U.S. retail sales of dog and cat food approached US$40 billion in 2021, up 15% over 2020, as reported in Packaged Facts’ just-released “Pet Food in the U.S.” (September 2022). Over the 2017–2021 period, dog and cat food garnered a compound annual growth rate (CAGR) of 11%.

Recent inflationary prices for pet food only partially spurred that growth. Double-digit sales growth in the pet food market — large and ostensibly mature as it may be — is driven by ongoing product premiumization, and especially “superpremiumization.” The question then becomes: What’s currently putting the “super” in pet food?

Current pet food trends

Fresh (refrigerated/frozen) pet food has epitomized superpremium in recent years and is especially linked to the varieties of direct-to-consumer (DTC) distribution. Between them, home delivery and DTC have eroded the distinction in consumer mindsets between in-store vs. online, as well as the channel-exclusivity tactic.

Freshpet is projecting 2025 revenue in the US$1 billion to US$1.25 billion range. Sealing the deal on the future of fresh, Mars launched its Cesar Fresh Chef refrigerated dog food line in December 2021 and acquired DTC fresh pet food marketer NomNomNow in January 2022. With fresh pet food getting more attention, high-water-content fresh and traditional wet pet foods boasting the health advantage of superior pet hydration and wet pet food outselling dry pet food in the veterinary channel, the future of pet food will be wetter.

The future of pet food will also be healthier. Packaged Facts’ April 2022 Survey of Pet Owners indicates that only half of dog and cat owners use regular/adult formulation pet food, with the other half opting instead for formulations specific to their pets and to specific pet health and wellness concerns. In this vein, pet food sales are benefiting from a reinvigorated focus on superpremium science-based diets and treats — partly in the wake of the DCM (dilated cardiomyopathy) scare, but more broadly due to increased pet-health consciousness in this age of COVID.

Clinical pet nutrition

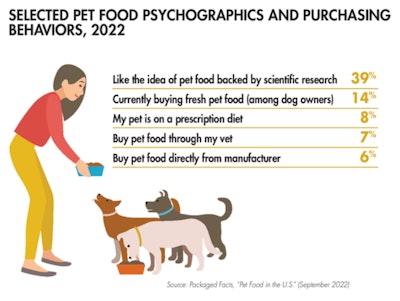

Hill’s Pet Nutrition, the pioneer of veterinary clinical nutrition, saw Q2 2022 pet food sales rise 14.5% over Q2 2021. Packaged Facts survey data show that 39% of dog/cat owners like the idea of pet food backed by scientific research (see Table 1). A key focus for Hill’s, and a buzzword pet food industry-wide, is microbiome: How “fiber rich ingredients, including prebiotics for dogs and cat, can both support and nourish the pre-existing gut ‘ecosystem.’”

From the veterinary sector point of view, however, there’s a rub. The “retailization” of pet health and vet care means that vets as pet food purveyors (as addressed in our March 2022 column) should be having their cake more, but instead are eating it less. Despite the pendulum swing toward scientific and veterinarian pet food formulations, Packaged Facts survey data show that only 8% of dog or cat owners buy prescription diets.

In this context, one of the most striking aspects of the current wave of science-based pet foods is the increasing overlap of the formerly quasi-adversarial “natural” and “vet-formulated” positionings, including in the trend-fertile DTC space.

Marketers working along these lines include celebrity chef Bobby Flay, with his Made by Nacho cat food line marketed as developed with veterinarians and nutritionists. On the foodie and natural front, you get “cat-crafted” pet food; “chef-approved flavors;” natural superfoods such as pumpkin, cranberries, blueberries and millet; and bone broth as a (not really very) “secret ingredient.” On the scientific and veterinary front, you get prebiotics, probiotics and a “dose” of antioxidants to support a healthy digestive tract — that is, the microbiome.

Fresh and hybrid natural/vet-formulated brands aim to minimize the rifts between the kitchen cutting board, the pet food bowl and the pet food lab, and pet parents are welcoming these developments.

Pet food sales continue to climb

www.PetfoodIndustry.com/articles/11599