Oral care products for pets are nothing new. Nonetheless, the continuing premiumization of the pet market, which includes a heightened focus on pet wellness and on human-style products for pets, has had a marked impact on availability and characteristics of products designed to address pet dental hygiene and oral health. Today’s consumers are willing to pay more for pet products and to pay for more types of pet products, but they are also more demanding about product qualities and performance, along with being more inclined to convey satisfaction or displeasure with a product via social media.

Several factors play into the development and marketing of oral care products for pets, not the least of which is the competitive fire necessity to come up with innovative and differentiated product concepts. Adding value to products through oral care benefits is one way for marketers to gain placement on the shelf, or to increase sales of products within a mature (and therefore crowded) category, as well as to boost manufacturer and retailer margins.Moreover, the presence of premium and even superpremium pet wellness products in mass-market channels means that pet oral care market potential is hardly limited to the specialty pet channel.

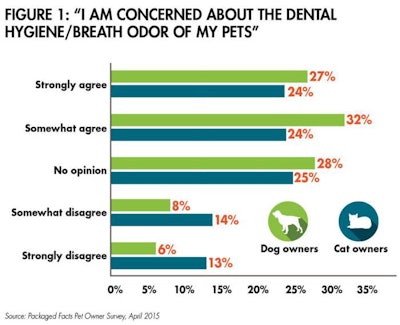

In fact, oral health is one of the top three concerns for companion animal owners, according to the American Veterinary Medical Association (AVMA). Approximately 80% of dogs develop some form of periodontal disease by the time they’re three years old, such that oral disease is the most frequently diagnosed health problem for pets. Dental disease impacts not only pets’ teeth, gums and mouth, but can (through bacteria that enter the bloodstream) potentially affect a pet’s heart, liver and kidneys. Although many pet owners need to be further educated about oral health issues, a baseline of awareness exists. Packaged Facts’ new report on Pet Oral Care Products and Services in the US (November 2015) shows that 59% of dog owners strongly or somewhat agree that they are concerned about the dental hygiene/breath odor of their pets, compared with 48% of cat owners (see Figure 1).

According to Packaged Facts data, the majority of dog owners and nearly half of cat owners agree that they are concerned about their pets’ dental hygiene.

However, when it comes to spending on services or products for pets’ oral health, a gap remains between level of concern and actual expenditures. In the case of products, Packaged Facts data show that only 44% of dog owners have purchased any oral care/dental hygiene products within the past 12 months. Dental treats and chews are the most popular (41%) such purchase. Although dental treats should not be promoted over regular brushing and professional cleaning, which remain the gold standard for pet as for human oral care, many veterinarians do recommend different kinds of treats—including rubber and rope chew toys, rawhides and treats that don’t break down easily—to trigger chewing and mechanical action on the teeth, which is beneficial to dental health.

Within the dental treats and chews arena, a competitive tug-of-war for natural product dollars is taking place between functional natural and organic formulations on the one hand, and rawhide, jerky and other natural animal part treats on the other. The recent product safety issues around rawhides have tilted some of the balance in favor of formulated products, but animal parts retain a permanent “whole foods” advantage, particularly in the case of superpremium products.

Following dental treats and chews in usage rates of oral care products for dogs are more generally positioned treats that include an oral care benefit (23%). Dog food with oral care benefits, breath freshener sprays/drops and oral care supplements form a third tier of oral care products for dogs by usage rates.

Prime purchasers of oral care products for dogs include younger adult (age 25-34) dog owners, suggesting a favorable demographic tide for market development. In addition, among dog owners who buy any type of pet oral care products, one of the top factors influencing purchase is recommendation by a veterinarian. This suggests that veterinarians’ pet health expertise and ability to recommend products can be a huge plus in the evolution of the market for pet oral care products.

In particular, the market for dog foods with oral care benefits may be capable of significant growth if veterinarians recommend and carry innovative specialty products of this type. Given that nearly two-thirds of dog owners generally agree that high-quality dog foods can be effective for preventive health care, dog food formulations that stress oral care benefits can help close the gap between the prevalence of oral disease among dogs and the participation of pet parents in addressing this pet health and wellness concern.