Across the retail marketplace, natural and organic products benefit from the consumer perception that they are purer and safer than conventional products. Within the pet food market in particular, the widespread pet food recalls of spring 2007 drove many shoppers into the pet specialty channel in search of natural and organic products. Natural products are now at the core of the specialty pet channel and of the premium pet products arena, especially in the pet food category. As reported in Packaged Facts’ Natural, Organic and Eco-Friendly Pet Products (October 2014), retail sales of natural pet foods in the US totaled US$6.6 billion in 2014, up 16% over the previous year.

To this day, product safety remains top of mind among consumers of pet products of all types. Packaged Facts survey data show 56% of dog owners and 44% of cat owners agree that concerns over pet food contamination and product safety are key to their pet food purchasing decisions. Moreover, a strong majority (66%) of pet owners who purchase natural pet products agree that natural/organic pet foods are safer than regular pet foods.

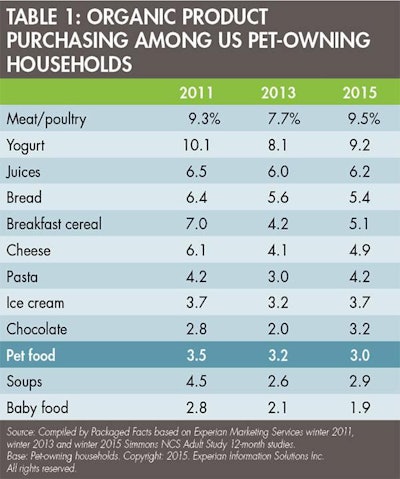

Nonetheless, Simmons National Consumer Survey data show that the shopper base for organic pet foods has failed to grow in recent years. As is the case with pet owner purchasing patterns across various human food categories, the purchasing rate for organic pet food actually slipped a notch between 2011 and 2015—from 3.5% to 3.0% (see Table 1). Organic pet foods are therefore playing to a small base, albeit a high-spending one.

In spite of the fact that the majority of pet owners who purchase natural pet products believe that natural and organic pet foods are safer than regular pet foods, the organic pet food shopper base has failed to grow.

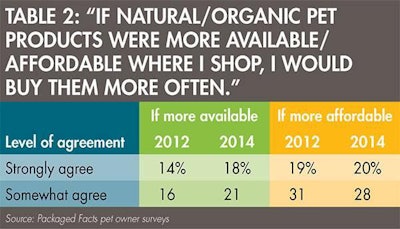

Especially with the US economy still bruised by the Great Recession, organic and other superpremium pet foods will inevitably meet with significant price resistance, even among the most devoted of pet parents. Packaged Facts survey data show that nearly half (48%) of US pet product buyers somewhat or strongly agree that if natural and organic pet products were more affordable where they shopped, they would buy them more often (see Table 2). That’s higher than the share of pet product buyers (39%) who find the lack of access to natural and organic pet products to be hindrance to wider purchase.

A significant percentage of pet owners say they would purchase more natural and organic pet products if those products were more available and more affordable.

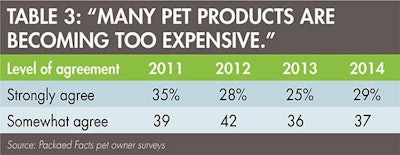

Moreover, a strong majority (66%) of US pet product buyers overall at least somewhat if not strongly agree that many pet products are becoming too expensive (see Table 3).

Though the feeling isn’t quite as prevalent as it was several years ago, the significant majority of pet owners still believe that many pet products are becoming too expensive.

But product safety isn’t simply a boxing match with conventional products in one corner and premium-priced natural and organic products in the other: the reverberations of the pet food recalls of 2007 are unfurling in many directions. Because so many recalled pet products are sourced in China or other countries with scant regulation when it comes to pet product safety, 61% of dog owners and 50% of cat owners in the US actively seek out pet foods made domestically, and “Made in USA” has become a major positioning point in the pet food marketplace.

Moreover, consumers are becoming more interested in buying pet foods that are not merely made or (more meaningfully) sourced in the USA, but that are locally manufactured. This ties in to a related development with more disruptive potential than opting to buy natural or organic: the preference of 38% of dog owners and 34% of cat owners for buying pet food products from smaller companies they feel they can trust. In a market where fewer than a handful of players control the lion’s share of sales, that mindset points beyond product reformulation to revolutionary potential.