“Follow the human.” In “Consumer trends driving growth in natural pet products,” a webinar presented by Petfood Industry last week, that was not only the final piece of advice from speaker Eric J. Pierce, director of strategy and insights for New Hope Natural Media, it was also the essence of his overall message.

During the webinar (sponsored by Trouw Nutrition), Pierce shared data on the sales growth of natural and organic food and beverages in the US: 11.7% versus only 2.9% for what he called “conventional” food and beverages, according to Nutrition Business Journal (NBJ, one of his company’s publications).

This same type of growth is being seen in pet products, though his comparisons weren’t quite as direct here. For example, he cited US sales growth of 13.5% for natural and organic petfood, per NBJ data, compared to only 1% volume growth in the US, according to Euromonitor. I think he was referencing overall petfood volume, though that wasn’t clear; and obviously, sales and volume are very different. Similarly, he compared only 1% growth in the US pet population to 125% growth in US pet owners purchasing or looking to purchase natural products, according to the American Pet Products Association. I don’t quite understand the connection there.

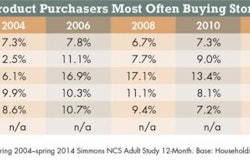

However, we know from many other sources that sales of natural petfood are growing. For example, for the 12 months through May 2014, natural dog food sales in the US pet specialty channel (pet shops, veterinary clinics and farm and feed stores) increased 8.8%, according to GfK, while natural cat food sales rose 10.6%. In fact, natural dog food products (including treats) claimed a 68.3% share of all dog food products sold in pet specialty over the same period, with natural cat food products having a 42.3% share.

The strength of Pierce’s message lay in the data and information he provided on how trends in natural products for humans are now showing up in petfood and pet products. “Trends and ingredients that used to take five years now translate to petfood within one to two years, especially in the natural industry,” he said. (I would argue that translation might be even quicker now.)

His company has unique insights in this area, thanks to a database called Next Trend that tracks all products—including their ingredients, label claims and other details—displayed at New Hope’s trade shows, Natural Products Expo East and Natural Products Expo West. More and more, those products include ones for pets.

For instance, Pierce showed how the human food trend of “snackification” is now spilling over into petfoods. With human food, the driver is people seeking to combine snacking with nutrition and function to suit their on-the-go lifestyles, Pierce said; because pet owners humanize their pets, they want to include their furry family members in this behavior, too.

He also highlighted the consumer trend—and demand—for transparency in the food supply chain. Pierce provided a quote from Greg Page, CEO of food giant Cargill (which also has divisions that manufacture petfood and supply ingredients to the petfood industry): “In a world where nothing can be hidden, you better have nothing to hide.” Pierce suggested that in this consumer environment, transparency can even be a market differentiator and competitive advantage—or at least a defensive tactic: “Find your villains and work them out of your supply chain before the internet does it for you,” he said.

In a way, it seems many petfood companies exhibiting at the Natural Product Expos already have heeded this advice, with 60% claiming “Made in the USA” on their product labels; that is the number one label claim for petfoods in the Next Trend database. Somewhat related, what Pierce referred to as “proxies for ingredient transparency,” other common petfood claims for products in the database include no additives (22%), natural (20%) and organic (16%).

Manufacturers are also responding to demand in another area of consumer focus and concern for both themselves and their pets, health and disease prevention. For petfoods in the Next Trend database, that shows up in 13.5% of products bearing a low-glycemic claim, 5% a whole foods claim and 4% a low fat claim. The most prevalent claim in this area for petfoods, Pierce said, is corn free, with 23% of products having that on their labels. (Never mind the tenuous science, if any, that might support a health claim here.)

Pierce also shared these health and longevity related claims for petfoods in the database:

- Protein, 42%

- Vitamins, 35%

- Omega-3 fatty acids, 34% (growing three times in the past year)

- Minerals, 33%

- Immunity, 18%

- Antioxidants, 16%

- Joint, 12%

Getting even more specific, Pierce said the top 10 ingredients in the petfood aisles of the Natural Products expos include the vitamins and minerals zinc, vitamin E, potassium, vitamin B1 and copper, and the herbal ingredients rosemary, tocopherols, flaxseeds and peas. (Chicken rounded out the 10 ingredients named.)

Finally, possible emerging ingredients, according to the database and New Hope’s tracking of consumer trends, include phytonutrients, yeast free, inositol, inulin, wheat germ, xanthan gum, olive oil and squash. How might these fit into your next natural petfood formulations?