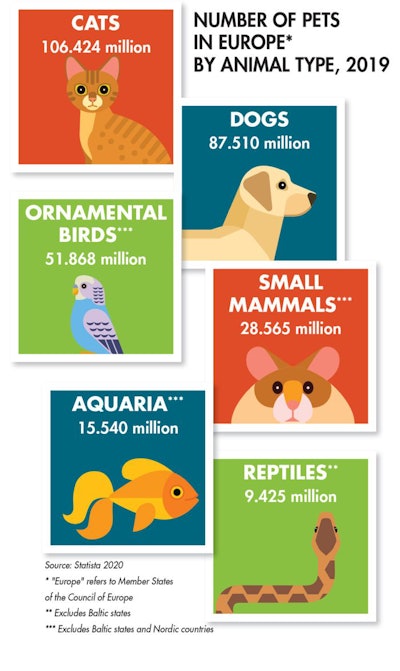

All over the world, dogs and cats rule when it comes to pet ownership. In the U.S. in 2019, 63.4 million homes (49% of all households) had at least one dog and 42.7 million homes (33% of all households) included at least one cat, according to the 2019–2020 American Pet Products Association (APPA) National Pet Owners Survey. In Europe, 2019 saw 106.4 million cats and 87.5 million dogs residing in roughly 25% (cats) and 24% (dogs) of European homes, according to data from Statista and the European Pet Food Industry Federation (FEDIAF).

But “other” pets, which include pretty much anything that isn’t a dog or cat by most definitions (small mammals such as rabbits, hamsters, gerbils, etc.; fish; birds; and reptiles and amphibians), have carved out a devoted and growing following with trends that will be familiar to anyone who deals in the dog and cat segments.

By the numbers: “Other” pets in the overall pet space

According to Packaged Facts data in the June 2020 update of its “U.S. Pet Market Outlook 2020–2021” report, 5% of overall pet market sales come from “other” (not cat or dog) pets. Additionally, the continuing COVID-19 pandemic has given this segment a boost in adoption rates, with 4% of U.S. adults adopting pets such as fish, birds, small mammals and animals, and reptiles and amphibians during the first three months of the pandemic (compared with a 9% adoption rate of such pets in the previous 12 months).

“Compared with overall and historic pet ownership patterns, (U.S.) pet adoption in 2020 has been disproportionately high for ‘other’ types of pets, rather than dogs or cats as the most popular types of pets, because current pet adoption also ties in to a multiple-pet-ownership trend,” said Packaged Facts in its report. It makes sense — homes with pets already are more likely to feel comfortable making the decision to add another furry, feathered or scaled member to the fold, and in a year when “stay home” is a worldwide mantra, it’s simply easier to find space for an additional pet if said pet is smaller or needs less space to thrive.

In Europe, birds are the third-largest pet population (cats and dogs being numbers one and two, respectively), according to FEDIAF data, with 51.87 million pet birds in all of Europe (37.23 million of those in the European Union) in 2019 (see Figure 1). 28.57 million small mammals (10.63 million in the EU), 15.54 million aquaria (10.63 million in the EU; overall equating to roughly 300 million ornamental fish) and 9.43 million reptiles (7.91 million in the EU) round out the top pet types in Europe.

FIGURE 1: So-called “small pet” owners can be found all over the world as a small but growing segment of the larger pet space.

In Asia, fish seem to be incredibly popular for pet ownership. A June 2018 survey conducted by Rakuten Insight, a consumer market research data collection agency focusing on the Asia region, found that 15.6% of pet-owning households in Indonesia own goldfish and 9.0% own tropical fish, alongside 12.3% and 4.9% (respectively) of pet homes in Thailand, 10.3% and 6.5% in the Philippines, and 9.6% and 6.0% in Taiwan. Bird ownership is also very popular, especially in Indonesia and the Philippines, where 19.3% and 12.2% of pet-owning homes, respectively, have feathered family members.

A segment within a segment: Reptiles seeing ownership growth

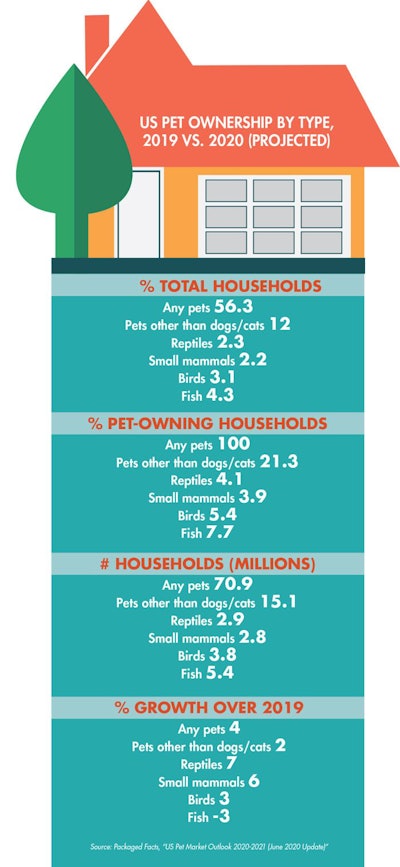

In its June report, Packaged Facts estimated above-average growth for nearly every segment of pet ownership in 2020, but one segment stood out more than the others: reptiles. It’s predicted that reptiles will make up 4.1% of U.S. pet-owning homes in 2020, seeing 7% growth over 2019 numbers — more significant that any other type of pet tracked (see Table 1). It’s perhaps not completely surprising, since sales in the reptile segment have seen an ongoing growth trend.

TABLE 1: While nearly every pet ownership segment is projected to see growth in the U.S. in 2020, reptiles are coming out on top with 7% growth over 2019 (small mammals come in at a close second with 6% estimated growth).

“In contrast to declining sales growth in all of the other ‘other pet’ segments over the past few years, reptile products have advanced at a healthy pace,” said Packaged Facts in its April 2020 report “Pet Reptile Products: U.S. Pet Market Trends and Opportunities, 2nd Edition.” In 2019, such sales came in at US$495 million, and while the pandemic is sure to take its bite out of the market, current conservative estimates still put sales growth at 2.1% for the 2019–2024 forecast period, bringing sales to US$550 million — a number that will likely increase if the economy rebounds sooner than expected.

Familiar faces in reptile trends: pets as family, premium foods

“The popularity of reptiles and amphibians within the pet trade is simply on fire right now,” said John Mack, founder and CEO of Reptiles by Mack and vice-chair for the Pet Industry Joint Advisory Council (PIJAC), in the February 2020 issue of Pet Age magazine. What’s more, “our research shows that reptile owners are more likely than owners of any other variety of pet to have multiple pets within their household, whether of the same type or other types,” he said. That means looking into the trend patterns of other types of pets provides opportunities for those in the dog and cat space to gain insights into both existing and potential customers.

We know that dogs and cats are family, but it turns out reptiles are getting the same consideration from their owners. According to Packaged Facts, 72% of reptile owners knew what to expect in terms of ownership before they bought their reptile — they did their research to ensure they could best care for their new pet. Further, 85% of “other pet” owners, which include reptile owners, said that they consider their pets to be part of the family in a February/March 2020 survey. One trend that has been seen across the reptile space is an increasing desire to provide these types of pets with both nutrition and an environment more closely resembling what they would have in the wild, an important consideration for smaller pets that need in-home habitats beyond a litter box or a pillow to sleep on.

Food-wise, things are a little different in the reptile world. Many of the reptiles sold as pets prefer their dinners whole, which is why significant food business (which makes up 33% of reptile product market share, according to Packaged Facts data) involves live or frozen mice; or live crickets, roaches, flies and worms. Traditionally, dry food for reptiles has been a somewhat simple dry “kibble” suited toward that animal’s particular nutritional needs. But as with dog and cat food, the reptile space is starting to see the desire for more options among its customers.

A June 2020 advertorial on ReptilesMagazine.com focuses on “building a positive relationship between your tegu and its food,” and goes particularly in-depth regarding the nutritional needs of this large lizard which, in the wild, is typically found in South America. “The general consensus among reptile experts is to feed your tegu a diet made up of fruits, veggies and a significant protein source — while avoiding any avocados, mushrooms and onions,” says the piece, sounding like any number of dog or cat recommendations for pet owners looking to feed their animals a more involved diet.

A search on Petco.com brings up the expected frozen mice and rats but also products such as “T-rex bearded dragon gourmet food blend,” a mix of “premium greens, veggies and insects” with all-natural ingredients, no preservatives and the instruction to “just add hot water.” It’s not just lizards feeling the love, either: Zoo Med’s “tortoise and box turtle flower food topper” is a mix of dried flowers alongside the claims of high fiber and healthy gut promotion. “Veterinarian formulated,” “natural” and “no artificial preservative/colors/flavors” are also popular claims on the reptile section of the pet specialty site — claims that are much newer to this growing space, but are well-known to the cat and dog food producers of the industry.