In 2013, the volume of the Russian petfood market should reach 585,000 tons in natural volume and exceed US$1 billion in monetary terms, estimate experts of the State Statistic Service of the country. At the same time it is forecasted that the pace of industry growth is going to rise in coming years following the increase of the purchasing power of the Russian population.

According to analysts of Research Techart, the level of sales of industrial feed for cats and dogs in the Russian market will rise 10%-15% annually in monetary terms. Currently this figure amounts to about 7%-8%. This trend is contributed to not only by the increase of the total number of pets, but also by the growth of the number of pet owners who use ready-made food for feeding their animals, as well as the increase of the share of the premium and superpremium types of petfood in the total structure of sales.

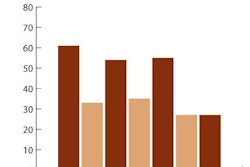

Today the undisputed market leaders are the brands of the economy segment (priced from RUB18-75, or US$1.6-$2.5, per kg), in particular Kitekat and Chappi. Second place is occupied by the brands of the premium segment (average price RUB170, or US$5.7, per kg). Here Whiskas and Pedigree are the main leaders. The economic segment accounts for 65% of the market, while premium accounts for only 30%-33%. The share of superpremium segment for the companion animals in Russia is estimated to be only about 1%. In coming years all annalists predict that the share of sales of petfood in the economy segment will gradually reduce, and by 2020 it will account for only about 45% of the total market.

According to official statistics, in 2012 the average pet owner in Russia spent about US$530 on petfood, which is US$22 more than in 2011. This figure is also predicted to grow at least by US$20-$30 per year until 2020, so Russians could be closer to the level of money spending on petfood in Western Europe.

According to Elena Dobrovolsky, expert researcher of Nielsen, currently the largest segment of the market is cat food. It occupies 82% of the total sales in monetary terms. Petfood manufacturers in recent years in Russia have achieved an important goal-they made pet owners pay attention not only to the brand they were buying, but also to the types of food that are nutritious and appropriate for their pets.

According to research company Comcon, in Russia about 58.9% of dog owners and 37.3% of cat owners currently buy specialized feed for their animals. Both of these figures are largely higher than they were a couple of years ago. According to experts, as the result of all these trends the volume market of petfood in Russia may rise to US$1.7-$1.8 billion by 2020.