In the January 2016 issue of Petfood Industry magazine, we asked pet food industry experts to give us their predictions on the state of the industry throughout 2016. Now that we’re a little more than halfway through the year, it’s time to take a look at those predictions and how they’ve played out so far, as well as what’s in store for the rest of 2016.

Freeze-dried, raw and fresh pet foods have been on the industry radar in a significant way for the last few years, and the beginning of 2016 ushered in a continuation of the trend, according to industry experts. Those in the know predicted that 2016 would be a year for companies to expand their specialty offerings in the category and find ways to make those offerings more accessible to a larger consumer base. So far, the data trends would seem to be on the side of this prediction: the premium pet food category overall—which includes freeze-dried, raw and fresh options—has grown twice as fast as pet food overall in the last 10 years, according to PetSmart Vice President of Dog and Cat Consumables Evelia Davis. Speaking at Petfood Forum 2016, she said that people are willing to spend more to ensure the wellness of their pets, and there is an increasing awareness and belief that feeding a high-quality pet food can have positive benefits.

One of the challenges of premiumization, and its accessibility, is price. According to Maria Lange, business group director at GfK, who spoke at Petfood Forum 2016 on current pet specialty trends, the average price per pound of pet food and treats has gone up 40% since 2011, largely due to premiumization. This has created “dueling trends,” where premium continues to grow but “value natural” offerings—usually about 20% cheaper than their premium counterparts—are also making their way into the market.

This doesn’t mean the more niche categories within the premium pet food market are suffering, however. Raw frozen pet foods, for example, have seen 36% year-over-year growth and hold 1.1% market share at a cost of US$5.83 per pound, according to Lange—a significant cost when compared to other categories such as natural (US$2.70 per pound) or grain-free (US$3.04 per pound).

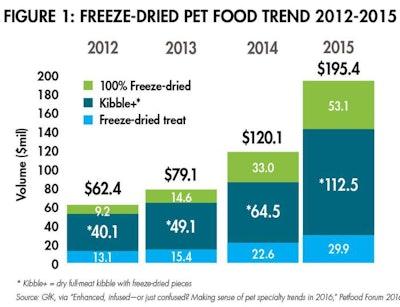

And freeze-dried pet food continues to grow year-over-year, whether we’re looking at the category as a whole or breaking it down further (e.g., 100% freeze-dried, full-meal kibble with freeze-dried pieces incorporated, freeze-dried treats). In 2015, the total freeze-dried segment grew 62.7% year-over-year, bringing in US$195.4 million (see Figure 1). Perhaps supporting the inclination of consumers to look for a mix of premium and value, the majority of those dollars (US$112.5 million) came from the “kibble+” category—those formulas containing kibble supplemented with freeze-dried pieces to make a complete meal. In January and February 2016, according to Lange, the freeze-dried category brought in US$38.2 million. If that remains the average for the rest of the year, said Lange, the category will see 17% growth by the end of 2016 (to US$229 million).

The total freeze-dried market grew 62.7% (year-over-year) in 2015, compared to 22.5% in 2014. 100% freeze-dried products (full meals) grew 61% in 2015, while kibble+ products saw 74.4% growth. Freeze-dried treats saw 31.9% year-over-year growth in 2015.

Consumer behavior was another hot topic at the beginning of 2016: pet parents are becoming more and more involved in their pets’ nutrition, largely through education, and industry experts fully expected to see pet food demands in line with that increased involvement. “We are all part of a unique industry that is growing,” said Davis. “We have highly engaged and informed customers, and that requires us to be engaged and committed to understanding our pets’ and pet parents’ needs.” Customers, she said, want healthy and safe products; a seamless, authentic and engaging shopping experience; innovative products that cater specifically to their pets’ individual needs and allow them to engage with their pets; and to shop with companies that 'do good.'”

These complex desires are causing consumer purchasing behaviors to change, said Davis. Rather than the “traditional” path to purchasing, which was direct and simple (see Figure 2), the industry is seeing a more complicated path—one that includes significant information gathering and shopping before the moment of purchase, and takes into consideration the “post-purchase experience,” a factor in the loyalty brands are trying to instill in their customers. As humanization continues to grow (in 2015, 95% of pet parents considered their pets to be members of the family), consumer needs will steadily become more intricate and individualized.

Pet parents now have access to a wealth of information that influences their purchasing decisions, according to Evelia Davis, vice president of dog and cat consumables at PetSmart Inc. There used to be a simple funnel from awareness to consideration to narrowing of choice to purchase, but today’s process is a more complicated, consumer-led journey, rather than being marketing, manufacturer or retailer led.

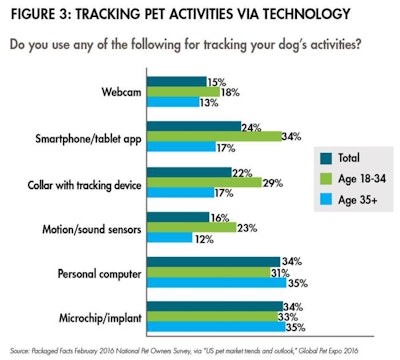

Technology in the pet industry is guaranteed to become more and more prevalent as consumers do their best to gain the information they need and interact with their pets in the ways they want (see Figure 3). This means that savvy pet food manufacturers would do well to take a look at things like online ordering when considering outlets for their products. In a March 2016 survey by Packaged Facts (Pet Food in the US), 29% of pet owners said they’d purchased pet products online in the last seven days. Another 39% said they’d done so in the last 30 days, and 17% more said they’d purchased pet products online in the last three months.

Consumers are, more and more, looking to technology to interact with their pets. More than 30% of pet owners use their personal computers and microchips to track their dogs, while those in the 18–34 age group are more likely to use things such as smartphone apps and tracking collars.

In a December 2015 Packaged Facts survey on Pet product marketing trends, 46% of pet owners said they used the internet to research pet products. More than 40% surveyed also said they use the internet for price comparison, looking for sales and coupons, buying products, comparing products and checking online sales flyers. Consumers are also diversifying their tools, using PCs, laptops, smartphones and tablets to accomplish these tasks, to varying degrees.

It is, perhaps more than ever, incumbent upon the industry to stay on top of how consumers are doing (and want to do) business with their pet food providers. With humanization in full swing and options increasing, the trends predicted at the beginning of the year rang true in the first half of 2016—and will continue to track for the rest of the year.

Pet food regulations in 2016

Fatty acids: http://goo.gl/XZTIss

“Feed grade”: http://goo.gl/InVnPI

“Human grade”: http://goo.gl/REGWwl

Hazard analysis for FSMA compliance: http://goo.gl/wswPcb

FSMA implementation: http://goo.gl/4cFvdT

More on pet food trends