Spotlight on Brazil

From to Associação Nacional dos Fabricantes de Alimentos para Animais de Estimação (ANFAL, or Brazilian Petfood Manufacturers Association)

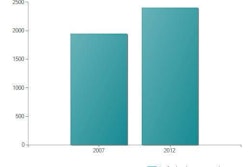

In 2007 petfood sales increased in Brazil but did not manage to achieve the expected 11% growth. Yet the industry hopes to accelerate growth in 2008 to at least 5% over 2007 sales, for a total of US$3.22 billion.

The 2007 revenues of US$3.07 billion represented a 4.26% increase over 2006. The slowdown in growth was caused by raw material price increases and high taxes, which make it more difficult and expensive for consumers to buy nutritionally improved products. This also reduces their competitiveness abroad.

In Brazil petfood is taxed at 49.9%, while farming and stock-breeding products are taxed at 15.25% and basic human foods at 7%. The reason for the disparity is that dog and cat food are classified as superfluous, although they really are equivalent to human food. The petfood industry claims its products should be classified in the same category as human food, which is the situation in the US and Europe.

Specifics of market segments

All 2007 sales growth occurred in the economy priced or basic product segment, which accounts for 65% of the Brazilian petfood market. Sales in the standard segment, with a 23% market share, have remained steady, whereas both the premium segment-8% of the market-and superpremium segment-4% market share-have been decreasing (Figure 1).

Economy or basic product manufacturers evade 60% in taxes. This amount is passed down to the consumer, who benefits from price reductions of up to 30%. As a result, the market has chiefly expanded among the lower social classes of Brazil. Products classified as economic or basic feature low nutritional value and high risk for the companies in that sector, because growth is based on lower quality and continually being able to evade paying taxes.

Greater potential

In 2007 the Brazilian petfood industry produced 1.8 million tons of petfood. ANFAL believes the potential of the market is much greater; its 31 million dogs and 15 million cats represent a potential petfood consumption of 3.96 million tons per year. But prepared foods are offered to only 45% of pets, while the remaining 55% are fed leftovers. "Approximately 2 million tons of rice, meat, milk and other foods are used to feed our pets; as a result, these are diverted from human nutrition," says José Maria Parra, president of ANFAL.