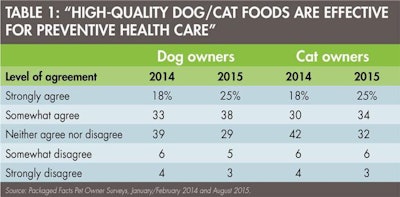

Pet parents are not only increasingly demanding about the health and wellness benefits of the foods they feed their pets, but increasingly convinced about the effectiveness of pet food as preventive health care. As reported in this column in 2014, a January/February 2014 Packaged Facts survey showed that about half of dog or cat owners (51% of dog owners and 48% of cat owners) somewhat, if not strongly, agreed that “High-quality dog foods/cat foods are effective for preventive health care.”

A follow-up survey in August 2015 shows these numbers notching up to 63% of dog owners and 59% of cat owners (see Table 1). Moreover, one-fourth of dog owners and cat owners strongly agree that high-quality pet foods are effective health care—the level of belief that readily translates into product purchasing behavior and choices.

The percentage of dog and cat owners who believe a high-quality diet is important to their pets’ health continues to increase.

As with the human market (the case with the lion’s share of pet food trends), concerns over pet health skew in the direction of senior and overweight members of the population. As of January 2015, 39% of dog owners have a dog age seven or older, while 43% of cat owners have a cat in that oldest age bracket, according to Packaged Facts research. Other surveys bear out the fact that the nation’s pet population is getting older. The growing population of older pets means more companion animals are suffering from age-related conditions including joint, coronary, cognitive and immune system issues, as well as diabetes and cancer.

At the same time, there is no question that overweight pets are a significant pet population health problem. A survey in 2014 by the Association for Pet Obesity Prevention (APOP) found that 58% of cats in the US and 53% of dogs were overweight or obese. Moreover, this APOP survey found an increase in dogs and cats moving from the overweight to the clinically obese classification. Excessive weight in a pet can lead to a whole host of other health issues, just as with humans.

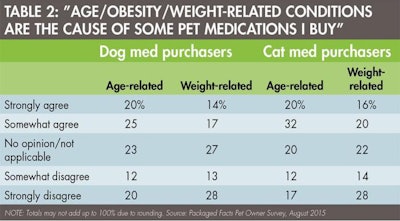

As reported in Packaged Facts’ Pet Medications in the US (September 2015), about half of pet owners who purchase dog or cat medications somewhat or strongly agree that age-related conditions tie in to some of the medications that they buy, andabout one-third somewhat or strongly agree that weight-related conditions spur pet medication purchases (see Table 2). Correspondingly, about half of dog owners and one-third of cat owners have purchased pet medications other than flea/tick or heartworm in the last 12 months.

Thirty-four percent of dog owners and 36% of cat owners say they “strongly agree” that age-, obesity- and weight-related conditions are taken into consideration when they buy medications for their pets.

The list of other pet medications most often used is headed up by antibiotics (15% of dog owners and 7% of cat owners), prescription or non-prescription pain relief products, allergy relief products, and eye or ear or joint/arthritis products.

Among those who purchase dry pet food, according to the Spring 2015 Simmons National Consumer Survey from Experian Marketing Services, 21% of dog owners and 19% of cat owners purchase senior or light/weight management formulations for their pets. While those figures are up from 17% of dog owners and cat owners in 2004, and while consumer recognition of the role of high-quality pet foods in preventive healthcare is increasing, a gap remains between the health needs of the pet population and pet owner addressing of those needs.

As part of the solution, the successful marketers and retailers of pet food—especially in the case of premium and superpremium products, including natural and organic offerings—will continue both to push the product formulation envelope in targeting these pet wellness concerns and to educate pet parents about daily, proactive health care for pets.