Packaged Facts will be presenting new research on consumer patterns for switching pet foods at Petfood Forum 2020 in Kansas City, Missouri, USA. This article previews some topline findings.

While dog and cat owners are traditionally somewhat conservative about changing pet foods — due in part to the principle of sticking with what works and in part to the risk of triggering gastrointestinal discomfort — switching pet foods is hardly uncommon.

Packaged Facts’ February–March 2020 survey of pet owners shows that about a fourth of pet owners have changed the pet foods they use within the last 12 months, at 28% of dog owners and 24% of cat owners.

Why do pet owners change their animals’ food?

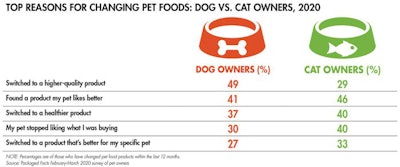

The top reasons for changing pet foods align with the larger trends driving the category generally: higher-quality and healthier foods, pet pampering and products targeted to the specific characteristics of an individual pet. Even so, the weighting of motivations varies between dog owners and cat owners (see Table 1), with felines earning their stripes for being more finicky:

- Switching to a higher-quality pet food is a driver for 49% of dog owners who switched, ranking as the single most important motivation, compared with only 29% of cat owners.

- Switching to a product the pet likes better is a top driver for 46% of cat owners and the top motivator, compared with a somewhat lower 41% of dog owners.

- Similarly, switching because the pet stopped liking or eating the pet food being used was a motivator for 40% of cat owners, compared with 30% of dog owners.

TABLE 1: Dog owners are far more likely to switch foods due to quality, while cat owners focus strongly on finding a food their finicky feline will eat.

What influences the decision to change pet foods?

A varied set of people or sources influence pet owners in their pet food changes. Veterinarians are the single top influencers, although at a fairly moderate 38% rate among dog owners, dropping to a 31% rate among cat owners — as is consistent with the lower usage rates of veterinary care for cats than for dogs. In addition, word-of-mouth from friends and family was the second-ranked influence among dog owners (27%), but much less important among cat owners, among whom information on a pet food brand website (23%) ranked second as a source influence.

By the type or market positioning of pet food formulas, the market continues to tilt toward specialty formulations and differentiating claims. Among dog and cat owners alike, only 42% identified themselves as using regular/adult formula pet foods. Among those who had changed pet foods in the last 12 months, only 33% of dog owners and 26% of cat owners switched to a regular/adult formulation.

The pet food claim most important to consumers, as numerous Packaged Facts consumer surveys have confirmed, is “Made in the USA.” Pet foods with a Made in the U.S.A. claim draw a higher percentage of customers than do regular/adult formulations, at 49% among dog owners and 39% among cat owners. In addition, the Made in the U.S.A. claim applies to a significantly higher percentage of the pet foods being switched to than does the grain-free claim. In the dog food segment, where the marketing of grain-free has been more prominent, 22% of those changing pet foods chose a grain-free formulation, compared with 36% for Made in the U.S.A.

Packaged Facts’ February–March 2020 consumer survey data also show that a fifth (21%) of dog owners are very aware of the possible link between some boutique, exotic and grain-free formulations and DCM (canine dilated cardiomyopathy). While that’s a very significant contingent of customers, and awareness rises among pet specialty store shoppers, grain-free has been more decidedly top-of-mind for a higher percentage of pet food marketers than of pet food customers.

From the pet food manufacturing point of view, that’s in part because grain-free kibble and canned pet foods have been a readier match to food culture metatrends than are, as Packaged Facts’ presentation at Petfood Forum 2020 will discuss, the increasing priority on foods that are free of artificial ingredients, less highly processed and preserve natural nutrition. These broader consumer priorities are reflected not only in the growing use of alternative types of pet food, but in pet owner patterns for adding kitchen foods to the commercial pet foods and mix-ins they buy.