A new report from Cascadia Capital, an independent investment bank that includes petfood and other pet product companies among its investments and transactions, shows the pet industry is "gaining momentum" coming out of the recession, not only in sales but also in merger & acquisition activities and new companies emerging.

While the report, "Pet Industry Overview-Fall 2011," clearly looks at the industry from that M&A perspective and at only certain retail channels* (the 2010 total it cites for US sales of cat and dog food, US$8.3 billion, is less than half of the overall US cat and dog food sales for last year), it does offer some new trends and insights to consider. For example, the report says that with the benefit of hindsight and full data and analysis of 2010 sales, it's clear that the recession took more of a toll on the industry than previously believed (at least by Cascadia): "Notably, a) specialty lost share to discount, b) total food sales produced anemic growth (1.5% for dogs and -0.2% for cats)*, c) superpremium food sales decelerated (growing 2.4% after years of double-digit gain) and d) spending by higher income households contracted."

(*Note: Cascadia is taking those growth rates, plus the US$8.3 billion sales figure, from retail sales tracked by SymphonyIRI, which includes US supermarkets, grocery stores, drugstores and mass merchandisers -- including Target and Kmart, excluding Walmart -- with annual sales of US$2 million or more. So the data does not include pet specialty channel sales or all the sales from smaller outlets.)

Yet, Cascadia sees signs the industry is making up lost ground, including strong second quarter sales for publicly traded pet companies, impressive sales and earnings for PetSmart (it is also publicly traded) and newly accelerating sales for superpremium petfoods. (By the way, Packaged Facts concurs.) The report also states that the "long-term fundamentals" for the pet industry remain solid: With more research under way on the "pet/human wellness connection," humanization will only get stronger, Cascadia believes, while baby boomers continue to pamper their pets.

Specific to petfood, the report noted these trends:

- The market is becoming more segmented and crowded as more companies enter and new product launches continue to rise despite the economy (Cascadia cites a 19% increase in new petfood introductions and 9% increase in petfood SKUs in 2010);

- Health and wellness continue as key product attributes, especially in new petfood products, often following trends in human foods (e.g., no wheat or gluten);

- Cascadia says 2010 was the "first year in many where premium was not the biggest thrust in product introductions";

- Conditions for alternative petfood categories, such as raw, frozen and freeze dried, continue to improve, thanks to the proliferation of dry petfood products ("marketing messages become muddled"), increasing acceptance of the concept that rotating food formats benefits pets and the fact that retailers, especially those backed by equity firms, are seeking "new high-density, high-margin sales opportunities";

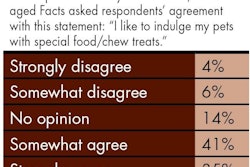

- Treats are outperforming petfood overall and will continue to do so because consumers view them as ways to pamper their pets (treat sales increased 8% in 2010);

- Nutraceutical treat sales are growing even faster, mainly through the pet specialty channel, while premium petfood products are increasingly incorporating nutraceuticals; and

- Treat and supplement businesses are becoming more vulnerable, which will likely drive industry consolidation.

A summary of Cascadia's April 2011 report on the pet industry is available on its website; I would guess the fall report summary will be available there soon, too.