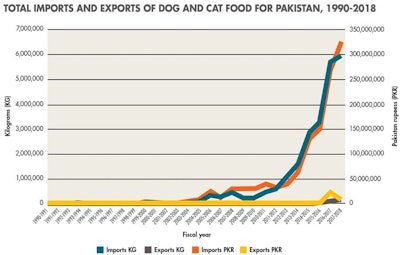

Pakistan’s fast-growing population and a burgeoning middle class have an appetite for imported, premium pet food. According to the Pakistan Bureau of Statistics, pet food imports have grown by more than 1,200 percent between fiscal years 2007-08 and 2017-18 (Figure 1). In the same timeframe, pet food exports have grown almost 1,500 percent, yet are lagging far behind imports. This gap highlights the country’s preference for imported pet foods and a lack of high-quality pet food produced locally.

FIGURE 1: Pakistani pet food exports are still very small, as the market develops, while imports into the country have increased 1,200 percent in the past 10 years. | Pakistan Bureau of Statistics

It is no coincidence that Nestlé Purina launched its own pet food line in Pakistan in 2018. With pet food imports to Pakistan standing at almost 6,000 metric tons compared to 150 metric tons exported to other countries in the 2017-18 fiscal year, pet owners in the country are demanding far more than current production capacity. Despite the local currency devaluing to approximately half in the most recent 10-year period, the fifth most populous country in the world imported a record PKR325.5 million (US$2.65 million) worth of pet food last year.

Thailand is king of pet food in Pakistan

A further signal of the growing significance of the pet food trade is Valuation Ruling No.977/2016 on Dog/Cat Food Retail (PCT 2309.1000) by the Pakistan Directorate General of Customs Valuation. In its ruling, the Directorate General sought to categorize imported pet food values by two major import regions: Chinese and Thai pet food imports were valued at US$0.76/kg, while North American and European pet food imports were valued at US$0.90/kg.

Thailand has been the undisputed king of pet food imports to Pakistan, holding the largest market share for more than 10 fiscal years. It currently holds 51 percent of the pet food imports market share, down from 63 percent in 2013-14. Its closest competitors are the U.S. and European Union, each holding a 12 percent market share. Interestingly, China, which has many sweetheart trade deals with Pakistan, holds only 2 percent of market share.

Pet food imports taxed as luxury items

In general, pet food imports to Pakistan have several taxes levied on them: a 20 percent customs duty, 35 percent regulatory duty, 17 percent sales tax, plus a 3 percent additional value tax and 6-9 percent withholding tax, depending on the importers’ tax filing status. Muhammad Ashfaq, additional collector at the Pakistan Board of Revenue said, “Being in a developing country like Pakistan, where human nutrition is currently prioritized, pet food is considered a luxury item, and is therefore taxed as such.”

The Directorate General’s recent interest in pet food imports to Pakistan may also be an attempt to incentivize local production. For instance, international pet food manufacturers can reduce their import regulatory taxes to zero by enhancing their pet food with local value addition and aiming to categorize their imports as “wholesale” or “other.” Keeping in view that such activities may facilitate Pakistan in reducing the burden on its dwindling foreign exchange reserves, it can be a “win-win-win situation for businesses, the government and Pakistani customers,” Ashfaq concluded.