A half-dozen deals at the beginning of 2020 appeared to herald another M&A/investment boom year for the U.S. pet industry. Then came COVID-19, pushing the stock market into bear territory for the first time since the Great Recession and casting an ominous cloud over most areas of U.S. industry, compounded by an unprecedented level of concern surrounding the presidential transition.

In August 2020, reacting to the upheaval, Phillips Pet Food & Supplies and Animal Supply Company terminated a merger agreement announced in February, explaining that, “While Phillips and ASC believe in the merits of a potential transaction, the economic uncertainties caused by the COVID-19 pandemic have made it difficult to close on many business transactions in the United States.” November 2020 saw pet specialty retailer Pet Valu shuttering all of its 358 stores and warehouses in the Northeastern and Midwestern U.S. “due to severe impact from COVID-19.”

In spite of challenges, U.S. pet industry remains defiant

As of 2021, nonetheless, the U.S. pet industry as a whole has emerged as not just recession resistant, in keeping with its enviable historic reputation, but recession defiant, with many sectors faring even better than had been projected prior to the pandemic. Market-fueling factors included:

- a heightened focus on human and pet wellness;

- increased interaction with pets among pet parents and their less furry children, who found themselves working and schooling from home; and

- a surge in pet acquisition among pandemic-stressed Americans seeking the comfort and companionship that pets offer.

At the same time — and seemingly defying the gravity of business closures, mass unemployment, staggering U.S. debt, stymied gross domestic product (GDP) and political chaos — the stock market bounced back and has remained at record highs.

The upshot for the pet industry has been a flurry of M&A and investment activity beginning later in 2020, including such significant developments as the PetSmart/Chewy realignment, Petco’s initial public offering and the sale of Pet Supplies Plus, amid dozens of smaller deals.

Trends to watch in 2021

As U.S. and global investment firms make up for lost time, how well (and why) an industry withstood COVID-19 is top of mind, implying a blockbuster 2021 for pet industry M&A and investment activity. As in many other areas of American life, the ongoing COVID-19 crisis has sharped existing high-level sightlines in the pet sector, including:

- Companies and brands centered on pet health and wellness, especially evident of late in activity involving marketers of natural pet food, supplements and medications.

- Marketers of home-centered, online-based pet products and services, including those fielding DTC (direct-to-consumer) subscription services home-delivering fresh pet food and gift boxes, and wellness-based technologies such as veterinary telehealth and pet health monitoring.

- Companies participating in disruptor trends such as CBD, alternative protein sources including insect proteins and (often overlapping) sustainability initiatives such as recycling and ethical sourcing. The New York Times’ February 6, 2021 opinion piece on “The Ugly Secrets Behind the Costco Chicken,” while not particularly news-breaking, is an indication that ethical sourcing is likely to increasingly affect the human food and pet food industry compass.

As reported in last month’s column, the 21% sales surge for pet supplements in 2021 ups the ante in pet supplement vs. pet food competition. Pet food and treats have significant advantages over pet supplements, including that there is no such thing as a dog — much less a cat — with a special interest in nutraceuticals. But especially over the long term, as questions and concerns over sustainability and ethical sourcing gain urgency, the degree to which pet supplements and pet foods address the same health concerns bears noting.

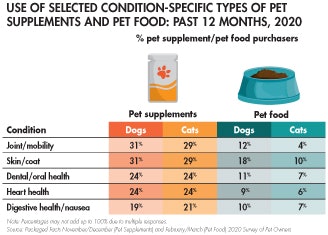

Packaged Facts’ November/December 2020 survey data show that skin/coat health, joint/mobility concerns, dental/oral care concerns, digestive health and heart health are top classifications for functional pet foods as well as for pet supplements, which are intrinsically functional in positioning (see Table 1).

TABLE 1: Joint/mobility and skin/coat are the two top conditions pet owners who purchase supplements are looking to address.

The pet industry has entered an era of multiple-front competition driven in large part by the e-commerce boom and now accelerated by COVID-19 impacts. In this new “omnimarket” landscape, companies large and small compete across former boundaries between brick-and-mortar and e-tail, pet specialty and mass channels, veterinary and non-veterinary, products and services, and food and non-food products. This new era is here to stay, and will continue to swell the current crescendo of business restructurings, expansions and contractions.