When it comes to creating and selling pet products and services in the current marketplace, nothing is more compelling than the promise of enhanced pet health — and pet-health-wise, veterinarians have pride of place. By extension, premium and superpremium brands of pet food marketed as veterinarian formulated or approved have proliferated.

At the same time, however, sales of prescription pet food diets directly at veterinary hospitals/clinics are in decline, with a customer base slipping from 9% of dog/cat owners in 2016 to 7% as of 2021, according to MRI-Simmons data. Vets risk snatching defeat from the jaws of pet food victory unless this tide can be turned.

Factors playing into the decline of veterinarian sales

The decline of veterinary hospitals/clinics as pet food purveyors is especially paradoxical at a time when pet food marketers and retailers, taking up a strategy long executed through PetSmart’s alliance with Banfield, are weaving veterinary care into the core of their operations. Mars and Nestlé Purina are buying into veterinary services and investing in related technologies including pet health diagnostics. Retailers and e-tailers including Petco, Pet Supplies Plus, Walmart, Tractor Supply and Chewy are joining with veterinary service providers to open in-store clinics, offer pop-up clinics, field online pet pharmacies and sell prescription pet food. Partnering with Vetsource, in which Mars has acquired a controlling stake, Banfield and VCA (both owned by Mars) now similarly offer online pharmacies where prescription pet food can be purchased.

To be fair, the rise of online shopping for pet products has generally flattened customer base growth for all other players, not just the veterinary sector. MRI-Simmons data show the share of pet-owning households who buy pet food online nearly doubling from 16% in the fall 2019 tracking period to 29% as of fall 2021, with the largest percentage point gain occurring between spring 2020 and fall 2020, corresponding to the initial COVID-19 era.

Veterinarians still have the advantage in pet food recommendations

But vets have notable advantages, which is the reason Hill’s, Royal Canin (Mars) and Purina Pro Plan compete aggressively in this closely guarded pet food segment. Packaged Facts survey data presented at Petfood Forum 2020 showed that vets are the most common impetus to pet food change, with 38% of dog owners and 31% of cat owners attributing veterinarian recommendation to a change in the pet foods they buy — well above any other influence, including word-of-mouth from family and friends, though word-of-mouth is generally considered the gold standard.

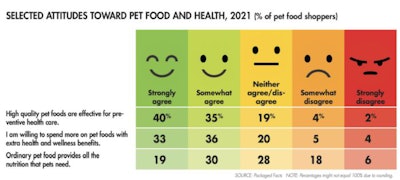

Moreover, many veterinary clients want pet food advice from their vets: 38% of dog or cat owners consider it “especially important” that their vet provide advice on which pet foods to use, as shown by Packaged Facts’ November/December 2021 pet owner survey. This expectation follows from a strong conviction by 40% of pet owners that “high quality pet foods are effective for preventive health care (see Table 1),” such that 33% strongly agree that they are “willing to spend more on pet foods with extra health and wellness benefits.” Conversely, less than one-fifth (19%) strongly agree that “ordinary pet food provides all the nutrition that pets need.”

A continually changing landscape

Given these numbers, you might think pet food buyers would be beating a path to veterinary hospital/clinic doors, especially during a period when the pendulum has swung back to a degree from “natural” formulations (which had disproportionately hitched their wagon to grain-free) to veterinary diet and science-based formulas. Sledge-hammering the pendulum back in the veterinary and science diet direction was the U.S. Food and Drug Administration (FDA)’s ill-starred warning over grain-free diets, which cast a pall over natural pet food formulations in general, and especially those with relatively newfangled formulations.

But between online shopping and direct-to-consumer trends, independent veterinarians find themselves in a new and not very auspicious competitive landscape, even as Mars’ recent acquisition of Nom Nom (capturing two birds with one stone: fresh refrigerated and DTC) underscores that the new next thing has arrived.

More on the veterinary sector and pet product sales

Veterinary Services in the U.S.: Competing for the Pet Care Customer (January 2022)