The past year has seen the merging, acquisition and selling of some major petfood players; a continued emphasis on humanization of pets; sleeker, simpler and sustainable packaging; and marketing campaigns that have pet parents buzzing on social media and in the pet store aisle. Continued strong sales in saturated markets, growth in novel categories like grain-free, “human-grade” and fresh/refrigerated petfoods, and expansion in emerging markets across the globe are certainly positive changes the industry is experiencing, but improving safety practices, learning to better communicate with consumers, and production, formulation and labeling transparency remain issues our industry is still learning to handle.

Let’s look back at 2014 critically, and focus on how we can improve the petfood industry in the new year while allowing for a few high-fives over hard-earned accomplishments.

The Regulatory Landscape

The Food Safety Modernization Act (FSMA) continues to be the topic du jour for petfood producers, with many speculating about its ability to truly make petfood safer and not just tie the hands of those trying to make safe petfood in the first place. The major elements of the proposed law are preventive controls, inspection and compliance, imported food safety, response, and enhanced partnerships, according to the US Food and Drug Administration (FDA). While some authorities will go into effect much sooner than others—like mandatory recall authority—much of the petfood safety system will be built in the coming years with input from petfood manufacturers and guidance from organizations such as the Pet Food Institute (PFI) and American Feed Industry Association (AFIA). The past year should have seen facilities putting funds into getting petfood and treat production lines inspection-ready, distribution channels un-muddled and the lines of communication between ingredient sources and formulation makers as open as ever. Otherwise, 2015 and beyond may be a struggle for some in the industry to remain compliant with FSMA and, in the eyes of pet parents and petfood peers, nontoxic, contaminant-free and safe.

Although the constant consumer fear of recall has certainly lessened with time since 2007, recalls can and still happen, so how the industry handles them remained a focus in 2014. Communication between companies and consumers about the causes for recall and the reason pet parents should still trust a brand whose food could potentially harm their pet is paramount. The Internet is often the first place people turn for answers, so it’s up to your company to provide a clear, concise message on your website, social media channels and digital press releases when and if a recall happens. You should be as informative and transparent as possible—petfood purchasers are more educated than those a decade ago and won’t tolerate being patronized.

Nutrition and Ingredients

Several years ago, petfood mirrored human food ingredient trends, but was often months or years behind once products hit the pet store and grocery aisle. In 2014, however, the latest human nutrition fad finally synced with the bag of petfood a few shelves over. Sometimes they are simply marketed differently; what is labeled “gluten-free” and “paleo diet-friendly” to humans is just “grain-free” and “wolf diet-friendly” for companion animals. Even small animal and bird foods—traditionally slower on the pet humanization uptake—are touting “ancient grains” and “superfoods” in their formulas.

Health benefits are equally touted in the form of kale, pumpkin, quinoa and pomegranate just as often for Fido as they are for the audience of Dr. Oz. Novel proteins, fresh and “lightly processed” foods, and organic, non-GMO ingredients are perceived as healthful and are often worth a higher cost for consumers if it means better breath, a shinier coat and a longer life for their pets. Ingredients like corn, by-products, added colors, preservatives and anything not easily read and understood off the side of a petfood bag remain bad words, as far as pet parents are concerned, and the industry has certainly responded.

Safety and Testing

Salmonella, mycotoxins and adulterated ingredients or formulas were the focus of those keeping petfood safe for pets and their parents this past year. With the regulations of FSMA looming, many petfood companies turned to third-party accredited labs or their own in-house testing teams to ensure that their products were safe and compliant. Antimicrobial effectiveness testing, challenge studies, shelf-life studies, nutritional chemistry and contaminant analyses are just some of the important processes many petfood companies are using to verify, check and double-check that every product meant for the consumption of pets is harmless and healthful.

Raw petfood was also in the safety spotlight again when a study published in September 2014 concluded one-third of samples of raw dog or cat foods ordered online were positive for Listeria organisms. The article, published in Foodborne Pathogens and Disease, “Investigation of Listeria, Salmonella, and toxigenic Escherichia coli in various pet foods,” indicated 65 of 196 samples of raw dog or cat foods were positive for Listeria, including 32 that were positive for L monocytogenes. In addition, 15 of the 196 samples were positive for Salmonella and two were positive for shig, a toxin–producing E coli.

“Consumers should handle these products carefully, being mindful of the potential risks to human and animal health,” said the researchers. Among 480 dry or semi-moist petfoods bought from local stores, only two dry cat foods were found to have contamination. The FDA’s Veterinary Laboratory Investigation and Response Network conducted the study in collaboration with the Food Emergency Response Network and its Microbiology Cooperative Agreement Program laboratories.

Packaging and Labeling

The consumer desire for convenience in petfood packaging continued to be king in 2014. Resealable, easy to carry, easy to pour and shelf-life stable packaging saw the most innovation in this area of petfood. “To-go” and “travel-ready” packaging might be the newest trend from the recent year, as petfood meal bars, flavored waters and ice, and easily carried and stored mixers and gravies made moves on the active, on the go market segments of Gen X/Y/Z and Baby Boomers. Although the sustainability of packaging remains important to these same consumer categories, programs and packaging practices that recycle or re-use materials can be perceived as just as critical.

In November 2014, ten petfoods tested in a Chapman University study contained a meat source not listed on the label, or couldn't detect the listed meat, bringing the mislabeling of petfood into the public spotlight. The study, published in the journal Food Control, also could not detect the listed meat in seven of the 52 samples. In three cases—a wet cat food, wet dog food and dog treat—the absence and the addition of meat sources may indicate intentional or accidental substitution, said co-author Rosalee S. Hellberg, MS, PhD, an assistant professor in Chapman’s Food Science Program. “Mislabeling of petfoods is misleading to the consumer and may result in economic deception or food safety issues,” said Hellberg. “Our study showed that 16 out of 52 products tested contained a meat ingredient not listed on the label.” PFI noted that the majority of products—31 out of 52—were labeled correctly.

The Retail Market and Consumer Trends

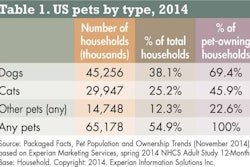

Both the United States and Western Europe have long been the leaders of the global petfood market. But today a number of other countries such as Brazil, Japan and Eastern Europe are emerging as world petfood industry forces to reckon with. Premium petfood continued to prosper in developed markets, as did refrigerated/fresh, holistic and natural petfoods. Online buying of petfood keeps growing and is not expected to stop, but consumers are still looking for informed, personal advice from retailers and their employees—whether in a brick and mortar store or through a chat box on a web-based market.

According to Euromonitor International, China, where ongoing economic improvement is providing more and more people with disposable income, is an emerging market that experienced expansion this past year and will continue to do so. India too is growing, although the majority of the retailers are "mom and pop"-type outlets, and the country has been slower to adopt commercial petfoods. Russia has experienced a huge growth in the realm of commercial petfoods, most notably in 2014. Other up-and-coming world petfood markets include Japan, Vietnam and Latin America—where Brazil and Mexico are two of the brightest stars.