto their pets. The petfood market is mature but growing, characterized by high polarization:

-

Sales of premium and superpremium petfood are increasing, reaching €830 million (US$1.29 billion) in 2007, according to Euromonitor.

-

Economy priced products are also performing well with 2007 retail sales of €267 million (US$417 million).

Growth of economy petfood is due to the tight budget of many German households, who are compelled to buy the cheapest products (especially for dry cat food) and from private label sources. Because of the polarization, mid-priced products are stagnant. Germans are also shifting from wet to dry petfood for convenience and pet health; dry food is often considered more nutritionally complete.

Still, Euromonitor projects the German petfood and pet care products market to grow 3% by 2012, to a total of 3.2 billion (US$4.99 billion).

According to IVH (the German association of pet product manufacturers), the country's petfood market reached 2.4 billion (US$3.76 billion) in 2007, a 0.4% increase over 2006. Growth is being fueled mainly by sales increases in cat food, with dog food sales remaining stable.

Supermarket chains (including drugstore and discount stores) continue as the main sales channel for petfood, with a share of 68% and sales of 1.5 billion (US$2.34 billion), IVH says.

Spotlight on the UK

Humanization is quite evident in the UK market. With pet obesity reaching record levels, this market is seeing increasing success with health-focused, multi-functional foods featuring ingredients such as omega 3 and 6 fatty acids and marketing claims such as gluten-free, hypoallergenic and organic.

The UK is the largest market for pet healthcare and dietary supplements in Europe, Euromonitor says, with retail sales approaching 220 million ($US343 million) in 2007, a 14% increase over 2006. There is also an influx of lifestage and lifestyle petfoods.

Premium and superpremium products, particularly cat food, have predominated, with a total growth rate of 10% in 2007. Overall cat food has been growing about 2% a year, according to the UK's Pet Food Manufacturers Association, while dog food sales have increased about 3%.

Major grocery and pet superstore chains have taken over a greater proportion of the UK pet market in recent years. Pet superstores especially have grown due to the humanization trend and increasing demand for superpremium products. Garden centers have also become important; in the last five years the number of pet departments within UK and Irish garden centers has increased 77%.

Eastern Europe

One of the fastest petfood growing markets, Eastern Europe increased sales nearly 200% from 2002 to 2007, and Euromonitor projects it to grow another 56% between now and 2012. That would put total retail sales for cat and dog food at US$3.95 billion, up from US$2.54 billion in 2007.

Influencing factors include increasing levels of disposable income, changing perceptions of pets, increased demand for prepared petfood (particulary economy and mid-priced products), rising urbanization and improved distribution infrastructure. The outlook is especially positive for Poland and Russia, which comprise 64% of the market. Other countries coming on strong in petfood include Hungary and Romania (Figure 3).

Spotlight on Hungary

Demographic and lifestyle changes are driving the growth of Hungary's petfood market. "The rise in single-person households has increased the need for companionship," says Lee Linthicum, Euromonitor anaylyst. "Pets are increasingly treated as family members, with the number of pet owners willing to purchase prepared petfood increasing rapidly."

Since the collapse of the Soviet Union, a new consumer class has emerged who can afford to spend part of its disposable income on pets. "The emerging, affluent urban middle-class is increasingly drawn to new status symbols, such as purebred animals," Linthicum says. "This trend has boosted sales of petfood and pet care products."

It's not surprising that multinational companies are capitalizing on these developments. According to Euromonitor, the industry is dominated by global marketers such as Nestlé Purina Petcare Hungary, Masterfoods Magyarorszag and Vitakraft Aqua Food. A domestic company, Babolna Takarmanyipari, operating under the name Tendre Takarmanyipari, also holds a substantial market share.

Supermarkets and hypermarkets have become vital venues for petfood and pet care products; originally pet specialty stores dominated.

Given Hungary's considerably large population, the potential for growth is higher than in other European countries, provided steady consumer demand and demographic changes continue, Euromonitor says.

Spotlight on Romania

Petfood sales in Romania have been growing at more than 20% annually as the number of pet owners increase and supermarket chains rapidly expand. "Consumers in Romania are buying more prepared foods for their pets," says Ivan Uzunov, an analyst in the Vilnius, Lithuania, office of Euromonitor.

The growth starts from a low base. "The spending per person for petfood and pet care products in Romania is US$7.91 per person, while in Poland it is US$10.47 per person," Uzunov says.

Sales in urban areas are a major growth driver, says Regina Maiseviciute of Euromonitor. "Consumers with higher incomes and more dynamic lifestyles are purchasing more prepared petfoods." These are mainly young professionals, living alone or in two-person households and increasingly concerned about their pets' health.

Romania's rapid growth is also due to the renewed construction of infrastructure, which is allowing people to buy prepared petfood more easily. This includes hypermarkets and supermarkets located mainly in urban areas, along with pet shops.

"Multinationals like Mars and Nestlé, and others like Hill's in the premium sector, are dominating the market," Uzunov says. "At the same time, many smaller local producers are switching toward production of petfoods under private labels for supermarket and hypermarket chains."

Asia

Asia is a tale of two petfood markets: developed countries like Japan, South Korea and Singapore, or developing areas like China, India and Vietnam. Countries such as Thailand fall somewhere in between.

The developed markets are characterized by aging consumers, people staying single or childless longer, busy lifestyles, pet owners willing to pay a premium and shorter product lifecycles as consumers demand variety, innovation, convenience and healthier offerings. In developing countries, consumers have rising but still low disposable incomes, so price remains key.

As a region Asia-Pacific has grown 21% in cat and dog food sales over the past five years, to a total of US$4.41 billion, and is projected to grow at the same rate until 2012, reaching US$5.33 billion then, according to Euromonitor.

Spotlight on South Korea

South Korea is seeing a spike in demand for premium petfoods, as pet owners increasingly look to buy high-quality products. Lee Linthicum of Euromonitor says pet owners now have a different outlook.

"A survey done by a local newspaper showed about 95% of owners think of their pets as family members," Linthicum says. "That is a huge cultural change from before: Dogs and cats were kept outside and fed leftovers." Buying expensive petfood is also seen as a sign of social status, especially among younger South Koreans.

Son Ji-hui, a spokeswoman for the Seoul-based CJ Group (one of the largest domestic petfood manufacturers), says expensive functional petfoods, including ones with organic, natural and Chinese medicinal ingredients, are gaining popularity.

Son also says food safety could be driving Korean pet owners toward premium brands. "Recently, many accidents related to petfood safety have occurred in foreign countries, including the US recalls last year, and these have invoked the Korean consumer's concerns," she says.

Linthicum predicts the South Korean petfood and pet care market will reach US$815.6 million by 2012. In 2007, retail petfood sales reached US$512.8 million, up from US$464 million in 2006 (Figure 4). Dog foods predominate; there are 2 millions dogs in Korea compared to 100,000 cats.

Spotlight on Thailand

Socio-economic changes, including higher disposable incomes, are leading to a rise in the number of pet owners in Thailand, driving petfood growth.

Thailand's petfood and pet care market is expected to reach US$392.3 million by 2012, from the current US$234.6 million, at an annual growth rate of 10.8%, according to Euromonitor. "With increasing incomes and households expected to become smaller, we predict many people will continue to seek the company of a pet," Lee Linthicum of Euromonitor says.

Varayuth Viriyachart, a spokesman with Bangkok-based petfood manufacturer Perfect Companion Co. Ltd., says the behavior of pet owners has changed. "Previously, owners fed their dogs leftovers or cooked food, but recent changes like an increasingly aging population and a declining number of newborns are causing the number of pets to rise and the petfood industry to continuously grow," he says. "Thai pet owners are also paying more attention to their pets' health, which is why dry petfood is becoming more popular."

Currently, 10 major companies are competing in Thailand, including CP, Nestlé Purina Petcare and Effem Foods, according to Euromonitor, which also predicts mid-priced and economy petfood products will see increasing demand due to the unstable economic situation in the country.

.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)