As of December 21, 2021, inflation stood at 7% in the U.S. economy—higher than other developed countries (and pet food markets) like Japan (0.6%), Australia (3%), Italy (3.9%), Canada (4.7%), the Euro area overall (5%, though some countries, like France, are much lower) and the U.K. (5.1%).

In some developing countries, including ones with relatively established pet food markets, inflation is even higher: 7.36% in Mexico, 8.4% in Russia, 10.06% in Brazil, 36.08% in Turkey and 50.9% in Argentina, according to Trading Economics.

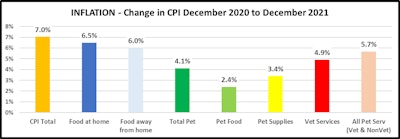

How does pet food inflation track with that overall economic picture? In the U.S. at least, it lags behind the national inflation rate: just 2.4%, according to December 2021 data from the U.S. Bureau of Labor Statistics (BLS), compared to that 7% for the total economy.

Pet food inflation lower than for human food, pet care

For consumer product categories closely related to pet food—e.g., human food—inflation in the U.S. is nearly as bad as the overall national inflation rate. According to the recent BLS data, which was analyzed and shared by John Gibbons, who goes by the “pet business professor,” inflation within the “food at home” category registered 6.5%, while “food away from home” was at 6%.

Within the U.S. pet care sector, pet food ranked the lowest, compared to pet supplies (3.4%), the total pet category (4.1%), veterinary services (4.7%) and all pet services (veterinary and non-veterinary, 5.7%). And, though pet food inflation was higher in 2021 than in 2020, that’s not a surprise: Not only did the industry suffer from the same pandemic-driven supply shortages and delays, combined with increased demand, that most other sectors did; but pet food also experienced a deflationary scenario in 2020, down 0.7% from 2019. As a result, from 2019 (pre-pandemic) to 2021, pet food inflation increased to only 1.6%, according to Gibbons.

U.S. pet food inflation compared to the overall economy and other sectors, according to U.S. Bureau of Labor Statistics data analyzed by John Gibbons. l Courtesy John Gibbons

With industry experts and economists in general predicting supply challenges and shortages to continue into early 2023, it’s possible pet food inflation will rise higher in 2022, though likely not to the level that the overall economy is experiencing. For some perspective, human food inflation was on the rise before the pandemic, according to the International Monetary Fund, due to other disruptions like African swine fever decimating the hog herd in China, which represented more than 50% of all hogs worldwide. While a ripple effect from human food to pet food seems to nearly always happen, not all global events and disruptions have the same impact on pet food.

According to an entity called the Official Data Foundation, pet food inflation rose only an average of 1.88% per year from 1997 to 2021. By comparison, human food has experienced average annual inflation of 3.13%, though that’s going all the way back to 1913.

What’s the situation globally?

Pet food inflation may be following a similar pattern worldwide as in the U.S.: rising in 2021 but not to the level of the overall economy. For example, in Mexico, as of August 2021, pet food inflation was 4.2%, according to Ivan Franco of Triplethree International. That was actually lower than for the same period in 2020, when it reached 4.7%, and significantly lower than the 7.36% for the overall Mexican economy in December 2021.

Yet pet food inflation could have increased through the rest of 2021, and Franco cautioned that the inflation data, from Mexico’s National Statistics Institute (INEGI) index, covered brands representing only about 60% of the local pet food market. “Likely, those excluded brands are increasing in price faster than the market leaders, as their negotiating power across the supply chain is less than that of the leaders,” he wrote. “The excluded brands are mainly regional, emerging and smaller players.”

In other developing markets with rampant inflation, like Turkey and Argentina, pet food prices could be rising at or close to the same level as the national economies. The COVID-19 pandemic seems destined to affect the world in myriad ways for quite some time.