The private equity community has developed a modest fascination with the pet industry over the past five years. Interest has accelerated markedly since 2007, as evidenced by deal volume. Notably, deal volume grew from 2009–2010 in contrast to the broader consumer marketplace, which contracted. 2011 is off to a strong start for the industry, with five announced deals in January to-date.

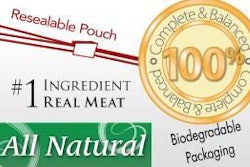

Petfood and treats account for a large percentage of this transaction volume. The proliferation in channels where petfood and treats are sold, coupled with the increased willingness of consumers to spend on premium, have pushed the category to impressive heights, with eight major petfood investments/acquisitions since 2007.

The two most talked about transactions took place prior to the recession. In October 2007, Swander Pace Capital, a consumer-oriented private equity firm, sold Eagle Pack Pet Foods Inc. for an undisclosed amount to Berwind Corp. Swander Pace made its initial investment in Eagle Pack in 2004. In August 2008, Berwind followed up its Eagle Pack acquisition by purchasing Old Mother Hubbard Inc. for US$400 million from Catterton Partners, also a consumer-oriented private equity firm. Like Swander Pace, Catterton had made its initial investment in Old Mother Hubbard in 2004, investing US$45 million for an undisclosed ownership percentage. Berwind ultimately combined the two brands to form WellPet LLC, which is an active consolidator in the petfood/treat space today.

Little was publicly disclosed regarding the transaction multiples associated with the buys outlined above. General consensus, however, was that these transactions took place in the range of 2.5x-3.0x latest 12 months revenue. The relevance of those multiples was established a year earlier by Del Monte Foods Co. in its acquisitions of The Meow Mix Co. LLC (3.7x latest 12 months revenue) and Kraft Foods Inc.’s Milk Bone Dog Food Business (3.2x latest 12 months sales). Subsequent petfood/treat deals have all involved a comparison to this multiple set, and collectively they have formed the basis for seller expectations thereafter.

While seller expectations in the petfood/treat space have remained anchored in the past, the general transaction market has undergone significant turmoil. A collapse of the debt market rendered private equity dormant for much of 2009-2010, with market activity bottoming in the second quarter of 2009 and only modestly recovering over the next 18 months. Without private equity as a foil, public company buyers felt less challenged to pay a premium for attractive properties, and valuation multiples contracted. The net result is a number of petfood/treat deals have died over the anchoring on these historical multiples. In short, sellers’ expectations have not changed with the times, in part due to the belief that the pet industry holds a sacred place in the consumer transaction landscape, a notion that has received considerable validation.

According to the Swander Pace website, the private equity fund recently closed on a new petfood platform acquisition, acquiring Merrick Pet Care Inc., a manufacturer and marketer of wet and dry dog and cat food under the Merrick, Before Grain and Whole Earth Farms brands. While there has been no deal announcement to date and transaction value and associated multiples have not been disclosed, the data points we are hearing, validated by several sources, point to a significant contraction relative to the multiples above. My opinion is that the sale of Merrick Pet Care will mark a meaningful bifurcation in petfood/treat transaction multiples. This parsing of the market is just what private equity has been hoping for in order to unlock transaction volume in the pet industry.

From time-to-time, I expect emerging companies with truly innovative products and defensible market positions in the pet industry to command premium multiples, even in excess of those outlined above. Companies that meet this criterion will:

- Have products that can be sold across the pet channel spectrum, in general mass and in specialty retail environments;

- Meet an emerging need that is not well addressed by existing alternatives, rather than being a new twist on an existing formula;

- Solve a long-term structural industry problem that impacts cash flow; and

- Be led by management teams with proven industry experience.

For all intents and purposes, however, the axis of the pet transaction world was effectively bent by the Swander Pace/Merrick Pet Care transaction and possibly for the better of total transaction volume.