In 2013, the size of the global pet care market reached US$96 billion, and the compound annual growth rate (CAGR) for the market through 2018 is 2.6%. This proves that pets are still, and will continue to be, big business for some time to come. However, economic downturns and consumer reticence have plagued various regional markets the last few years, and Western Europe is one of those markets.

Europe overall actually saw negative gross domestic product (GDP) growth in 2012, and is still working on recovering—growth isn’t expected to rise above 1.5% through at least 2017, according to Euromonitor International’s “The Ins and Outs of Global Pet Care,” published in November 2013. Many Western European economies have seen record high unemployment rates and public debt levels of over 90% of the total GDP.

How does this translate to the pet industries in Western Europe? Globally, growth of the pet care industry is being supported largely by emerging economies. More developed markets, such as Western Europe, are faced with tight budget constraints and low economic confidence. This is affecting the way consumers shop and how the relation price of quality is perceived.

In spite of economic woes, Western Europe was still the second-largest market for pet care sales in 2013 (North America came in first, accounting for more than 30% of the market’s value). The country-by-country reports are mixed in success, however. While the UK and France saw growth in 2013, Greece and Spain struggled with tight budgetary pressure and severe expenditure cuts, which undermined consumer confidence and the willingness to spend on pets, according to Euromonitor. In comparison, the emerging markets of Latin America and Eastern Europe were the most dynamic regions in 2013, posting solid growth and offering potential for future increases as pet owners in those regions become more educated and willing to spend on their pets.

Several of the countries in Western Europe made the list of top ten pet care markets in 2013. The UK (third, behind the US and Brazil), France (fifth, behind Japan), Germany (sixth) and Italy (seventh) saw competitive numbers, and all but Italy claimed market values of more than US$5 billion, according to Euromonitor’s October 2013 presentation, “Global Pet Care: In the Age of Economic Uncertainty.”

It’s no surprise, then, that some of those same countries also present impressive statistics relating to the pet and petfood markets. The UK, for example, has one of the largest dog populations in the world—50% are small dogs, 35% are medium-sized dogs and the remaining 15% are large dogs. (The US, Brazil, Russia and China also claim large dog populations.) The country is also one of the leading markets in wet petfood, producing 2.465 million metric tons of product annually. Germany, France and Italy also top the wet petfood market, producing 1.811 million metric tons, 1.363 million metric tons and 1.26 million metric tons of product, respectively. France also makes the list of top dry petfood manufacturers, coming in at 1.961 million metric tons annually, according to Euromonitor.

Growth in Western Europe may be struggling, but it’s not completely stagnant, and the categories within the pet market slated to grow are varied by country. France will see top growth in its cat food markets, at a CAGR of 1.8% (US$1.986 billion in 2013 to US$2.167 billion in 2018). Germany will see the fastest growth in its dog food market, at 0.8% (US$1.56 billion to US$1.621 billion between 2013 and 2018), as will the Czech Republic (2.8%; US$249.2 million to US$286.3 million), Portugal (2.9%; US$226 million to US$260.6 million) and Turkey (a significant 6%; US$98.2 million to US$ 131.6 million). Belgium will grow quickest in its small mammal/reptile food market, at 1.9% CAGR (US$12.9 million to US$14.2 million) between 2013 and 2018.

Pet health is a considerable market these days, and some Western European countries can expect growth in related areas. Italy’s pet market will see the fastest growth in its pet healthcare market (2.4% CAGR; US$342.6 million in 2013 to US$385.8 million in 2018). So will Denmark, with a 2.4$ CAGR (US$39.4 million to US$44.4 million), and Switzerland (1.7% CAGR; US$7.7 million to US$8.9 million), according to Euromonitor. Sweden and Norway will see the best growth in pet dietary supplements, recording an expected 2.3% CAGR (US$5.9 million in 2013 to US$6.6 million in 2018) and 5.9% CAGR (US$3.8 million to US$5 million), respectively.

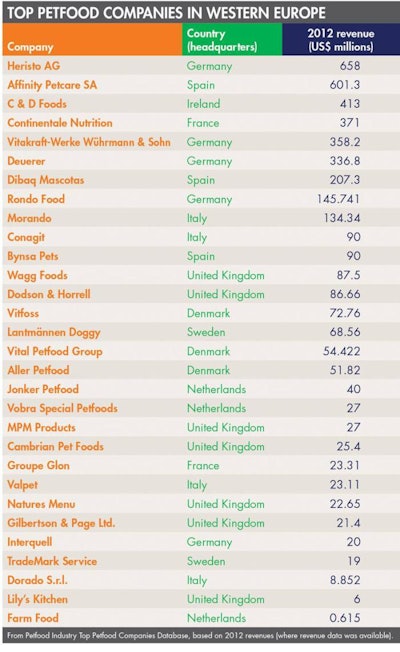

The top petfood companies in Western Europe, based on 2012 revenue data provided to Petfood Industry, are spread throughout the region, but there are some notable groupings. Germany, for instance, holds four of the top ten spots, including the first spot: Heristo AG, headquartered in Germany, reported a 2012 revenue of US$658 million. The other three German companies, Vitakraft-Werke Wührmann & Sohn (fifth), Deuerer (sixth) and Rondo Food (eighth), contributed a combined US$840.74 million to the top ten’s total revenue (US$3.316 billion).

Spain and Italy are two more countries with multiple companies in the top ten of Western Europe. Spain-based Affinity Petcare SA (second on the list) brought in US$601.3 million in 2012 revenue, Dibaq Mascotas (seventh) reported US$207.3 million and Bynsa Pets (tied for tenth with Italy’s Conagit) reported US$90 million. In Italy, Morando (ninth) and Conagit (tied for tenth with Spain’s Bynsa Pets) brought in a combined US$224.34 million in 2012.

Ireland and France round out the top ten petfood companies in Western Europe: Ireland’s C&D Foods came in third with US$413 million, while France’s Continentale Nutrition was fourth with US$371 million in 2012, according to Petfood Industry data.

The data show that, although Western Europe is still recovering from a global economic downturn, the petfood industry has steady (if moderate) growth to look forward to. Pets aren’t going anywhere, and more people than ever before own them, so as consumer confidence recovers with the economy those customers will be looking to spend—which translates to more revenue all around.