Pet care spending is showing its recession-resistant mettle, at least in relative terms, even in this newer phase of high consumer inflation.

Packaged Facts’ August 2022 survey of pet owners shows that two-thirds (68%) of consumers have been cutting back on household expenses in the past 12 months due to price inflation, economic uncertainty or other factors. At the US$25,000–$34,999 household income bracket, just above the poverty level, that percentage rises to three-fourths (77%).

Where are households cutting back on expenses?

Nonetheless, among households that are curbing expenses, pet care and human medical care are relatively spared categories, with only 12% of households who are cutting back doing so in these spending categories. Pet care and medical care, that is, cluster together in consumer mindsets and priorities.

In comparison, among the households that are curbing expenses, nearly half (46%) are cutting back on food grocery spending, and two-thirds (69%) are cutting back on eating out, takeout and other spending on foods prepared outside of the home. This finding confirms the observation that pet owners will often cut spending on themselves before curbing expenses on their pets.

What areas of the pet space are seeing consumer cost-cutting measures?

In terms of cost-cutting choices within pet care spending categories, moreover, pet food lines up with medical products and services as the expenses pet owners are least likely and most reluctant to cut.

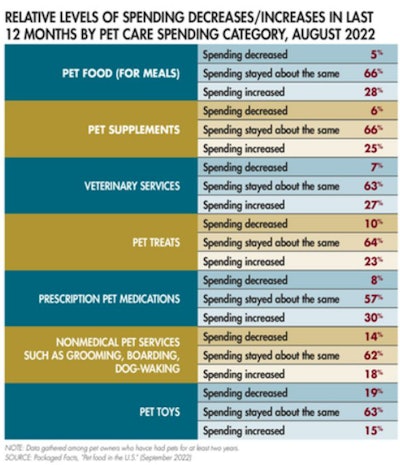

Among pet owners who have had their pets for at least two years, only 5% report spending less on pet food in the last 12 months, compared with 28% who report spending more on pet food (see Table 1). That is, most pet owners, at least so far, are absorbing the hit of rising pet food prices.

That 5% figure for spending less on pet food lands on the same end of the spectrum as the 6% spending less on pet supplements, 7% spending less on veterinary services and 8% spending less on prescription pet medications. This alignment with medical expenses is fortunate for the pet food industry but again not surprising, given that pet owners consider pet food the most important pet health product expenditure. Packaged Facts’ January 2022 Survey of Pet Owners showed that four-fifths (81%) of pet owners consider pet food to be “the most important health products for [their] pets,” with flea-tick prevention (56%) and heartworm prevention (48%) trailing.

At the other end of the spectrum — keeping in mind that pet care expenses as a whole are a relatively privileged and protected spending category — 14% of pet owners report spending less on non-medical pet services such as grooming and boarding and 19% report spending less on pet toys, though pet toys have previously been a growth monster within the durable products sector. Pet food sales, in contrast, are less subject to the wheel of fortune.

Owners buy smaller pet food packages as inflation rises

www.PetfoodIndustry.com/articles/11564