In early January, Petco announced it had followed through on its May 2014 promise to remove all China-made dog and cat treats from its more than 1,300 retail stores nationwide, plus online at Petco.com. The move and initial announcement (which was quickly followed by similar notices from PetSmart, Canada’s Global Pet Foods and other retailers), were prompted by strong implications that jerky treats sourced in China had caused pet illnesses or deaths, and the resulting uproar from pet owners, humane groups and activists.

The entire sad, sordid saga regarding China-sourced treats highlights the importance that owners are assigning treats as part of their pets’ overall diets. Pet owners want safe, nutritious treats—and are buying them at continually increasing rates—because they want to pamper their pets. A review of the hottest growth categories for pet products globally from 2009 to 2014 by Euromonitor showed cat treats, dog treats or both among the top five in every region worldwide. Latin American and Eastern Europe saw double-digit increases, while even mature regions like North America and Western Europe enjoyed 6% to 10% growth (Figure 1).

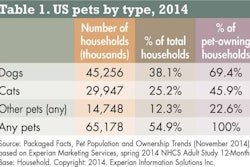

What’s remarkable is that in many parts of the world, cat treats are growing even faster than dog treats. Granted, sales of cat treats are much lower, giving them a higher growth potential; and in regions like Latin America and Middle East/Africa, where dogs far outweigh cats in popularity, cat treats don’t even crack the list of hot growth categories. Yet in most other regions, cat owners seem to be trying to catch up to dog owners in terms of pampering their pets. David Sprinkle, research director for Packaged Facts, has noted that the percentage of US cat-owning households purchasing pet treats soared to 52.8% in 2013, up from 39.6% in 2006.

Both dog and cat owners around the world are looking for ways to feed their pets natural fare and specific types of ingredients (or to avoid certain types of ingredients), and that’s expanding beyond the pets’ main diets to treats. For example, Packaged Facts report Pet Food in the US, 11th edition (September 2014) cited WellPet’s grain-free, low-calorie treats that pet owners can give to feel good about “offering small indulgences.”

This trend is expected to continue, with industry experts foreseeing growth in functional treats as well as new categories borrowing from other petfood trends. “High-meat treats, both baked and jerky, will dominate this segment,” predicted Tom Willard, PhD, with TRW Consulting Services.

Willard also mentioned new forms of treats, such as the gelatin and gummy types prominent in human food; trends in that industry continue to influence petfood product development. In an October Petfood Industry webinar, Eric J. Pierce of New Hope Natural Media discussed how the human food trend of “snackification”—combining nutrition and function to suit on-the-go lifestyles—is now spilling over into pet treats.

You can learn more about the treat market and developing new types of treats at Petfood Innovation Workshop: Next Generation Treats.