For several years now, virtually all dollar growth in the US pet food market has been coming from pricier products, reflecting both higher ingredient costs and the deliberate efforts of marketers to "premiumize" products. Also well established is the potency of the human/animal bond as a driver behind consumer willingness to spend amounts that would have been almost unimaginable less than a decade ago, even during time of recession, especially on products positioning on health and wellness.

At the same time, while marketers are certainly doing their part to support these trends, not all the action is marketing driven by savvy companies looking to fuel or ride the wave. Rather, two other macrotrends are responsible for much of the power behind the premium pet health product surge: senior pets and pet overweight/obesity.

Older pets = stronger bonds

The most direct driver of interest in senior pet products is of course the aging pet population, since a larger population of older pets means that more companion animals are suffering from age-related issues such as joint, coronary, cognitive and immune-system-related conditions. According to the American Veterinary Medical Association's 2007 US Pet Ownership & Demographics Sourcebook, the percentage of the US dog population age 6 or older increased from 42% in 1996 to 44% in 2006, while the percentage of cats age 6 or older rose from 37% to 44%.

In the American Pet Products Association's 2009-2010 National Pet Owners Survey, among single-dog owners the average age of the pet is 6.6 years, while among single-cat owners the average age is 8 years. Pets are living longer because their owners are taking better care of them, both medically and nutritionally. Perhaps even more important, longer lives mean ever stronger emotional bonds and thus an increased willingness among pet owners to do whatever it takes to keep their pets healthy and happy for as long as possible.

Swelling population of overweight/obese pets

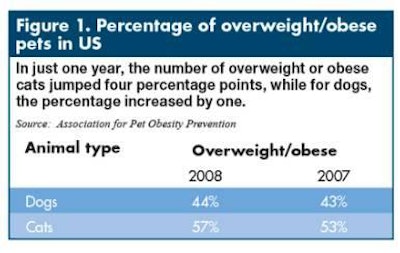

Correlating with the rising population of senior pets is the growing tendency of pets to be overweight or obese. According to the Association for Pet Obesity Prevention's (APOP) second annual National Pet Obesity Day Study, conducted in October 2008, 44% of dogs and 57% of cats are either overweight or obese, with the proportions of overweight dogs and cats up 1 and 4 percentage points, respectively, just since 2007 ( Figure 1 ).

The APOP study also reveals that older animals have a higher incidence of being overweight, with 52% of dogs and 55% of cats over age 7 found to be overweight or obese. "This is a particularly concerning discovery for veterinarians," explains the study's lead investigator and APOP founder, Dr. Ernie Ward, in press releases. "Extra pounds in older pets amplify any pre-existing conditions and complicate treatment. We're seeing more and more diabetes, respiratory and arthritic conditions in older pets as a direct result of obesity."

The impact of the senior and aging pet trends are having a clear-and growing-impact in the US pet food market. According to Experian Simmons consumer survey data, 20% of the dog or cat owners who purchase dry or wet food-about 12 million-purchase senior or light/weight management varieties on a regular basis as of winter 2008/2009, up from 16% in 2004 ( Figure 2 ).

US$3 billion+ retail market

According to Packaged Facts' latest pet market report, this adds up to more than US$3 billion in senior and weight management dog and cat food sold at retail. The true total may be much greater, however, in that these are pet food market segments that can only broaden further in the years to come. Market players closely associated with senior health and weight management likely also will reap the rewards of being viewed as overall pet health experts at the center of the lucrative pet wellness movement.

Information provided by Packaged Facts based on reports including The US Market for Senior, Overweight and Disabled Pet Products (September 2009).