Dog food is the leader of the pack in U.S. pet food market, accounting for two-thirds of sales. Packaged Facts projects dog food sales (excluding treats and chews) to approach US$26 billion in 2021, for a 9% jump over 2020. This exceptional annual gain is driven by the COVID-19 pet acquisition wave as well as by the long-running pet food “humanization” and premiumization trends, which remain in play notwithstanding the pandemic.

Who spends what on dog food

About two-thirds of dog-owning households spend less than US$50 a month on dog food, and average pet food sales per dog are approximately US$250/annually. Who are the big spenders on dog food? Not surprisingly, because higher spending on pet food is discretionary, the likelihood of spending US$500 or more annually closely tracks household income levels.

MRI-Simmons Summer 2021 data show, for example, that among one-dog households, those with a household income of over US$200,000 index at 167 (67% above average) on spending US$500+ on dog food, compared to an index of 154 among one-dog households with incomes of US$150,000–$199,999, and dropping to an index of 117 among one-dog households with incomes of US$100,000–$149,999.

By geographical region, living in New England is also a prime indicator for significantly higher-than-average spending on dog food, at an index of 146 (46% above average) among one-dog households. This regional pattern ties back to income levels — nearly 13% of New England households have an income of US$200,000 or more, compared with 9% nationally. Having a Master’s/professional school degree, another trait associated with higher income, similarly is an indicator for higher spending on dog food, at an index of 145 among one-dog households.

Dog food spending and brands

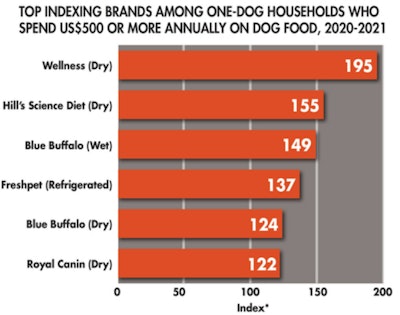

What dog food brands do these disproportionately high spenders disproportionately buy? Wellness comes out on top, with one-dog households who spend US$500+ annually on dog food being nearly twice as likely (index of 195) to buy Wellness brand dry dog food (see Table 1). That is, nearly 4% of these high spenders buy Wellness dry pet food, compared with only 2% of one-dog households overall.

Notable also, and reflecting an ongoing premiumization trend in wet dog food, is that these high spenders are half again more likely to buy Blue Buffalo canned dog food, at an index of 149 (49% above average). That is, 6.6% of these high spenders buy canned Blue Buffalo, compared with 4.4% single-dog owners overall.

Notable too is the refrigerated/wet Freshpet, bought by 2% of these high spenders, for an index of 137 (37% above average). Freshpet and a handful of kindred brands have mounted a significant challenge to the kibble old guard in defining the superpremium pet food segment, given that these brands feature the single most important attribute in the human food market: freshness.

Dry pet food remains, nonetheless, the most prevalent form of dog food. With a nearly universal usage rate among dog owners—steadily in the 92%—94% range over the past decade—kibble represents about 70% of spending in the dog food (excluding treats and chews) category.

Which U.S. pet owners spend the most on pet food?