Clean label human food products are growing five times faster than the rest of the market, and 33 percent of all food and beverage sales in the US are generated by clean label products.

These numbers were presented by Joseph Borchardt, strategic marketing director for Kerry, during a recent webinar, “Clean label: more than ingredients.” The webinar, presented by the Kerry Health and Nutrition Institute (part of the Kerry Group, a company that provides ingredients for both human and pet foods), highlighted the growing nuance of the “clean label” trend as consumers in the human food market demand more from their food providers. As we well know, it’s not just their own food humans are concerned about — whatever’s trending in the human food market inevitably affects the pet food market. So, it behooves the industry to take a look at just what it is customers are looking for when they think of “clean label.”

Key growth drivers of the clean label movement

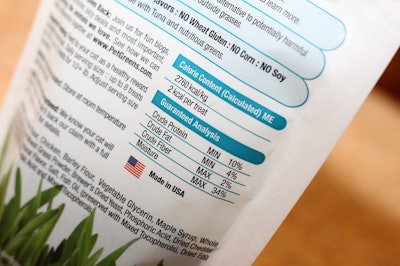

Ingredients are the easiest way to define a “clean label,” according to Borchardt. The institute’s research says that 75 percent of global consumers say they’re worried about the long-term impact of artificial ingredients; 80 percent of those say they worry because they believe artificial ingredients are harmful to their own or their family’s health. And while the types of ingredients consumers are most concerned about vary depending on what part of the world those consumers are in (US and Canada have a higher avoidance of ingredients like sugar, salt and MSG, while Europe eschews “artificial” ingredients and GMOs), everyone agrees that they want plain language on their ingredient statements.

Plain language is easier said than done, particularly in an age that has given rise to labels for just about every claim possible. As “Certified Gluten-Free,” “USDA Organic,” “Non-GMO Project Verified,” “Certified Vegan” and the like take over store shelves, it’s easy for the true message to get lost in the shuffle. But according to Borchardt, to consumers, “clean label” intrinsically communicates an environmental message that rises above package labeling: that of sustainability.

Consumer expectations: 'I believe that clean food should protect food, people and the planet.'

Sustainability and transparency go hand-in-hand with the clean label movement, according to the Institute’s research. A full 99 percent of consumers would pay more for transparent products, and nine out of 10 want to see transparency in ingredients and their sources. Ninety-four percent, according to institute data, would be loyal to manufacturers who adopt “complete transparency.”

These are trends we’re seeing in full swing in the pet food world, with consumers caring just as much (if not more) about what goes in their pets’ bowls as what goes on their own plates. It is, at this point, a safe bet to assume that a significant number of those who would pay more for transparency in their own food purchases would do the same for their pets’ food.

In the January 2018 issue of Petfood Industry magazine, I’ll cover the top trends the pet food industry expects to see in the coming year. While the responses are still rolling in, it’s a safe bet that “clean label,” “sustainability” and “transparency” will be front and center, as pet owners continue to directly correlate their own well being to their pets’ health and wellness.

Briefly: The Clean Label Movement, boomers vs. millennials

Source: Kerry’s proprietary consumer insights study on Clean Label Exploration, 2017

Millennials:

- Organic claims resonate more

- “Made with real ingredients” is a priority

- Higher willingness to pay for “clean” and propensity to shop at natural food stores

- Higher importance on how food is made

Boomers:

- Sustainability ranks higher

- Antibiotic and hormoe free also means more

- Greater percentage practicing “avoidance”

- MSG, nitrates and nitrites among the ingredients they’re avoiding

- Higher importance on where food comes from

Contact Me