China’s pet food market is drawing more manufacturer eyes than ever. With the country’s growing middle class and the resulting increased disposable income driving opportunities, domestic and international companies alike are beginning to watch and move into the developing segment of global pet food sales.

China’s current pet food landscape

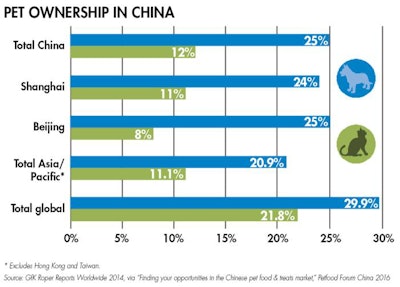

China’s pet ownership outpaces Asia-Pacific numbers, as 25% of the population owns dogs and 12% of the population owns cats (compared to Asia-Pacific: 20.9% of the total population owns dogs and 11.1% owns cats). Shanghai and Beijing, China’s two largest cities, carry a lot of that ownership, with 24% and 11% of Shanghai residents owning dogs and cats, respectively, and 25% and 8% of Beijing residents doing the same (see Figure 1). As 29.9% of the total global population owns dogs and 21.8% owns cats, China’s growth has put it on track to become an increasingly significant force in the global pet market.

Figure 1. China’s pet ownership still falls below the global percentage, but comes out above Asia-Pacific numbers. Shanghai and Beijing, China’s two largest cities and hubs of the country’s urban pet ownership growth, make up a significant portion of the country’s total ownership.

The primary reason for these numbers is economical: Disposable income in urban China households has gone up each year since 2010, and continues to increase. This means more people are looking to pets as companions, and those people are willing and able to spend more on their dogs and cats than ever before.

Their money is being spent both in person and online, but China consumers’ online pet food market presence is far stronger than in more developed markets—38% of the country’s pet food is purchased online, according to Fung Global Retail & Technology data, compared to just 9.4% in the United Kingdom (total pet products, including pet food) and 7% in the US (total pet care sales, including pet food). Ecommerce’s global share of the entire pet care market is smaller still, at 5.3%. And as the current pet food market for China comes in at around US$1.76 billion, with double-digit annual growth, online purchasing’s share of the pet food market continues to increase (see Figure 2).

Figure 2. As China’s pet food market develops, its online pet food purchasing is outstripping other countries’ markets significantly. Online market share of pet food purchasing is slated to continue increasing as consumers look for more varied options and begin following the trends of more mature markets.

Dogs versus cats

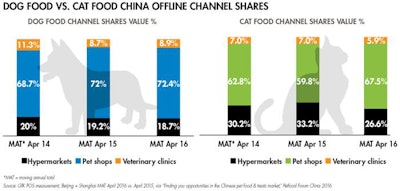

The three primary channels for purchasing pet food domestically in China are hypermarkets (large, warehouse-style supermarkets with a unified collection area), pet shops and veterinary clinics. For both dog food and cat food, pet shops reign supreme, and continue to grow in dominance as China’s consumers increase their desire for diverse options. In April 2014, for example, pet shops held 62.8% of the channel shares for cat food and 68.7% for dog food, according to GfK data gathered on Beijing and Shanghai (see Figure 3). In comparison, hypermarkets held 30.2% of cat food channel shares and 20% of dog food channel shares. By April 2016, the percentages of pet shop shares increased to 67.5% (cat food) and 72.4% (dog food), while hypermarket shares dropped in both categories. Veterinary clinic shares have also decreased in the last couple of years, likely as more options are made available in pet shops for consumers to provide their pets with healthier, more specialized formulas without the aid of a veterinarian.

Figure 3. Pet shops continue to gain market share in China over both hypermarkets and veterinary sales, combining international options with domestic brands for maximum variety.

Unsurprisingly, as in other markets, dry pet food makes up the majority of China’s pet food sales. According to GfK data focusing on Beijing and Shanghai, 78.6% of cat food (by sales value) sold is dry across all market channels—the veterinary channel sells the largest percentage of dry cat food (86.3%), while hypermarkets sell the smallest percentage (69.4%). Hypermarkets sell the largest percentage of its cat food as wet (30.3%), while 12% of veterinary clinic cat food sold is wet. Dog food has a slightly different make up, according to GfK, although it skews even more towards dry: 82.4% of dog food sold is dry across all market channels, with the veterinary channel selling 76.5% of its food (the highest percentage) as dry and pet shops selling 74.9% of its food (the lowest percentage) as dry. Alternately, pet shops sell 16.3% of their dog food as wet, the highest of the channels, while hypermarkets and veterinary channels sell 14.9% and 14.8% of their food, respectively, as wet.

In general, international pet food brands dominate China’s cat food market, with an 80% market share, but the domestic brands are driving growth as their options increase and their prices remain more competitive. Dog food shows a more even split between international and domestic brands, with hypermarkets dominated by international brands but pet shops carrying plenty of domestic brands alongside their imported counterparts.

Diversified options in a developing market

As more pet food formulas hit the Chinese market, flavor trends are beginning to emerge. While chicken is the dominating flavor in several categories (cat and dog dry food, cat treats), beef is also driving growth in both cat and dog food categories (and particularly in wet dog food).

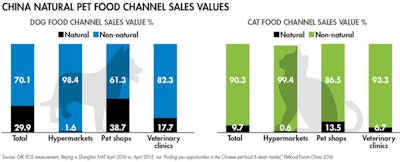

Natural and grain-free trends have hit China’s market, and while they’re smaller segments of the available pet food options, they are growing. Overall, natural pet food makes up 24% of the market, according to GfK, growing at 55% year-over-year. As might be expected, pet shops have the largest share of the natural market for both cat and dog food—13.5% of cat food and 38.7% of dog food sold in pet shops fall into the category (see Figure 4).

Figure 4. With a more developed market comes the adaptation of more specialized trends. The natural pet food market in China is small but growing, and is expected to continue that growth.

Pet shops are also driving the much smaller grain-free segment, with 3.4% of cat food sold and 5.1% of dog food sold falling into the category. And while grain free only makes up 4% of the total pet food market, the segment is growing at 168% year-over-year.

China’s future in the pet food industry

China’s growth of the last several years is slated to continue. It’s one of the fastest-growing developing markets in the pet food industry, and companies looking to expand internationally are turning their eyes towards the potential of the country’s growing urban pet ownership demographic.

From Petfood Forum China 2016: China’s pet food market