CBD (cannabidiol, one of 113 known cannabinoids in cannabis plants) seems here to stay, in spite of continued complicated legal and regulatory hang-ups and still-developing research on the ingredient in both the human and pet space. Marketed for several years to humans for anxiety, depression, insomnia and post-traumatic stress relief, it eventually made its way into the pet sphere for the same professed reasons. Now it’s a powerhouse of a growth segment, with sales of CBD pet products hitting US$20–25 million in the U.S. in 2019 and predicted to grow to US$40–60 million by the end of 2020, according to data from The Nielsen Co. and presented by Hemp Industry Daily in its 2020 publication “Sector snapshot: Insights on the growing market for hemp-CBD pet products.” By 2025, according to predicted data, the CBD pet space could be worth US$175–225 million across all channels, making up about 3% of the estimated US$6–7 billon hemp-derived CBD consumer products category.

“For the past several years, pet products have consistently been among the fastest growing segments of the CBD sector — which itself is growing extremely quickly,” said Greg Dicum, co-founder and CEO of CWI Consulting Services, which provides cannabidiol consulting and product development. “Thus far, CBD has been an expensive product input, so it tends to be featured in the higher-priced category of natural products. However, wholesale prices for CBD have been dropping precipitously over the past few years and should continue to do so as lower cost producers come online (including foreign producers and biosynthetic sources). This will make CBD a viable addition to products in lower price ranges, which will in turn contribute to continued strong growth.”

COVID-19 has had significant effects on the CBD space

Use of CBD was already on the rise for both humans and their pets, but COVID-19 and its accompanying stressors — working from home, homeschooling, inability to travel, the list goes on — has provided a boost to the segment as people look to both their own health and wellness and that of their pets.

“It’s been really fascinating to watch,” said Amanda Howland, co-founder of ElleVet Sciences, a provider of CBD mobility products for dogs and cats. “First, of course, the obvious thing is that people are home with their pets. They’re watching them more. And I think when things feel out of control in the world you try to take care of the things you can focus on, so people might be a little overly attentive to their pets. So I think people noticed that their dogs were stressed and they started looking to CBD to help calm them. And I’m sure people were looking into it for themselves, too, but we saw a huge uptick in inquiries and calls for pet-based calming products.”

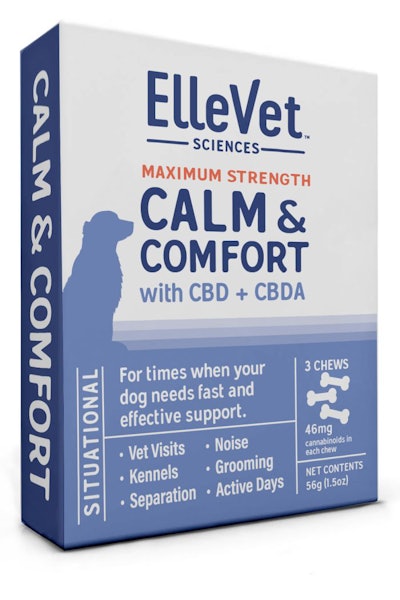

ElleVet’s “calm and comfort” product is designed to deal with situational anxiety, such as a vet visit, loud noises or a sudden change in environment (such as an owner heading back to the office). | Courtesy ElleVet Sciences

According to the 2020 National Study of CBD Use, conducted by advertising agency Bigeye in the first quarter of 2020, a majority of human CBD users have been using products containing the ingredient for two or fewer years (43% less than one year, 31% one to two years), further lending credence to the growth being seen in the last couple of years. And as those users do research for themselves and become more comfortable with their options (which currently range from topicals, tinctures and capsules/gummies to nasal sprays, dry-herb vaping and oil vaping) it makes sense that, just like every other human trend that has crossed the pet owner-pet barrier, users who also have pets would begin to research options for their furry friends.

“Pet parents are interested in bringing their lifestyle habits into their pet parenting styles,” said Jay Hartenbach, founder of Medterra, a provider of CBD products in the human space that has recently entered the pet space, as well. “We’ve found that both pet parents and their owners look for natural relief for these five main reasons: to manage a health problem, avoid prescription medications, improve quality of life, relieve pain and manage stress.”

Each of these is, understandably, a growing focus among people during the ongoing pandemic.

“We've seen in 2020 that though COVID-19 can disrupt the entire economy, it has only created opportunities in CBD,” said Dicum. “Brands that have been able to market effectively online have reaped rewards even as brick-and-mortar sales have slowed. I expect this to continue, as the volume of online shopping we are seeing now is unprecedented. The post-pandemic retail landscape is likely to retain a lot of this online activity as the pandemic has already gone on long enough to create new, ingrained habits among consumers.”

What’s coming for CBD pet products in 2021?

If the data predictions and industry experts are correct, 2021 will see continued significant growth for CBD pet products. One of the contributing factors will certainly be an evolution of the home dynamic for pets, who are now used to having their people home (or in the case of newly adopted pets, may not know anything different) and may suffer from separation anxiety once leaving the house and returning to the office becomes a more regular thing.

“I think that’s going to be a huge topic,” said Howland. “Because pets like routine, and of course for dogs it’s a dream come true to have their people with them all the time, so it can be very stressful if their people suddenly leave. We’ve started to write some articles and blogs about separation anxiety and trying to ease pets back into that kind of routine. That’s where calming products are going to be helpful — for pets to adjust back to a normal life.”

Medterra’s own growth provides the company with a snapshot of what it thinks the next year will bring, according to Hartenbach.

“We believe the CBD pet market is just scratching the surface of its potential and will see significant growth in 2021,” he said. “Given that Medterra’s pet products have some of the highest reorder rates out of any product in our portfolio, this expansion will come from an increased focus on the category by brands like Medterra. Coupled with pet ownership at an all-time high, the Medterra Pet Division is forecasted to grow by at least 150% next year alone.”

With anxiety and stress both at an all-time high across the globe and the two most dominant indications for CBD use (according to Bigeye’s report) for humans and for pets, it’s safe to say that 2021 will bring a continued evolution of CBD in both markets.