This year we have experienced many positive and not so positive social and economic factors that have impacted the US petfood market. Now that we're in the fourth quarter, let's look at the state of the market and future trends.

Reaching nearly US$25 billion in sales for 2007, the US petfood and pet supplies market has grown by 54% in current terms and 35% in constant terms since 2002, according to Mintel. Given what we have seen, heard and experienced, the five-year prognosis is forecasted to be bullish, with total US sales of petfoods and pet supplies expected to grow at an annual average rate of 7.3% in current dollars and increase 4.7% per annum after adjusting for inflation.

The market dynamics this year were fueled by increased retail competition via channel switching and consumer tastes, as customers purchased more premium pet consumables for the past three years. Sales through mass merchandisers and pet special stores were major contributors to the overall sales growth in 2004 and 2005, with these channels acquiring more market share from traditional grocery stores. Mass merchandisers offered pet owners lower prices and a wider variety of products, while pet specialty stores offered a wider variety of products and a wider price range.

Movement due to recalls

In addition, this year witnessed a variety of quality concerns about petfood with the massive recalls in the spring. Despite that, this year's category sales are expected to be higher than last year's. The recalls did not push consumers out of the market for obvious reasons: Pet owners still needed food for their pets. Hence, this episode only fueled cross-subcategory purchases, from segments impacted by the recalls to segments where there was no impact. In addition, re-evaluating the affected segments shows that losses due to the recalls were limited to a small group of brands, most of which were low-margin items.

Evidence from both retailers and manufacturers indicates that a notable share of concerned petfood consumers switched to more expensive natural and organic foods in response to the recalls (16%, Mintel says). This movement would serve to sustain market sales.

Pampering technology

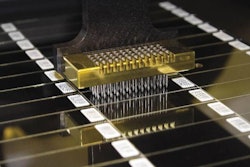

Innovation and personalization have encouraged pet owners to continue to pamper their pets more than they did even a year ago. Technology also plays a major role in the lives of some pet owners. For example, after reading a 52-page user guide, a pet owner can use the automated Perfect Petfeeder to set the feeding time and amount of food for a pet.

Impact of older pets

Wellness is another trend that will drive growth. According to an October 2007 article in Prepared Foods , a significant percentage of US pets have reached the mature lifestage15% of dogs and 17% of cats are over the age of 11.

In the short term, a large number of doting owners will pay a premium for products and services that enhance and lengthen the lives of these pets. For some this will likely include the purchase of more expensive lifestage and condition-specific foods, supplements and treats, like those that address joint and digestive health, as well as those that maintain vision. One example is Purina One Adult Dog Total Nutrition, said to ensure the health of the immune system, bones and joints, digestion, skin, coat, eyes and teeth.