The Chinese Belt and Road Initiative (BRI) could impact the pet food industry of Central Asian countries such as Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan. Under BRI, which seeks to revive the old Silk Road that connected major trading centers in Central Asia to Turkey, Russia and Europe on one end and China on the other, the landlocked and historically volatile Central Asian markets could open up, transforming the economic and trade dynamic of the region. Combined, they boast a population of 73 million and a GDP of US$262.86 billion, roughly the size of the Egyptian economy.

The World Bank notes that for these landlocked Central Asian countries, BRI can reduce travel times and trade costs, while increasing investments in infrastructure and manufacturing. Previous coverage of Central Asia by PetfoodIndustry.com highlighted growing domestic production capacity specifically in pet food manufacturing that could further strengthen, if BRI is properly implemented.

Central Asian pet food trade built on imports

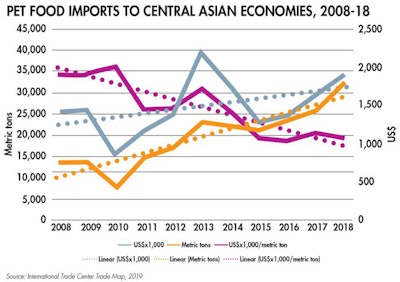

To ascertain the impacts of any prospective BRI investment in the pet food industry of Central Asia, with most investments remaining opaque until now, it is imperative to understand where the region’s pet food industry stands today in terms of global trade. Central Asian countries are import-driven. The market value of pet food imports entering these economies has grown by 35%, starting at US$25.5 million in 2008 and moving up to US$34.4 million in 2018.

In terms of tonnage of pet food imported, these economies saw a 141% increase, going from 13,000 metric tons imported in 2008 to 32,000 in 2018. Across Central Asia, the price for each metric ton of pet food imported has also dropped by 41%, from US$1,899/metric ton in 2008 to US$1,061/metric ton in 2018, signifying growing demand in the region leading to economies of scale for manufacturers abroad.

Figure 1. Pet food imports to Central Asian economies, 2008-2018

Pet food imports to Central Asia increased 35% in value and 141% in tonnage in 10 years.

Kazakhstan clear pet food trade winner in Central Asia

A breakdown of Central Asian economies reveals that Kazakhstan has the highest demand for imported pet food in the region, despite representing only 26% of the regional population. In 2008, Kazakhstan represented 96% of the imported pet food market, in terms of dollar value; the country has slowly seen its dollar market share dip to 93% in 2013, with another drop to 80% in 2018.

Within the same time frame, Kyrgyzstan (with only 6% of the Central Asian population) has gained significant market share in dollar value. In 2008, Kyrgyzstan had only a 4% share in the Central Asian imported pet food market. By 2013, that rose to 5% and to 12% by 2018.

Uzbekistan, another emerging economy with a population of 32.8 million (45% of Central Asia), is similarly poised for increasing its market share in terms of imported pet food. In 2013, Uzbekistan had a share of 1%, which rose to 5% in 2018.

BRI may cause shift away from Russia for pet food imports

Russia enjoys an overwhelmingly favorable position in the pet food market of Central Asia. It is the largest exporter of pet food to all five of the region’s economies. Much of the reason for Russia’s success is the result of free and preferential trade agreements with Commonwealth of Independent States (CIS) member states.

In Kazakhstan, Russian pet food imports account for 87% market share by dollar value. In terms of tonnage, the figure jumps to 92%. Their price per metric ton is well below European competitors (France, Italy, Germany and Netherlands), standing at US$936/metric ton for importing to Kazakhstan.

However, under BRI, China intends to boost manufacturing and economic growth within its western provinces, positioning itself to expand its reach further into Kazakhstan, where it currently holds a 1% pet food imports market share by dollar value and a 2% share by tonnage. Their price per metric ton is also lower than Russia’s (US$767/metric ton). Once infrastructure projects are completed, transport costs can reduce further, effectively shifting demand to Chinese pet food manufacturers.

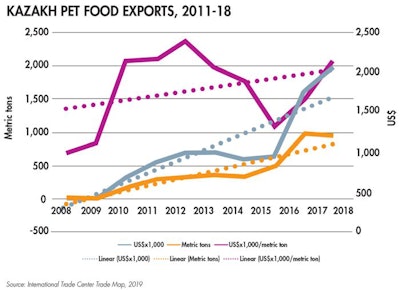

Kazakhstan focused on enhancing pet food manufacturing for exports

Kazakh pet food exports are reaching new heights. In 2011, Kazakhstan exported 149 metric tons of pet food at a value of US$318,000. The country has seen its pet food exports grow by more than 500% in just seven years, exporting 931 metric tons at a value of US$1.97 million.

Although their price per metric ton of pet food exported remains high at US$2,120 in 2018, Kazakhstan is challenging Russia for the Kyrgyz and Uzbek pet food markets. In Kyrgyzstan, Kazakhstan imports more pet food than Russia by tonnage, claiming a market share of 51%, compared to the Russian 44%. In terms of share by dollar value, Kazakhstan and Russia hold 48% each.

Figure 2. Kazakh pet food exports, 2011-2018

Kazakhstan’s pet food exports have grown by more than 500% in just seven years.

In Uzbekistan, Kazakhstan still has some ground to cover, holding only a 14% market share in pet food imports for both metrics, behind France and far behind Russia. It must be noted, however, that Kazakhstan only started exporting pet food to Uzbekistan in 2017, compared to Kyrgyzstan where they have been exporting pet food since 2011.

Although it is likely that Russian pet food investors will have to strategize against the shifting market under BRI, Kazakhstan can gain comparative advantage by expanding its market share in the other Central Asian countries.