Pet specialty chains claim the leading share of pet product sales in the U.S. market at 24%, Packaged Facts estimates and reports in U.S. Pet Market Outlook 2019-2020. That share is primarily based on PetSmart at an 11% share and Petco at 7%, although with other leading pet specialty chains gaining in presence and sales. Next in line are discount stores/supercenters at 20%, primarily based on Walmart.

The internet ranks third in share of sales at 18%, with Chewy.com (owned by PetSmart and representing the pet specialty side) and Amazon.com (very much representing itself but also consumer market generalists) as the dominant players. Further weighing in from the wider consumer market are food/grocery stores, at a 12% share of pet products sales, and wholesale club stores at 8%.

Mass-market pet product retailers on the defensive

In analyzing the balance of power between pet specialty and mass-market retailers – made more tumultuous by this age of e-commerce – I noted in August 2019 that although “cross-channel shopping is heavy across the pet products market generally, supermarkets and discount stores/supercenters such as Walmart have the advantage here with their grocery and one-stop shopping draw.” Mass-market pet product retailers are clearly on the defensive, nonetheless, from the perspective of overall channel shopping trends generally and the patterns of prosperous and younger pet owners specifically.

To whom the future belongs may be a matter of debate and distress, but in consumer markets more prosperous pet owners (whose expenditures run higher) and younger pet owners (whose spending patterns will last longer) provide extra perspective on where things are headed.

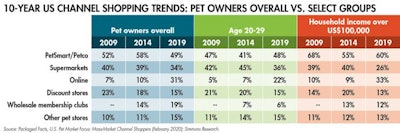

Table 1: From 2009 to 2019, younger pet owners and those with higher incomes shifted their pet product spending from supermarkets and discount stores to online and, less significantly, to large pet store chains.

Pet product shoppers jumping to online

The internet remains the overarching retail landscape story, with the percentage of overall pet owners who buy pet products online jumping up from 7% in 2009 to 30% in 2019 and correspondingly from 10% to 33% among pet owners with a household income of US$100,000 or more (Table 1). Within the brick-and-mortar arena, with the dramatic gains in e-commerce limiting upside anywhere else, the performance of pet specialty is a mixed bag, while the numbers for the mass-market are primarily down:

- The percentage of overall pet owners who buy pet products at the two leading pet specialty chains, PetSmart and Petco, wobbled from 52% in 2009 to 58% in 2014 and 49% as of 2019. Even so, the more recent five-year trend is positive among upper-income pet owners (rebounding from 55% in 2014 to 60% in 2019) and among 20-something-year-old pet owners (41% in 2014 and 48% in 2019). Moreover, other pet stores in aggregate – based on the growth of regional pet chains, rather than the performance of traditional local/independent pet stores – posted incremental but steady gains in shopping rates.

- The percentage of overall pet owners who buy pet products at supermarkets dropped from 40% in 2009 to 34% in 2019, with a corresponding drop among 20-something-year-old pet owners (from 42% to 36%) and an even sharper fall among upper-income pet owners (from 39% to 26%).

- The percentage of overall pet owners who buy pet products at discount stores such as Walmart dipped from 23% in 2009 to 15% in 2019, with a similar dip among 20-something-year-old pet owners and with a rise and fall among upper-income pet owners from 14% in 2009 to 20% in 2014, but back down to 13% as of 2019.

Both pet specialty and the mass market are diving into and putting up a fight against pet product e-commerce, with veterinary and non-medical pet care services as a strategy of choice for the latter. Following in the footsteps of PetSmart’s longstanding affiliation with Banfield Pet Hospitals, Petco is adding Thrive (in-store) and PetCoach (freestanding) clinics. PetIQ is partnering with Walmart to open vet clinics in as many as 1,000 stores by the end of 2023. But however the balance of power plays out between pet specialty and mass, it will certainly do so in the force field of e-commerce.