Despite inflation and a slowdown in pet population growth, global retail sales of pet food, treats and other products continued to grow in 2024, reaching US$200 billion with a growth rate of 1.6%, according to Euromonitor International data. Pet food production reached 37.692 million metric tons (mt) in 2024, a 4.5% increase from the previous year, according to Alltech’s 2025 Agri-Food Outlook report. Publicly traded pet food companies demonstrated strong financial performance in 2024, bucking broader market challenges and signaling a continued recovery from post-pandemic normalization. In the world’s largest pet food market, the U.S. pet owner expenditures reached $152 billion in 2024, with projections of $157 billion for 2025, according to the American Pet Products Association’s 2025 State of the Industry Report. Although, like other industries, the global pet food industry faces the effects of tariffs, inflation, conflicts and other challenges in 2025, analysts forecast continued growth for the sector.

Companies not currently featured in Petfood Industry's online database, or those seeking to update or correct existing information, can contact us at [email protected].

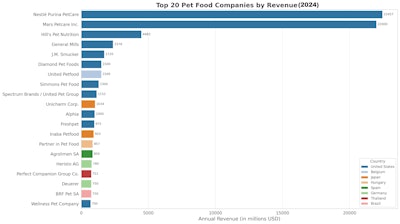

The 20 companies in this chart led the world’s pet food industry in annual revenue. The data was taken from Petfood Industry's Top Companies Database.

Nestle Purina PetCare and Mars Petcare continue to dominate, as do U.S.-based companies overall. However, outside of the top 10, the pet food industry becomes more diverse with smaller, agile and regional companies fitting where the giants don’t. The largest companies balance economies of scale with innovation, expanding global infrastructure while investing in branded differentiation and digital engagement. Meanwhile, smaller and mid‑tier privately owned companies demonstrate robust volume growth through niche product development and distribution dexterity. Publicly traded firms like Freshpet and Nulo deliver transparent growth metrics and improved margins, while private firms, including Mars and ZIWI, leverage major investments and global scale.

In particular, fiscal year 2024 was a breakout year for Freshpet, Billy Cyr, Freshpet’s chief executive officer, as the company delivered full-year positive net income for the first time. Meanwhile, net sales for General Mills’ pet segment declined 4% in fiscal year 2024 compared with FY2023. In General Mills’ annual report, company executives stated that this decline in pet food sales value was due to a decrease in contributions from volume growth, partially offset by favorable net price realization and mix. In 2024, Colgate-Palmolive announced plans to exit from private-label pet food production in 2025. Hill’s Pet Nutrition made up 23.1% of parent company Colgate-Palmolive’s sales in the fourth quarter of calendar year 2024, following a net sales increase of 2.3% and organic sales increase of 2.9% compared to Q4 2023. In the 52 weeks ending January 18, 2025, Nulo sales increased by 2.1% to US$261.8 million while volume growth increased 13.4. Nulo was among three brands identified by NielsenIQ as posting year over year sales increases. The other two were Purina (up 0.4%) and Hill’s Science Diet (up 1.7%).