People's growing affinity with their pets is driving demand for premium pet care products, with Asia-Pacific as the fastest growing market for consumer spending in household and pet care. The region is forecast to achieve the highest added sales globally by 2023, according to analysts at ecommerce insights company, Edge by Ascential.

The Household and Pet Care CPG report reveals that the Asia-Pacific market currently dominates consumer spending in the category. However, by 2023, sales in the region will expand by 37% to $384bn. This is closely followed by North America, where sales will grow to $281bn. Household and pet care spending in Europe is also expected to show a similar amount of growth through 2023, increasing by 28% to $203bn.

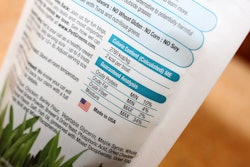

The consistent increase in global consumer spending in the household and pet care categories is attributed to the growing trend of pet humanization, as consumers increasingly see their pets as family members. This suggests that the evolution of the category is becoming more premium, as consumers are prepared to spend more on pet food and products that are healthy, nutritious and improve living conditions. An example brand is Mars, which is updating its entire Whiskas pouch portfolio to highlight healthy ingredients on the pack design and launching an 11+ years range for older cats as research suggests that more than 18% of cats are over 11 years old.

The report also highlights that online sales in the household and pet care category are set to grow at the fastest rate over the next five years and are expected to increase by 15% between 2018 and 2023. This surpasses online growth in a range of other sectors including health and beauty, electronics and fashion.

The Edge by Ascential report also reveals the following:

- Direct-to-consumer (D2C) models will continue to disrupt the value chain of the household and pet care sector, offering differentiation, convenience and personalised services.

- Consumer packaged goods (CPG) brands should therefore consider building branded product lines that are exclusive for specific retail partners.

- Given the growing trend of pet humanization, brands and retailers should leverage occasions such as 'Love Your Pet Day' through dedicated promotions and events to drive footfall and new customer acquisition.

- Consumer trends around product sourcing, origins and ingredients are prompting retailers to review in-store household and pet care ranges in favour of natural and healthy alternatives.

The findings are drawn from Edge by Ascential's Retail Market Monitor, which analyses how individual sectors are currently performing and how they are forecast to grow by 2023. The household and pet care category comprises of laundry and air care, household cleaning, dishwasher detergents, paper, wrap, liners and pet food and pet products such as healthcare, toys and supplies.

"We are seeing the pet humanization trend proliferate, being increasingly influenced by human trends, such as ethical spending, which means there is a bigger focus on health, wellness, sustainability and transparency," said Ioli Macridi, Analyst at Edge by Ascential. "The focus on pet welfare and health will soon become 'table-stakes', evidenced by retailers like Petco banning artificial ingredients from cat and dog food sold at its stores. With this in mind, brands and retailers must ensure they are catering towards owners' desire to care after their pets, with services and advice on personalized pet nutrition, stricter product curation and multiple fulfilment and subscription options to lock in consumers."