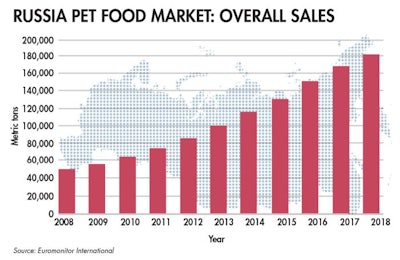

In 2018, overall sales in the Russian pet food market reached 620,000 metric tons — the highest figure ever seen — and yet this is only 25 percent of what sales are expected to achieve in the future, according to Fyodor Borisov, director of the Russian Association of Pet Food Producers (see Figure 1).

FIGURE 1: Overall sales in Russia’s pet food market continue to grow each year, providing significantly more opportunities than ten years ago.

In 2015, Russian customers spent an estimated Rub150 billion (US$2.3 billion) on pet food, according to Euromonitor International. In the last three years, overall sales in the country increased by 15 percent and the average retail price per kilogram of pet food grew 25.8 percent from Rub144.2 (US$2.20) in 2015 to Rub181.4 (US$2.76) in 2018, according to research conducted by the Russian analytical agency Alto Consulting Group. In 2018, Russian customers spent Rub207 billion (US$3.17 billion) on pet food, according to Euromonitor data.

To some extent, growth can be connected to the rising number of pets, which increased by 6.3 million (or 14 percent) over the last three years. There are currently 33.7 million cats and 18.9 million dogs living in Russian households with both figures expected to grow further, according to Mars Petcare estimates. This number of pets could easily make Russia the biggest pet food market in Europe.

Old habits die hard with Russian pet owners

So far, Russia is only in the top three biggest pet food markets in Europe, together with UK and France, according to Alessandro Zanelli, regional director of Purina in Russia and the Commonwealth of Independent States (CIS). There is a clear upward trend in the market, and Purina has plans to invest Rub6 billion (US$90 million) to expand production at the plant in Kaluga Oblast, Russia in 2019, in order to increase production by 30,000 metric tons, said Zanelli.

The old habits of Russian customers are still a main challenge that prevents the domestic market from fully unlocking its potential, said Borisov. So far, only 29.3 percent of Russian cats and 15.4 of Russian dogs are being fed commercial pet food, while the rest are getting food “from the master’s table,” (e.g., table scraps) he said.

Increasing the popularity of commercial pet food among pet owners is one of the main objectives of the Russian Association of Pet Food Producers, said Borisov. Bringing a larger share of commercial pet food in Russia to the European average could significantly expand the domestic market, and this task is quite achievable.

New competitors in the Russia pet food market

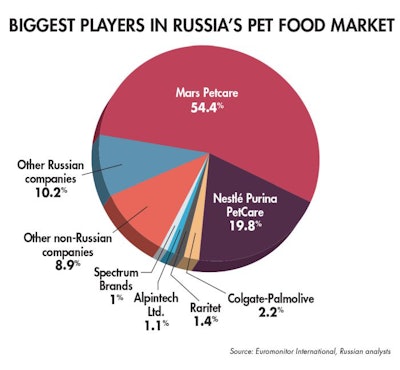

In 2018, local pet food producer PetKorm finished building the biggest independent pet food plant in Russia. With an investment cost of Rub2 billion (US$30 million), the plant is designed to manufacture 10,000 metric tons of pet food per year. Mars and Nestlé jointly accounted for 75 percent of sales in the Russian pet food market in 2018, but the share of local factories has been seen steadily growing over the past few years (see Figure 2).

FIGURE 2: The biggest sellers in the Russian pet food market remain large international companies, but there is some growth in the domestic production segment.

Independent producers currently manufacture 70 percent of pet food under contracts with the biggest retailers under their stores’ brands and the remaining 30 percent under their own brands, according to Alexey Silvestrov, co-owner of PetKorm. Various market research shows that Russian pet food producers already account for 10–15 percent of sales on the domestic market, and this figure is steadily growing. There are nearly a dozen Russian pet food producers, the biggest of which are PetKorm and R-Trade.

In addition, there are several Russian meat giants with plans to start producing pet food, including Miratorg and RusAgro. For example, Miratorg — Russia’s biggest pork and beef producer — unveiled plans to invest Rub4 billion (US$8 million) into producing 25,000 metric tons of pet food per year and planned to start implementing the project in 2018.

Moving in an Eastern direction

Export to China could be a promising direction for the Russian pet food industry. In November 2018 Mars reported that it planned to launch export supplies from its Russia plants to China and other countries in Southeast Asia. Export to China is possible not only from the plant in Novosibirsk Oblast in Siberia but also from those in European Russia, Mars said in a statement in late 2018.