The growing population of older dogs and cats means that more companion animals are suffering from age-related health issues, including obesity and conditions related to joint, coronary, cognitive and immune system function. Senior or overweight dog- or cat-targeted pet foods address these concerns on top of routine nutritional needs.

Packaged Facts survey data from late 2015 shed light on distinctive pet food purchasing patterns among caregivers of senior pets with age-related health issues. Among these pet parents, 28% of dog owners and 23% of cat owners use senior pet formulations. Among these parents of senior pets, more generally, 74% strongly or somewhat agree that they read pet food ingredient lists carefully, compared with 61% of dog or cat owners overall (see Table 1).

While consumers overall are becoming increasingly educated and focused on what their pets are eating, those pet owners with senior animals claim to read the ingredient lists of their pets’ food more carefully than the average owner.

Among these owners of senior pets, even more markedly, 42% of dog owners and 46% of cat owners strongly agree that they are willing to pay more for healthier pet foods, compared with 30% of dog or cat owners overall.

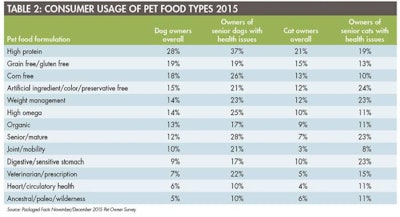

This receptiveness to health-focused superpremium and premium pet foods becomes evident in the types of formulations these senior pet parents are disproportionately likely to buy, especially in the case of pet parents of senior dogs with age-related health issues. Among this cohort, for example, 37% describe themselves as buying high-protein dog food, compared with 28% of dog owners overall; 22% buy veterinarian/prescription formulation dog food, compared with 7% of dog owners overall; and 21% buy joint/mobility formulation dog food, compared with 10% overall (see Table 2).

The popularity of specialty pet food formulations is nothing new, but pet owners with senior pets are particularly focused on claims such as artificial ingredient or preservative free, senior formulations, and veterinary prescription diets overall.

Though this effect is somewhat less pronounced and consistent in the case of pet parents with senior cats, the general pattern holds. Among those with senior cats with age-related health issues, for example, 24% describe themselves as buying artificial ingredient/color/preservative free cat food, compared with 12% of cat owners overall; 23% buy weight management cat food, compared with 12% of cat owners overall; and 23% buy digestive/sensitive stomach formula cat food, compared with 10% overall.

Because of their specialized health focus and targeting of senior, overweight and other distinctive pet health needs, these pet food formulations are typically priced well above the market average, fueling pet food industry growth. Smaller, entrepreneurial superpermium marketers often drive the innovation in pet food formulation. Mainstream marketers with massive economies of scale in ingredient sourcing and product manufacturing, as well as entrenched retailer relationships and deep-pocketed marketing campaigns, then step in and amplify the trends and the profits.

Further market information

For more Market Reports from David Sprinkle: www.petfoodindustry.com/authors/145

For information on Packaged Facts’ report on Senior, Weight Management and Special Needs Pet Products in the US (February 2016): www.packagedfacts.com