Petfood Forum 2016 concluded on April 20 with about 2,500 pet food professionals from around the world participating in two-and-a-half days of networking, learning at conference sessions and visiting with leading industry suppliers in the exhibit hall. (Not to mention a fair amount of eating, drinking, laughing and other enjoyment.) The event took place in Kansas City, Missouri, USA.

There was a lot of information and activity packed into a short timeframe, yet several topics kept appearing and connecting throughout the conference:

1. Protein. “Only at Petfood Forum could you say that protein is a sexy word.” So proclaimed Victoria Stilwell, internationally known dog trainer and star of the TV show, It’s Me or the Dog, during her opening keynote on April 19. She was commenting on the transformation she’s seen over the past 15 years in the way consumers—and trainers like herself—think about pet food and the types of ingredients and other items they now focus on.

The focus on protein began the previous day with Petfood Innovation Workshop: Meat and Novel Proteins, which kicked off with David Sprinkle, research director for Packaged Facts, reporting that 28% of US dog owners and 21% of US cat owners look for “high protein” as a claim on the pet foods they buy. That’s according to pet food purchasing patterns recorded in 2015 and included in Packaged Facts’ latest report, Pet Food in the US, 12th Edition (March 2016). Other pet food label claims scoring high with US pet owners included “red meat as first ingredient” (20% for dog, 14% for cat) and “poultry as first ingredient” (19% dog, 24% cat).

Sprinkle also shared data on 2015 pet food purchasing patterns in the US by protein content. While chicken reigned supreme, beef also had a strong showing for dogs, with salmon and other fish doing the same for cats. Novel proteins such as boar, rabbit, venison and bison are also starting to make their mark, though they are mostly still in the single figures by percentage. However, in the pet specialty channel, GfK data presented by Sprinkle showed huge sales gains (albeit from a small base) for these and even more exotic proteins such as kangaroo, goat, duck, pheasant and quail.

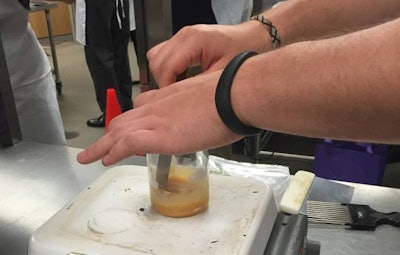

After Sprinkle’s presentation, Petfood Innovation Workshop moved to a test kitchen at the Kansas State University-Olathe campus, where participants got to immerse themselves in hands-on stations making meat-based pet treats (meat roll-ups, anyone?) and working with pet food ingredients focused on protein.

During Petfood Forum, Mark J. Mendal of Pet Proteins presented on the novel proteins market for pet food, including benefits, challenges, supply and demand—with those latter elements being nearly the same. (Supply and demand is the major challenge to using many novel proteins in pet food.) Another key challenge is consumer education about the benefits, including help with managing weight and allergies/dietary intolerances in pets. Such education could promote acceptance in the US, Europe and other Western markets, Mendal said.

2. Sustainability. Mendal also keyed on the sustainability of novel proteins, asserting that they all use less water and antibiotics, and emit much lower levels of carbon dioxide than do conventional proteins (mostly livestock such as beef and chicken). His comments were echoed by Joseph Wakshlag, DVM, PhD, associate professor of clinical nutrition at Cornell University Veterinary College. While Wakshlag’s presentation covered several elements of sustainability in pet food, his main point was also about protein sources and the need to continue developing ones from rendering, vegetables and grains, and “unconventional animals.” In his mind, the future of the industry may depend on it, because consumers continue to demand more protein for both human and pet foods, and the environmental reality is that we can’t continue to rely on conventional livestock sources.

Wakshlag especially extolled the benefits of rendering and by-products. “That’s what’s beautiful about the pet food industry is that we can use by-products … so we can basically not have to worry about using consumables that the humans can eat as part of their daily diet,” he said.

Sustainability also was the main concept of a session on biomass ingredients by John Greaves, PhD, Kemin Industries, as well as one of the pet food processing sessions, by Anders Haubjerg of Graintec. And it came up during a panel discussion about the top issues in today’s dynamic pet food market, held at the end of Petfood Forum on April 20.

3. Transparency. Besides protein, the most frequently uttered word during Petfood Forum was probably transparency. So many speakers, from Stilwell in her opening keynote through to the ending panel discussion, discussed how consumers today not only want transparency from the brands and companies whose products they purchase, any more they demand it. This is especially true for pet owners.

Evelia Davis, vice president of dog and cat consumables for PetSmart, focused on it in her April 20 general session. “Pet parents want transparency and trust,” she said. In response to a question about how pet food manufacturers and retailers can meet this demand, she commented, “Transparency is a journey, and all of us are at the beginning of the journey. We have to talk to the pet parent and understand what she’s looking for.” In her experience, pet parents mainly want to know where the food comes from and is made, she added.

During the panel discussion, Cathy Enright, PhD, president and CEO of the Pet Food Institute (PFI), also talked about transparency and how her organization’s board and members are moving to practice it, if slowly. Before joining PFI a year ago, she served as executive vice president, food and agriculture, for the Biotechnology Industry Organization, where she spearheaded the development and launch of GMO Answers, an industry-wide initiative to address negative perceptions about GMOs. For too long, that industry essentially ignored activist protests and campaigns against GMOs, she said, allowing the activists to sway consumer opinion. “We allowed them to win,” she added, which could provide a cautionary tale for pet food.

4. Pet specialty rules. At least in the US, the main retail channel for pet food growth and innovation is the pet specialty channel, said Maria Lange, business group director for GfK, during her general session on April 19. (Granted, that’s the channel her organization tracks; yet Sprinkle of Packaged Facts backed this in his Workshop presentation, where he showed US mass market pet food sales are flat or declining.)

In addition to reporting a healthy sales gain of nearly 5% from 2014 to 2015, Lange also said there were 3,278 new pet food products introduced in US pet specialty in 2015—a pretty amazing number when you think about it. And much of the new research and key trends highlighted in other Petfood Forum presentations focused on ingredients, products and concepts that are thriving in pet specialty, according to data: natural products, phytonutrients, natural colors, human food trends, freeze-dried and baked pet foods, and the previously mentioned novel proteins.

5. Buzz words backed by numbers. Lange began her presentation by highlighting some of the buzz words popular in pet food now, such as paleo, GMO free, grain free, natural, freeze dried, air dried and high protein. Several are just that, "buzz," but many of them have the sales and new product development to put substance behind the sizzle.

Natural pet foods, for example, accounted for 80% of new product introductions in US pet specialty in 2015 (consistent with 2014) and US$5.5 billion in sales—representing nearly 10% growth over 2014 and a 69% share of the specialty market, Lange said. Grain-free’s data were 45.5% of new products (up nearly 3 percentage points), US$2.8 billion sales, a whopping 25% growth and 35% market share. (And, grain-free pet foods averaged US$3.04 per pound in cost, higher than natural’s US$2.70 per pound.)

Then there’s freeze-dried pet food. Lange’s deep dive into that data—including separating it into 100% freeze dried meals, “kibble+” (traditional dry kibble mixed with freeze-dried pieces) and freeze-dried treats—showed that for the overall category, only 3.8% of new pet food products in US pet specialty in 2015 were freeze dried, but that has doubled in just one year. In addition, sales for the category reached US$195 million in 2015, a 62.7% increase, mainly driven by a 74.4% jump in sales of kibble+. According to Lange, that’s because the price per pound of that subcategory, US$3-4, is so much more attractive than 100% freeze dried at US$36 per pound.

Calvin Smith, director of Pet Nutrition NZ from New Zealand, presented similar data in his session focused on freeze-dried pet food: per 1,000 calories of food fed, kibble+ costs US$3.80-5.40, while “premium” freeze dried costs US$11-18.