Packaged Facts estimates brick-and-mortar (B&M) pet product sales through Walmart stores (excluding Sam’s Club) at US$9.4 billion in 2017, accounting for 86 percent of B&M pet product sales through the mass merchandiser/supercenter channel, and for the leading 19 percent of B&M pet product sales in the U.S. retail market overall.

By comparison, Target is a distant second with a 12 percent share of mass merchandiser/supercenter B&M pet product sales, while PetSmart as the top pet specialty chain accounts for an 11 percent share of B&M pet product sales overall.

By pet owner shopping patterns, similarly, Packaged Facts’ Q1 2018 Survey of Pet Owners places Walmart squarely in the lead when it comes to the purchasing of pet food and supplies: 44 percent of pet owners buy their pet food at Walmart, and 31 percent buy other pet supplies (excluding pet medications) there. PetSmart, the closest competitor, draws 32 percent of pet owners for pet food and 26 percent for pet supplies. Survey results also suggest that Walmart has broadened its scope of pet food and pet supplies purchasers, with purchase incidence rising for both pet food and non-food pet supplies over the 2016 to 2018 period.

The not-so-secrets of Walmart’s success in the pet market

There are many reasons for Walmart’s success in the pet market, mirroring Walmart’s prominence in the retail market overall. Packaged Facts survey data confirm that lower prices are at the core of Walmart’s appeal, strengthened by sales and promotions as well as by price matching against competitors. Convenient location of stores is another top reason for choosing to buy pet products at Walmart, combined with better one-stop shopping for food and non-food products. Carrying the pet brands shoppers like, including private-label Walmart brands, rounds out the top motivations for shopping at Walmart for pet products.

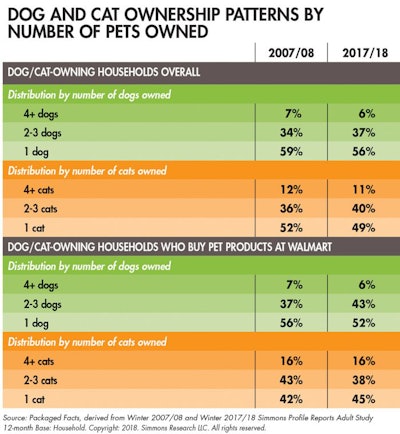

Walmart’s competitive pricing becomes even more beneficial when buying food and supplies for multiple pets (as in the case with multiple children), as evident in dog and pet ownership patterns by number of pets owned.

Packaged Facts estimates that among dog owners who buy pet products at Walmart, 49 percent have two or more dogs, compared to 43 percent of dog owners overall (see Table 1). Among cat owners who buy pet products at Walmart, 54 percent have two or more cats, compared to 49 percent of cat owners overall. These patterns, of course, tie in to the geographic locales of Walmart stores and of Walmart shoppers.

TABLE 1: Walmart holds particular appeal to pet owners with multiple cats or dogs, largely due to the chain’s competitive pricing.

Channel sales and Walmart’s piece of the pet product pie

With its distinctively strong draw among pet product shoppers, and especially multiple dog or cat owners, Walmart pushes the mass/merchandiser/supercenter channel to the head of the class in sales per pet client household. Packaged Facts estimates that, on average, pet-owning households who buy pet food and supplies at mass-merchandisers/supercenters spend US$677 annually on these products through this channel.

That’s significantly higher than the average spending by pet product shoppers at supermarkets or the pet superstore chains, even though both of these competing channels have a larger base of pet product shoppers. It also equates to an impressive 91 percent of the average annual spending on pet products among U.S. pet-owning households overall.

The corresponding numbers for wholesale clubs are nearly as strong, reminding us that even in the omnichannel era of indulgent pet parents, it’s a mistake to underestimate the strengths of the discount channel. And with Walmart aggressively pivoting to embrace omnichannel strategies that marry in-store performance with online capabilities, it’s especially a mistake to take your eyes off the retail leader.

Packaged Facts: Walmart as a pet market competitor

The latest pet food market insights

www.PetfoodIndustry.com/authors/145