During the past few years several modern pet food plants have been built in Central Asia, a region that historically has only imported pet food.

Central Asia stretches from southern Russia to the western borders of China and consists of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan. With an overall population of 105 million, the region’s per-capita demand for prepared pet food production is believed to be one of the lowest in Eurasia.

Mikhail Bazanov, general director of Mars Kazakhstan, said that the pet food industry in Central Asia has to compete primarily with “food from the table.” Bazanov said he estimates that only 30 percent of cats and less than 10 percent of dogs in Kazakhstan are being fed with prepared pet food. Nevertheless, he said, pet food is one of the fastest-growing segments of the fast-moving consumer goods (FMCG) market in the region and it is not likely this growth will slow down in the foreseeable future.

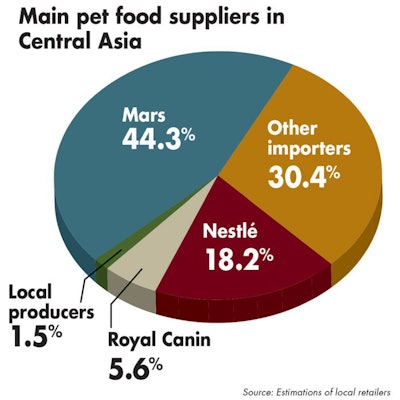

FIGURE 1: Pet food importers currently hold the vast majority of market share in Central Asia, a very small regional segment with significant growth potential.

In general, it is believed that there was a slump in pet food sales in the region between 2013 and 2014, when an economic crisis in the post-Soviet space caused a sharp devaluation of the national currencies of most countries in the region. This factor has made all imported pet food less affordable for local customers, providing an impetus for the development of local pet food production.

First pet food plants in the region

Yummi is the first industrial pet food producer to establish itself in Kazakhstan and in Central Asia post-Soviet times. The company launched a production line in the city of Petropavlovsk in 2013 for some KZT60 million (US$200,000), though it took a few years to develop proper receipts and begin full-scale production.

Sergey Shevelev, general director of Yummi, said the company’s plant manufactures up to 100 metric tons of the dry pet food per year. According to Shevelev, expanding into wet pet food production would require about US$4 million in additional investments, and at the moment the company sees no economic feasibility in expanding in that direction.

The average retail price for dog food under Yummi’s premium pet food brands is KZT9000 (US$24) per 20 kilogram pack, and cat food is KZT8000 (US$21) per 10 kilogram pack. Yummi is currently operating with profitability of about 25 percent. The company could have boosted it to 50 percent or even 100 percent by using cheaper raw materials, said Shevelev, but the company’s primary focus is manufacturing top-quality products, rather than going straight for the money.

The growth potential is enormous, as up to 99 percent of pet food in Kazakhstan is currently imported, said Shevelev. Yummi is selling its pet food in most big cities of Kazakhstan and also exports some production quantities to Russia.

The second pet food producer in Kazakhstan is Asia Nutrition. The company has run a plant next to the city of Almaty since 2017 where it manufactures pet food under the Jandi brand. Asia Nutrition so far sells just one established product — dry dog food, Jandi Dog Standart, at a retail price of KZT8500 (US$22) per 9 kilogram pack. But at the end of 2018, the product line expanded to include dry pet food for cats.

Asia Nutrition launched its plant with support from both regional authorities and the National Entrepreneurship Development Fund. In addition, Jandi-brand products were developed by the state-owned Kazakhstan Research Institute of Processing and Food Industry.

Kenen Jandosov, general director of Asia Nutrition, has not disclosed exactly how much pet food the company manufactures and whether it plans to expand its business further.

Of the local pet food production options in Central Asia, three stand out: Yummi and Jandi in Kazakhstan, and Wenzhou in Uzbekistan. | Map by Yandex

An export-focused project

The biggest pet food plant in Central Asia is located in Uzbekistan. According to information posted by the Ministry of Economy of the Republic of Uzbekistan, the plant was launched by China-based Wenzhou Jingshen Trade Co. Ltd. with an investment cost of US$1 million and a designed production capacity of about 1,000 metric tons of pet food per year.

Under an agreement reached in 2013, the Uzbekistan government granted the Chinese company with residency in the Jizzak special industrial zone, meaning the investor was provided with tax and customs privileges in carrying out projects for a period of five years. Bertym Murdamakhomedov, a member of the National Chamber of Commerce, explained that most residents within the Jizzak zone are primarily focused on export. Murdamakhomedov said that Wenzhou was already exporting its production to Kazakhstan, Tajikistan and Turkmenistan and recently received the green light to start exporting pet food to China.

The Jizzak zone has the best possible geographical location in the country to develop exports, and its establishment was in line with the Concept for the Development of Export Activities of the Republic of Uzbekistan, which envisages a surge in exports to US$30 billion by 2022, 2.6 times of the current level, according to Murdamakhomedov.

There are also several other companies that have registered in Uzbekistan to manufacture pet food over the past two years, but so far there is no information available on whether they are actually running any production facilities.

More on Asia markets: 10 top companies in the Asia-Pacific pet food industry