A poll conducted by Petfood Industry gathered insights from readers about pet food safety investment trends and priorities across the industry.

The poll results suggest that pet food safety investment is increasing for some companies, but strategic clarity and technology adoption remain inconsistent. Pet food industry leaders may benefit from formalizing safety priorities, strengthening supplier verification programs, modernizing testing infrastructure, and accelerating digital tool adoption to improve resilience, compliance and consumer confidence.

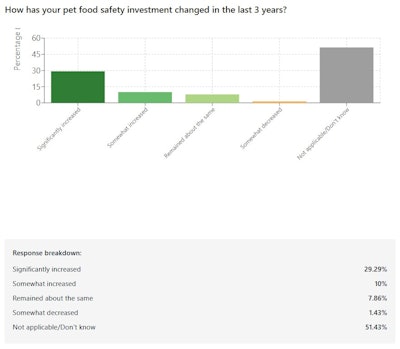

Q1: How has your pet food safety investment changed in the last 3 years?

When asked how safety investment has changed over the past three years, 29% of respondents reported significantly increased spending, while 10% noted somewhat increased investment. However, more than half (51%) selected "not applicable/don't know," and only 8% indicated their investment remained about the same. Just 1% reported decreased safety spending.

What this means: While nearly 40% of respondents report increasing food safety investment, more than half selected “not applicable/don’t know,” suggesting either limited visibility into budget decisions or fragmented safety ownership within organizations. For pet food manufacturers, this may indicate an opportunity to strengthen internal communication around safety strategy and ROI measurement.

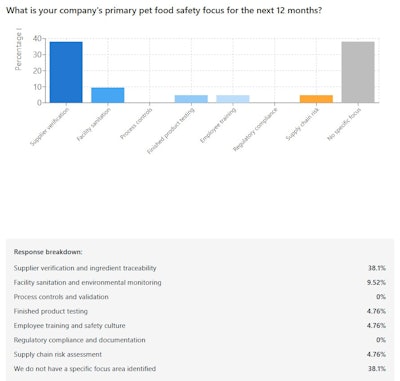

Q2: What is your company’s primary pet food safety focus for the next 12 months?

Looking ahead to the next 12 months, companies' primary safety focus areas showed a split between active planning and uncertainty. Supplier verification and ingredient traceability topped the list at 38%, tied with those who reported having no specific focus area identified (also 38%). Facility sanitation and environmental monitoring garnered 10% of responses, while finished product testing, employee training and safety culture, and supply chain risk assessment each received 5%. Notably, process controls and validation, along with regulatory compliance and documentation, received 0% as a primary focus area.

What this means: Supplier verification and ingredient traceability lead as the top defined priority, reflecting ongoing concerns about raw material risk and supply chain disruptions. However, an equal share of respondents reported having no defined safety focus, signaling potential gaps in structured food safety planning. Pet food manufacturers with clearly defined safety priorities may gain competitive advantages in compliance readiness, brand trust and recall prevention.

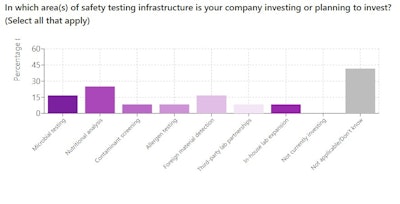

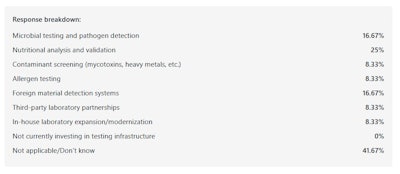

Q3: In which area(s) of safety testing infrastructure is your company investing or planning to invest?

Note, those taking the survey could choose more than one answer. For safety testing infrastructure investments, nutritional analysis and validation led at 25%, followed by microbial testing and pathogen detection, and foreign material detection systems, each at 17%.

Contaminant screening, allergen testing, third-party laboratory partnerships, and in-house laboratory expansion each received 8%. However, 42% selected "not applicable/don't know," and no respondents indicated they were not currently investing in testing infrastructure.

What this means: Investment trends suggest a growing emphasis on nutritional accuracy, pathogen control, and physical hazard detection, aligning with regulatory scrutiny and consumer expectations for product integrity. Still, the high “not applicable/don’t know” response rate may reflect uncertainty about capital planning or limited investment in testing infrastructure across smaller manufacturers.

Q4: What is your company’s plan to incorporate data analytics and digital tools to enhance pet food quality and safety?

Regarding data analytics and digital tools for quality and safety enhancement, adoption remains limited. Only 20% reported using these tools in limited capacity with plans to expand, while 40% are not currently considering such implementation. An additional 40% selected "not applicable/don't know." No respondents reported extensive use across operations, current evaluation for near-term implementation, or consideration of future implementation beyond 12 months.

What this means: Adoption of digital quality and safety tools remains early-stage, with no respondents reporting extensive implementation. This highlights a potential technology gap in predictive analytics, real-time monitoring, and automated compliance tracking. Pet food companies that invest early in digital transformation may improve risk detection, reduce waste and enhance audit readiness.

Survey methodology: Data collected January 26-February 9, 2026, from 140 pet food industry professionals via the Petfoodindustry.com polling platform.