At the two pet trade shows I attended earlier this year, Global Pet Expo in Orlando, Florida, USA, and Interzoo in Nuremberg, Germany, the new product areas were larger than ever and featured many pet foods and treats. Yet most were line extensions or reiterations of new ingredient or product categories we’ve seen growing for the past few years.

I’ll be interested to hear if my colleagues attending Superzoo 2024 this week have similar impressions of that new product showcase or the displays in individual pet food/treat booths. Aside from their perspectives, data from Mintel show global new pet food launches have continued to decrease over the past decade and especially since 2020, when the COVID-19 pandemic began.

Fewer entirely novel products globally except for Asia-Pacific

The data was shared by Kate Vlietstra, Mintel’s director of food and drink, in Pets International magazine; it drew from the company’s Global New Products Database and its generative AI tool, Mintel Leap.

Mintel seems to purposely distinguish between truly new products and more iterative ones. “The definition of a new launch is an entirely novel product as opposed to a new flavor, new packaging and so on,” Vlietstra wrote. “Those [new launches of novel products] accounted for more than half of all pet food launches in 2014, but dropped to around a third of the launches in 2023.”

On the flip side, new varieties, as she called them, accounted for about 40% of new pet food products in 2023, up from about 25% in 2014. Products with new packaging increased slightly during the same timeframe, from 13% to 18% globally, though they grew more in Europe, from 9% to 20%. These overarching trends have happened across all pet food categories, Vlietstra said, encompassing, dry food, wet food and treats for both dogs and cats.

Unsurprisingly, launches of novel new pet food products dropped significantly in 2020, yet they did not recover much in 2021 compared to the pre-2020 period, and declined further in 2023. There are exceptions; Vlietstra singled out the Asia-Pacific region, “where there’s been a surge of new product development in recent years, including during the pandemic,” she wrote. “According to Mintel’s research, about half of launches during 2020-2021 were of completely new products.”

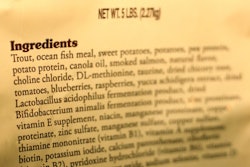

South Korea, China and Japan were particularly active, contributing 17%, 14% and 12%, respectively, of the region’s novel new pet food launches. Gut health was an area of focus, along with clean label formulations and, in South Korea, alternative proteins such as insects.

Inflation and cost-of-living concerns have greatly impacted new product launches in Europe, Vlietstra said, while in the Americas, new packaging launches have risen from 14% of all new product launches in 2014 to 26% in 2023. Wellness has also been a focus of new products in the region.

Pet food innovations also down in U.S., but recovering?

Data on new product launches in the U.S., shared by NielsenIQ (NIQ) at Global Pet Expo 2024, mirrored the Mintel global data, though NIQ didn’t distinguish between truly novel products vs. new varieties or packaging. They referred to all launches as “innovations.”

Since 2020, most pet care innovations have been with supplies, NIQ said, with far fewer for pet food — however, pet food launches did increase over the 52-week period ending December 30, 2023, compared to the same period the year before. That means new pet foods accounted for 28% of pet care launches in 2023, up from 18% in 2022.

And no matter the relative numbers of new products in supplies or pet food, the latter definitely grabs the largest share of dollar sales among new products: 63% for pet food in 2023 vs. 34% for supplies, though the pet food share is down significantly from its 78% of sales in 2022. For several years now, new dog foods especially have dominated sales among new products, according to NIQ, while consistently ranking third in number of new products (behind pet toys and dog accessories like collars and leashes). New cat foods have often shown up as fourth or fifth among number of new product launches.

3 ways to innovate

To truly innovate in pet food, what Vlietstra called “product development outside the box,” she recommended three areas of opportunity:

- Take inspiration from baby food. This applies to developers of pet foods and treats for puppies and kittens, and could encompass packaging design, format and materials, or “creating food bonding moments.”

- Justify sustainable options. Financial concerns, especially among younger pet owners who may be more interested in sustainability, are putting a damper on purchasing related products. This creates an opening for private-label producers to “venture further into insect-based and plant-based options.” And pet food brands could explore blends that “hit the taste and health marks,” Vlietstra wrote.

- Take the next step in digestive health. Pet food brands should capitalize on the fact that pet owners continue to prioritize gut health and link it with many other areas of health and wellness.