It’s not just that e-commerce has upset the apple cart of pet product retailing. It’s that specific dynamics associated with this omnichannel and omnimarket age make it especially treacherous to keep one’s competitive footing.

The challenge: shopper loyalty in e-commerce

The bedrock for competitive footing is shopper loyalty: hanging on to the key customers you have and winning over those you don’t have but want, including new pet owners. Therefore, in tandem with acquiring and building out online operations, and with delving more deeply into veterinary and non-medical pet care services (where online is intrinsically at a disadvantage to brick-and-mortar), loyalty programs are at the heart of store-based pet product retailer efforts to compete in the e-commerce age. And as facets of loyalty programs, click-and-collect and home delivery options (including auto-delivery subscriptions) offered by store-based retailers can simultaneously bridge the gap and blur the lines between bricks and clicks.

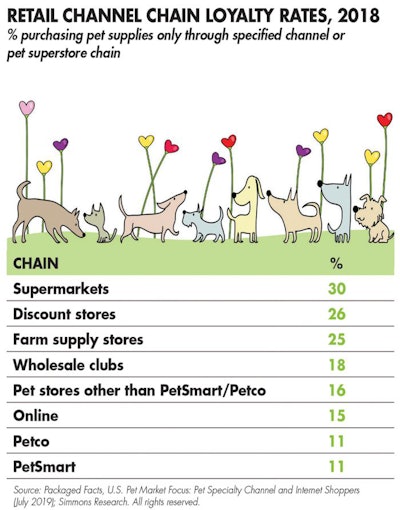

But there’s a rub. Although internet shoppers for pet products also cross-shop extensively for pet products through brick-and-mortar channels, e-commerce has evolved to the degree that online as an overall channel claims a similar rate of customer loyalty as pet stores (see Table 1). That is, 15% of online pet product customers only buy pet products online, compared with 11% for either PetSmart or Petco (at the individual chain level), and with 16% for the rest of the pet specialty store sector (combining other chain pet stores and traditional locals/independents).

TABLE 1: Thanks to e-commerce, the online space can now claim customer loyalty rates comparable with some brick-and-mortar channels. | wenpei I AdobePhoto.com

The advantage: supermarkets and supercenters

Although cross-channel shopping is heavy across the pet products market generally, supermarkets and discount stores/supercenters such as Walmart have the advantage here with their grocery and one-stop shopping draw. The advantage in pet product shopper loyalty goes not to the pet specialty channel, which arguably might seem to most merit it, but to the consumer packaged goods/foods generalists in the brick-and-mortar sector.

Factor in that though they are superchains within the specialty pet channel, PetSmart (with approximately 1,600 outlets, though these numbers are moving targets) and Petco (with approximately 1,500, including Unleashed formats) are far out-bricked by the likes of Walmart (4,672) or Kroger (2,764).

Another wildcard in the loyalty deck is Tractor Supply Company (approximately 1,765 outlets), in the too-easy-to-overlook farm supply store channel, though this sector accounts for 8% of pet food sales. Farm supply store pet product customers are on the loyal side, with 25% shopping for pet products only through this channel, therefore ranking in the same range as supermarkets (30%) and discount stores such as Walmart (26%) by this measure.

Nearly half of farm supply store pet product shoppers also buy in the pet specialty channel, and the sharpest overlap is with independent/local pet stores, rather than with PetSmart or Petco. Farm supply stores — with their distinctive town-and-country, edge of metro and “ruralpolitan” demographics — also fall outside the general pattern whereby the more specialized the store-based channel, the more likely its pet product customers are to also buy pet products online.

Further challenges: Amazon

Further bedevilling shopper loyalty dynamics in the e-commerce age is the Amazon dynamo, through its Amazon Prime (90 million subscribers) and credit card programs. Amazon’s fast-growing credit card program reached an estimated US$18 billion in purchase value in 2018, not much short of the combined pet product revenues of Walmart, PetSmart and Petco. Though these three pet market leading retailers outrank Amazon in pet product sales, Amazon keeps building out its capacity to lock in customers through a cross-market loyalty strategy emphasizing fast and free home delivery, click-and-collect options, exclusive brands, the Whole Foods connection and credit card financing and payments, plus instantly and variously redeemable credit card reward points.

In aggregate, these dynamics help explain why the internet has not only scrambled everything but made it very hard to collar pet product customers.

Briefly: top 5 takeaways

- Shopper loyalty is a key strategy in maintaining a competitive business edge.

- With the growing staple of e-commerce, the internet is gaining just as much customer loyalty as brick-and-mortar stores.

- Supermarkets and discount shopping/supercenters have a loyalty advantage with their one-stop shopping draw.

- The beast that is Amazon has also muddied the customer loyalty waters with its multitude of consumer options.

- Read Packaged Facts’ new report on specialty channel and internet pet product shoppers.