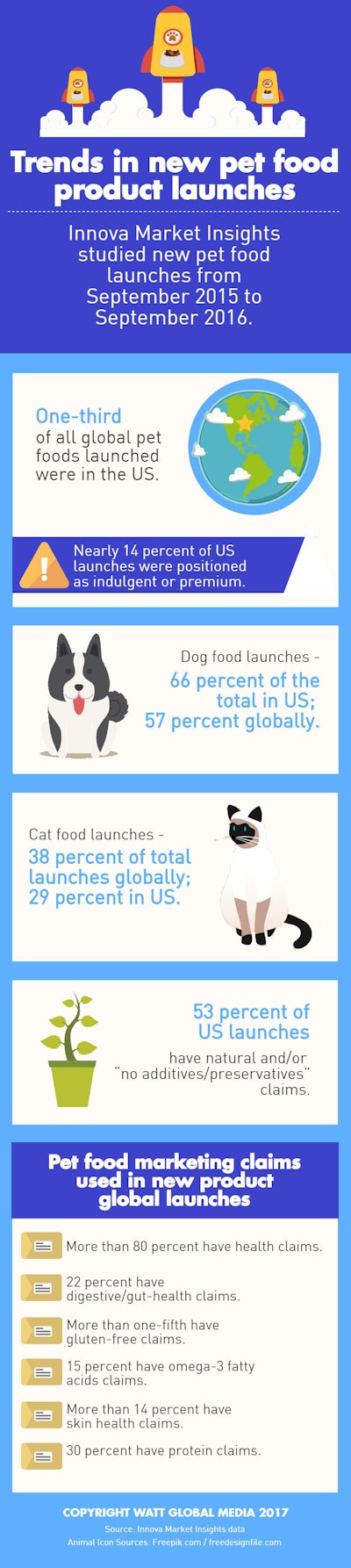

While dog foods predominate somewhat in new pet food product launches in the US and globally, both new cat and dog food products share a focus on health-related claims. Worldwide, more than 80 percent of pet food launches recorded by Innova Market Insights from September 2015 to 2016 were marketed with a focus on health aspects, such as omerga-3 fatty acids or digestive support.

In the United States, health claims dominate US new pet food product launches. Ninety percent of pet food product launches in the US feature health-related marketing, often with multiple claims.

Pet food health trends follow human trends

Pet foods are now being formulated to address concerns of humans, including organic and non-GMO pet food ingredients, “free from” options, and low-carb recipes. As in the human-food industry, interest in clean labeling continues to grow in pet food. In the United States, nearly 53 percent of launches used natural and/or “no additives/preservatives” claims, driving forward interest in natural and organic formulations.

Most popular health-related claims

Vitamin- and mineral-related claims are the most popular of active health claims for pet food (used on over 23 percent of global launches). The next most popular claims are digestive- or gut-health claims, used on 22 percent of global launches and addressing issues such as sensitive stomachs in dogs and also furball/hairball problems in cats. Probiotic and prebiotic ingredients are popularly marketed for these conditions.

Omega-3 fatty acids are also popular in the pet food market, included in just over 15 percent of global launches. Skin health is also a popular market, with over 14 percent of global introductions featuring claims related to skin health.

Allergy-related claims are also very popular. There has been a strong rise in gluten-free and grain-free formulations for both dogs and cats. More than one-fifth of global launches were gluten-free, and nearly a quarter of dog food launches alone were gluten-free.

There is also continued interest in protein content just as there is in the human-food and -drinks industry. Just over 30 percent of pet food launches between September 2015–2016 featured “high in” or “source of” protein claims, up from just 20 percent a year previously.