The 16 pet food brands named most prominently in June 2019 by the Food and Drug Administration (FDA) in its investigation into cases of canine dilated cardiomyopathy (DCM) are now experiencing sales declines, according to data presented by Natasha Davis, strategic client partner with Nielsen.

Looking at the brands’ grain-free dry dog food sales from mid-July 2019 through the first week of October, in aggregate they decreased about 10%. At the same time, other dry dog food sales were increasing, rising from a down period in mid-2018 to slightly positive growth by early October 2019, Davis said. She presented the data as the keynote speaker during the Petfood R&D Showcase 2019 at Kansas State University in Manhattan, Kansas, on October 16.

All grain-free pet food sales declining

Not only did the decline happen after FDA’s June alert naming the brands, but the data also showed that their grain-free dog food sales had started falling in 2018 and throughout the first part of 2019, following the timeline of FDA’s previous DCM investigation alerts in July 2018 and February 2019. That is likely also because grain-free pet food sales overall started slowing in late 2018, after FDA’s initial DCM alert.

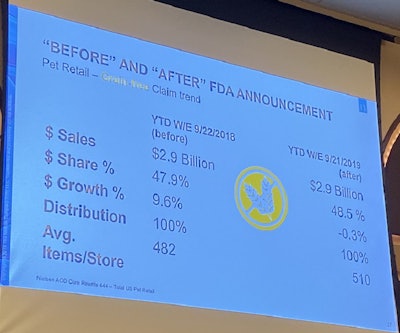

Through September 22, 2018, Nielsen data showed grain-free pet food sales in the U.S. at U.S.$2.9 billion, representing 9.6% year-over-year growth. As of September 21, 2019, grain-free pet food sales were flat or experiencing a slight decline of -0.3%, Davis said.

Conversely, pet foods containing grains (what Davis called “grain in”) showed a -6.9% year-over-year sales decrease as of September 2018. While those sales were still declining a year later, in September 2019, the decrease was smaller, at -2.7%.

Affecting brands’ other pet food lines

In addition, Nielsen data showed that for the 16 brands prominently named by FDA, their overall pet food sales had been affected: before FDA’s initial DCM alert and even through the first half of 2019, after the second alert, the brands’ overall pet food sales experienced more than 5% growth in aggregate. After the third alert, their sales growth was down to 1.2%.

The difference was even more noticeable in the pet specialty channel, where these brands tend to be mainly sold. After the third FDA alert, the brands’ grain-free dry dog food sales fell 11% in the pet specialty channel, while their total pet food sales (all their lines) decreased 9.7% in pet specialty.

Davis said she and her team had not analyzed sales data for the other brands named in the third FDA alert, but she indicated she would do so soon.