The veterinary industry, challenged by lower usage rates among millennials and an online shift in pet medication sales (and profits), is actively reassessing its relationship to dog and cat owners and its role in modern consumer approaches to pet care.

The top pet owner question about pet care generally, and pet health care specifically, is what to feed their pets. As is characteristic of the forces reshaping the pet industry, this follows from a human market metatrend: consumers increasingly making the connection between what they themselves eat and their health and wellness status, and even how they feel and how productive they are day to day. In turn, and with a new degree of intensity, today’s dog and cat owners want their pets to have long lives and healthy, happy days, and therefore are honed in on finding pet food with the optimal quality, nutrition and suitability for their individual pets.

Pet food: top of mind for owners, not as much for veterinarians

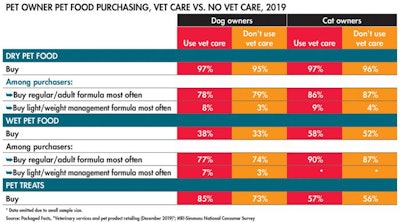

So here’s the rub: Pet food is central to consumer mentalities about pet care, but relatively peripheral to veterinary training and veterinary practice billing. Correspondingly, a bird’s eye view of pet food purchasing patterns, comparing pet owners who do with those who don’t use veterinary services, suggests that vets have limited influence.

An exception and bright spot, in the context of pet obesity, is the use of light/weight management pet food formula. The use of these formulas is nowhere near the rates that might be expected from the hard facts on pet obesity: 60% of cats and 56% of dogs are overweight or obese, according to the Association for Pet Obesity Prevention. But light/weight management formula usage rates are at least significantly higher among pet owners who have used veterinary services in the last 12 months, versus those who have not.

In the case of dry pet food purchasers, for example, 8% of dog owners and 9% of cat owners who go to a vet use these formulas, compared with only 3% of dog owners and 4% of cat owners who don’t (see Table 1). Presumably, this is a two-way street: pets with health problems linked to obesity are more likely to be taken to the vet, and vets are likely to raise the option of light/weight management pet food formulas to their clients with obese pets.

TABLE 1: Overall, pet owners who use veterinary care purchase pet foods more than those who don’t, including specialized formulas such as those for weight loss/management.

Purchasing patterns: Higher pet care spending = premium purchases

Otherwise, looking at purchasing patterns for pet food and treats, it seems safer to say that pet owners who use veterinary services disproportionately tend to use premium products, in keeping with higher levels of pet care spending, rather than that their purchasing patterns are conspicuously more pet health-driven.

Among dry pet food purchasers, those who go to a veterinarian are more likely than those who don’t to use the premium vet-connected brand Hill’s Science Diet (at 7% vs. 3% among among dog or cat owners). But either camp is equally likely to use the premium and consumer marketing-driven Blue Buffalo, or premium and natural-positioned Nutro. The differentiation is more consistent with economically priced brands: vet-going dry pet food purchasers are less likely to buy Pedigree (at 7% vs. 13% of dog owners who don’t use a vet) or either Friskies or Meow Mix (at 10%–11% vs. 15%–16% of cat owners who don’t use a vet).

Pet owners who go to the vet purchase wet pet food — often indulgence- and pampering-positioned — at higher rates than those who don’t. Similarly, a higher share of dog owners who go to the vet buy pet treats — although, as is the case with human snacks, pet treats typically are more likely to pile on calories than to ratchet up fitness levels. Dog owners who go to the vet are somewhat more likely to buy Milk-Bone (at 29% vs. 25% of those who don’t), a brand that balances traditional biscuit treat position with a functional edge. But purchasing rates for the indulgence-positioned (though increasingly clean label conscious) Beggin’ Strips do not vary by whether dog owners do or don’t go to the vet (at 12% across the board).

Pet food consumers going their own way on what constitutes “healthy” for their pets

And here’s another rub: In reading the tea leaves of pet food purchasing patterns, how firm of a ground are we on in identifying which behaviors are truly health-prioritizing? Veterinarians, as doctors, tend to be confident that most of what scientifically needs to be known about pet nutrition already is. (As scientists, they also find terms such as “animal hospital” or pet food “diets” congenial, though these terms are not necessarily appealing to their consumers.) Consumers, however, are increasingly less sure that the food processing industry has gotten it right — hence the sales success of grain-free and of niche alternatives such as refrigerated/frozen, raw and dehydrated.

Above and beyond product sales growth patterns and the increasing use of the online shopping and subscriptions, larger food culture trends suggest that time is on the side of consumer choices, rather than veterinary prescriptions.